Session 8 - Zipcar

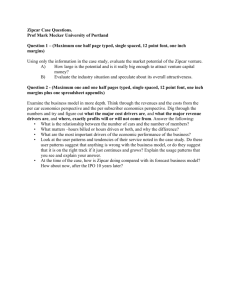

advertisement

Zipcar: Refining the Business Model Elevator Pitch • Objective . . . . . . . tell me more. The Logic of Analyzing New Venture Opportunities Source: Mullins, J.W. (2003). The New Business Road Test. Prentice Hall: London Market domain Industry domain Potential Profitability of opportunity Is the market large enough? What is the growth rate and the upside potential? Market attractiveness Industry attractiveness Macro-level Does the opportunity fit the team’s business mission, personal aspirations, and risk propensity? Mission, aspirations, Ability to execute propensity for risk Team domain Venture strategy Connectedness up, down, and across value chain Micro-level Target segment benefits and attractiveness Sustainable advantage What industry forces have the strongest impact on profitability? How are industry forces likely to change in the future? Does the team have what it takes, in a human sense – in experience and industry know-how – to deliver superior performance for this particular opportunity? To which target market Is the venture’s value proposition particularly compelling? Is the target market large enough to support the business model? Does the target market provide an Option to grow into other markets? Is the team well connected up, down and across the value chain so it will be quick to notice any opportunity or need to change its approach if conditions warrant? What entrepreneurial or firmlevel capabilities create a sustainable competitive advantage relative to rivals or potential rivals? Market Attractiveness • Size • Growth rate – Past – Future • Trends – Economic, demographic, socio-cultural, technological, regulatory, natural Industry Attractiveness • • • • • • What industry? Ease of entry? Supplier power? Buyer power? Substitute products? Rivalry among existing firms? Segment Benefits / Attractiveness • Customer pain? Incentive to buy? • Who are the customers? What do we know about them? • Benefits above other solutions? • Will they buy? • Will the segment grow? • Other related segments? Can we serve them? Sustainable Advantage • Proprietary elements? • Superior processes, capabilities, resources? • Economically viable business model? • Customer acquisition? Costs? Speed? • Customer retention? Evaluating Performance (Per Car) Monthly Figures May Plan / Sept Actual On per car basis Total Revenue Revenue/Car Number of Cars – Contribution/Car Cost/Car Lease Access Equip. Insurance Parking Maintenance Fuel Evaluating Performance (Per Car) Monthly Figures May Plan / Sept Actual On per car basis Total Revenue - $27,104 / $14,645 Revenue/Car $2,259 / $1,003 Number of Cars – 12 / 14.6 Contribution/Car $1,536 / $225 Cost/Car $723 / $778 Lease Access Equip. Insurance Parking Maintenance Fuel $367 / $400 $42 / $42 $142 / $142 $50 / $63 $33 / $33 $90 / $99 $723 / $778 Evaluating Performance (Per Member) Monthly May Plan / Sept Actual Revenue/ Member Monthly Fee - Monthly Usage Per Hour Fees Per Mile Fees Monthly Interest Contribution/ Member Security Interest Cost/Car Cost/ Member Members/Car Evaluating Performance (Per Member) Monthly May Plan / Sept Actual Revenue/ Member $130 / $94 Monthly Fee - $6.25 / $6.25 Monthly Usage $ $123 / $ 87 Per Mile Fees $35.2 / 13 Monthly Interest $1 / $1.1 Contribution/ Member $91 / $27 Per Hour Fees $88 / $73 Security $300 / $300 Interest .33 / .37 Cost/ Member $39 / $67 Cost/Car $723 / $778 Members/Car 18.33 / 11.62 Diagnosing the Problem Hourly vs. Daily (September) Exhibit 8b Hourly $9,327/1,351 = $6.90/hour Revenue from hourly use / hours used Daily $5,318/1,872 = $2.80/hour Revenue from daily use / hours used (not hours billed) Epilogue • Robin was concerned when her analysis showed low revenue figures, driven primarily by the daily use of vehicles. • Beginning in December, Zipcar increased the max daily rate from $45 to $55, increased the lowest hourly rate and changed from two-tier to four tier pricing. • Still in business (http://www.zipcar.com/index) – 36 US cities and London • Appears that they did not get any venture capital funding until July 2005 ($10 million) (http://www.zipcar.com/press/releases/press-28) • Raised $25 million in 2006 (http://www.redherring.com/Home/19957) • http://gigaom.com/cleantech/zipcar-prices-ipo-at-14-to16-per-share/ Takeaways • Keep business model fluid in early stages • Understand factors that provide sustainable competitive advantage – Network externalities* – Reputation and buyer uncertainty* – Buyer switching costs* – Legal restrictions (e.g., patents) • Odd financing strategy? Not really. * First mover advantages Reminders • Read “Writing a Business Plan: The Basics”