Board Secretary Report Presentation

UNDERSTANDING

THE

BOARD SECRETARY

AND TREASURER

REPORTS

Juanita A. Petty, RSBA

Wayne Township Board of Education

PURPOSE

• To provide overall summary of financial activity and a picture of the District’s financial status

• To provide assurance that estimated revenues are being realized to support current operations

• To provide a better awareness of the budget-toactual status

• To monitor cash

• To ensure that the District’s accounting system is in balance

ACCOUNTING BASICS

ASSETS:

Items owned by the District

Normally have “debit” balances

Current Assets include:

• Cash

• Investments (NJ Cash Management, CD’s)

• Capital Reserve Account

• Maintenance Reserve Account

• Receivables (tax levy, tuition, state aid)

• Resources: Unrealized Revenues (estimated-actual revenues)

Basics continued

LIABILITIES:

Amounts owed by the District

Normally have “credit” balances

Current liabilities include:

• Accounts payable

• Contracts payable

• Those debts the District expects to pay within a year or less

ESSENTIAL LAWS OF

ACCOUNTING

DEBITS = CREDITS

ASSETS = LIABILITIES + FUND BALANCE

ASSETS – LIABILITIES = FUND BALANCE

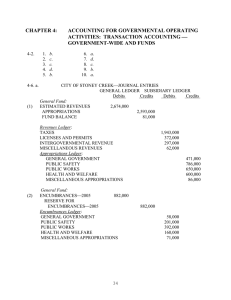

FUND ACCOUNTING

* Fund 10 – General Fund

11: general current expense

12: capital outlay (items over $2K)

13: special schools

* Fund 20 – Special Revenue Fund

(entitlement grants)

Fund Accounting continued

* Fund 30 – Capital Projects Fund

(funds construction costs)

* Fund 40 – Debt Service Fund

(cashier to pay bond principal/interest)

* Fund 60 – Enterprise Funds

(food service, support services)

* Fund 90 – Trust and Agency Funds

REPORT ORGANIZATION

• Interim Balance Sheet

• Interim Statements comparing budgeted revenue with Actual-to-date and

Appropriations with Expenditures and

Encumbrances-to-date

• Schedule of Revenues – Actual Compared with Estimated

• Statement of Appropriations Compared with Expenditures and Encumbrances

INTERIM BALANCE SHEET

Contains two sections:

Assets and Resources Section

Liabilities and Fund Equity Section

REMEMBER:

Assets/Resources MUST EQUAL Liabilities + Fund Equity

Balance Sheet Accounts

Asset Accounts

101 Cash

102-106 Cash Equivalents (petty cash)

111 Investments

116-118 Reserve Accounts

121 Tax Levy Receivable

132 Interfund Receivable

141

142

Intergovernmental Receivable – State

Intergovernmental Receivable – Federal

143 Intergovernmental Receivable - Other

153 Other Receivables

Balance Sheet Accounts

Liabilities Accounts

411 Intergovernmental Accounts Payable – State

421 Accounts Payable

Fund Balance Accounts

753 Reserve for Encumbrances – Current

754 Reserve for Encumbrances – Prior

761 Reserved Fund Balance – Capital Reserve

770 Unreserved Fund Balance

Assets :

Report of the Board Secretary

For the Month: _________

Cash

Investments

Capital Reserve

Receivables

Total Assets :

1,000

100

5,000

0

6,100

Liabilities :

Fund Balance :

Total Liab + FB :

Accts. Payable

Res. For Encumbr.

Unreserved

500

2,100

3,500

6,100

INTERIM STATEMENTS

Provide the first layer of detail of the amounts shown in the general ledger budgetary control account balances. There are two parts:

Revenues Section – budget estimated, actual, over/under, and unrealized balance

Expenditures Section – appropriations, expenditures, encumbrances, and available balance

Revenue Statement

• Contains “summarized” information as of date of report

• Budget Estimated Column is the budgeted amount, including revisions (adjusted budget)

• Actual Column is actual amount recognized to date

• Over/(Under) Column reflects whether actual to date is greater than or lesser than budgeted

• Unrealized Balance Column shows the difference between the budgeted and actual amounts

Positive amount – will still be recognized

Negative amount – actual has exceeded the budgeted amount

Expenditures Statement

• Contains “summarized” information as of date of report

• Presented at function level – same as advertised budget

• Appropriations Column reflects budgeted amount, including revisions (adjusted budget)

• Expenditures Column reflects the expenditures when purchase orders are closed and paid

• Encumbrances Column reflects outstanding commitments, either open orders or contracts

• Available Balance Column is the balance left after the

Expenditures Column and Encumbrances Column are subtracted from the Appropriations Column (uncommitted amount; funds available)

Detail Statements

Schedule of Revenues

Contains detail of Interim Revenue

Statement

Statement of Appropriations

Contains detail of Interim Expenditures

Statement

Variations to Report

• Reports for other Funds (Special Revenue

20, Capital Projects 30, Debt Service 40) are more summarized

• They do not include Interim Statements

Balancing Details

• Total Assets MUST equal total liabilities + fund balance

• Actual revenues, expenditures and encumbrances MUST match on all sections of the report

• Revenue Account (302) = Total of Actual Revenue

• Encumbrances (603) = Reserve for Encumbrances (753/4)

• Encumbrances (603) = Total Encumbrances on the Expenditure

Report and Open Purchase Order Report

• Expenditure Account (602) = Total Expenditures on Expenditure

Report

Timelines

• Secretary Report

• Treasurer Report monthly monthly

• Recommended timeline – example:

Bank statements received beginning of October for month of September. Reports would be submitted to

Board for approval at the end of October

Nonconformance to this timeline results in an audit recommendation

What if it’s not in balance?

• Transaction may be have posted to the wrong Fund

• If you’ve done a journal entry, you may have to do the transaction through the budget, revenue or purchase order module rather than the general ledger

• If you’ve added a new account in your general ledger, you must ensure that it is properly set up to reflect in your

Board Secretary’s Report

• Check to be sure all reports were run at the same time and on the same date

• Electrical problems could create a surge that affected a transaction as you posted it

Treasurer Report

• Basically a monthly bank reconciliation

• Details cash receipts and cash disbursements

• Includes all Governmental Funds – 10, 20,

30 and 40

• Includes Enterprise Funds (60)

• Includes Trust and Agency Funds (90)

Format of Report

Three Sections:

• Governmental Funds

• Enterprise Funds

• Trust & Agency Funds

Four Columns:

• Beginning Cash Balance

• Cash Receipts This Month

• Cash Disbursements This Month

• Ending Cash Balance

Funds

Fund 10

Fund 20

Fund 30

Fund 40

TOTAL

Fund 60

Payroll

Agency

Report of the Treasurer

For the Month: ___________

Beginning

Cash Balance

5,000

100

1,000

Cash

Receipts

1,500

100

2,000

Cash

Disbursement

400

50

1,000

5,000 5,000 0

11,100 8,600 1,450

500 100

0 10,000

0 5,000

500

10,000

3,800

Ending Cash

Balance

6,100

150

2,000

10,000

18,250

100

0

1,200

Reconciling to Secretary Report

• Compared on Fund by Fund basis

• Ending Cash Balance on Treasurer Report MUST equal Cash and Cash Equivalents on Secretary’s

Report

• For Fund 10, also include Investments and

Reserve Accounts in cash total

What if they don’t match?

Similar to balancing your checkbook…

• Verify timing differences – make sure all deposits are recorded in the correct period; otherwise, detail as deposits in transit

• Verify outstanding checks to be sure they are included or have been removed if cleared by the bank

Matching cont’d

• Make sure that interest has been posted during the period

• Be sure to verify that a transaction was not posted to the wrong Fund