Relevant life policies

advertisement

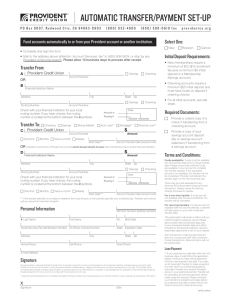

Relevant Life Policies Relevant Life Policies Presented by NAME TO BE SUPPLIED TITLE TO BE SUPPLIED Scottish Provident Relevant Life Policies An introduction to relevant life policies (RLPs) • Non registered • Single life • Death in service policy • Provides a lump sum benefit on death Relevant Life Policies Where do RLPs sit within the legislation? Group life cover Registered The normal employee group life scheme* Non registered Relevant life policies S393B(4) (b) ITEPA 03 -single life -group life* *Scottish Provident do not offer group life X Employer Financed Retirement Benefit Schemes Unattractive tax regime 40% charge on claim Relevant Life Policies What do relevant life policies do? • Provide employer sponsored life cover • Available for an employee on a stand-alone basis • Tax efficient Relevant Life Policies How are they tax efficient? • Premiums paid by the employer • No P11D charge on the employee (S247 FA 04) • No NIC charge on employee or employer • Possible tax relief on premiums (subject to wholly and exclusive rules) • Do not form part of pension annual allowance • Benefits paid • Usually tax free under a discretionary trust • Do not form part of pension lifetime allowance Relevant Life Policies How much could be saved? Premium Employee owned plan Relevant life policy £1,000 £1,000 Company gross cost Income Tax @ 40% £690 Employee’s National Insurance @ 2% £34 Employer gross cost Employer’s National Insurance contribution @ 13.8% Total gross cost £238 £1,962 £1,000 £392 £200* £1,570 £800* Company net cost Corporation Tax relief @ 20% Total net cost * For the purpose of the example, it has been assumed that Corporation Tax relief at 20% has been granted under the ‘wholly and exclusively’ rules. Also assumes 40% tax payer. Rates as at 2011/12. Relevant Life Policies What are the restrictions? The policies must: • Only provide for a lump sum death benefit payable before age 75 • Only be payable to an individual or charity (required to be paid into discretionary trust) The policies must not: • Provide any other benefit • Be capable of having a surrender value • Be used mainly for the purpose of tax avoidance Relevant Life Policies How does the trust work? Relevant life policies must be written in trust • Paid to dependants at the discretion of the Trustees • Nomination form can be used • No income tax for the employee • Normally no IHT • Possible 10 year and exit charge if claim paid into trust close to 10th anniversary and benefit not distributed immediately Relevant Life Policies How much cover? Scottish Provident would normally cover up to 15X annual salary • This can include salary, regular dividends paid in lieu of salary and benefits in kind Relevant Life Policies Do we have a replacement policy option? • We do not need one as it is a single life policy • The trustees just appoint policy back to employee • Better and cheaper than most group scheme options Relevant Life Policies Can the policies be transferred to a new employer? • Yes – the new employer just pays the premiums • We would suggest a change of Trustees Relevant Life Policies Who is it aimed at? • High earning employees or directors • Who have substantial pension funds • Who do not want their death in service benefits forming part of their lifetime allowance • Smaller businesses • Where there are too few employees to warrant a group life scheme • Members of group life schemes • To top up their benefits beyond the scheme rules Relevant Life Policies Is it just aimed at limited companies? No – but the person covered must be an employee of a: • Sole trader • Partnership • Limited liability partnership • Limited company • Charity Relevant Life Policies How do I submit the business? • Self Assurance Term Business quote for level or increasing Death Benefit • Self Assurance Term Business application form (online submission available) • Separate plan/application for each life • Cannot incorporate other benefits • Relevant life policy discretionary trust Relevant Life Policies Where are the sales opportunities? • Do you have clients who are directors of their own business? • Do they have dependants? • Do they have Life Cover? • How are they paying for it? • Could you sell them up to 49%* discount on that cover? *Assumes 40% tax-paying employee and 20% Corporation Tax paying company and payment is acceptable to local tax inspector as trading expense Tax Rates 2011/12 Relevant Life Policies Support for you and your client We have placed all of our relevant life policies information in one toolkit to help you with every step of the relevant life recommendation. The toolkit includes our relevant life policies guide, business generation letters to introduce the tax benefits of relevant life policies, a client facing sales aid, a question and answer document, a relevant life policy calculator and an application checklist. All of our literature can be ordered or downloaded from: www.scottishprovident.co.uk/businessprotection If you want to find out more, contact: NAME TO BE ENTERED 0000 000 0000 Thank you. Important information The information in this presentation is based on Scottish Provident's present understanding of current law and practice and does not constitute legal and/or taxation advice. You may wish to use all or some of the slides from this presentation. But please keep in mind that if you use or adapt any of these slides for your own presentation, you must make sure it’s compliant with the appropriate regulations and incorporate any appropriate risk warnings. Scottish Provident does not accept liability for any adapted wording you may use in this presentation. SCPR 6030 JAN 11