DG TREN - SF Energy Invest

advertisement

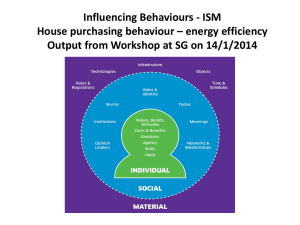

Financing Energy Efficiency Roman Doubrava Directorate-General for Energy C3 Energy Efficiency SFEI Event, 4.12.12 Energy FINANCE: A PARTICULAR MOMENTUM New Multiannual Financial Framework (2014-2020) . . Cohesion funding to allocate some € 17 billion to energy efficiency and renewable energy (doubling current allocations) Horizon 2020: € 6.5 billion is to be allocated to research and innovation in "Secure, clean and efficient energy" Likely to include an IEE-type follow-up programme Energy 2 FINANCE: A PARTICULAR MOMENTUM • Energy Efficiency Directive (2012/27/EU) • New Regulatory Frameworks provide an opportunity to develop the EPC market - Article Article Article Article Article 3 – required renovation of 3% of central government buildings 7 – energy efficiency obligations 1.5% target to be met 8 - obliges large companies to carry out mandatory energy audits 19 – removal of barrier to energy efficiency in accounting rules 20 – Maximising the benefits of multiple financing schemes More Stable legislative framework: renewed efforts from MS & investment predictability for investors 3 Energy . . . . FINANCE: A PARTICULAR MOMENTUM EU funding should provide opportunity to attract & leverage funds from private investors However, the big bulk of EE/RES investments should come from private sector, with EU and national funding to complement; Using market mechanisms to avoid crowding out investors and increase leverage; Grant to address primarilly market failures, innovative technologies and beyond cost-effective EE projects (deep renovation) Energy 4 COHESION POLICY PACKAGE NEGOTIATIONS • EU General Regulation, ERDF, CF, ESF regulations under discussions between EP-council • In parallel, EC to start bilateral discussions on country partnership contract to define each MS's priorities (further implemented through OPs) DG ENER providing input on country status regarding EE/RES investments, implementation of EU legislation, financing schemes… & provide recommendations Energy 5 WHAT ARE THE BARRIERS TO INVESTMENT? Regulatory framework & market barriers: • Procurement rules, public deficit accounting • Split incentives • Low level of awareness & capacity Access to Financing • • • • • High perceived risk -unclear market valuation Unadapted financing products High upfront financing High transaction costs Grant dependency Energy 6 FINANCIAL INSTRUMENTS FOR ENERGY EFFICIENCY • Cohesion policy funds (2007-2013): • 5,1 billion € for energy efficiency • Intelligent Energy Europe Programme – IEE II (2007-2013): • 735 million € for ‘soft’ energy efficiency/ renewables projects • ELENA Facility and MLEI under the IEE II: • 97 million € for technical assistance to mobilise investments • European Energy Efficiency Fund (EEE-F): • 265 million € for investments into mature, bankable efficiency/renewables projects Energy WHAT IS THE ‘INVESTMENT’ NEED? • Energy savings potential across sectors requires investment of around 850 billion € (2011-2020) • Around 85 billion € per year • Buildings take the lion’s share of around 60 billion € per year 8 Energy BEST PRACTICES EXAMPLES REFURBISHMENT OF SOCIAL HOUSING (FR) • Investments of € 320 M of ERDF in whole country • Average support by ERDF = € 2,886 per dwelling (14% of total needs) • Impacts: • generated over € 1 billion in investment in energy performance in social housing in FR • helped to create and maintain 15,000 local jobs & potentially 31,000 with measures in the pipeline • 50,000 households with modest incomes supported to fight energy poverty (heating costs reduced on average by 40%) Energy 9 KREDEX REVOLVING FUND IN ESTONIA • Switch from grants to a revolving fund • KredEx (Credit and Export Guarantee Fund of the State) supports this • Why revolving fund? • Opportunity for re-usage of the funds • Funds stay in state • Loan is needed for reconstruction anyway • Easier to administer, lower administrative costs • End-beneficiary is used to take loan • Innovative scheme, help from kfW • Started 06/2009 • March 2010: 70 contracts with multi-apartment buildings, total 5,1 mn € (average 74 400 €, 2035 apartments, saving 33%) Energy 10 THE EPC OPPORTUNITY Source: International performance, measurement and verification protocol, EVO, 2010 11 Energy THE EPC OPPORTUNITY Provision of loan Investor (Bank) Customer Repayment of loan Guarantee for savings Payments for services Financing by Bank ESCO Source: European Energy Service Initiative Energy Guarantee for payments DG ENER Energy Performance Contracting (EPC) Campaign • To highlight awareness of EPC at national, regional and local levels • To hold a series of practical workshops to, increase knowledge, build confidence and share experience • Three pillars working to complement each other: EPEC, ManagEnergy and Covenant of Mayors 13 Energy EPC CAMPAIGN STRUCTURE National EPEC Regional ManagEnergy Local Covenant of Mayors 2012-13 – series of national events planned 2012-14 – 42 events planned 2012-14 Webinar events Targeting key policymakers at national level Aimed at regional authorities and energy agencies Capacity building events for local stakeholders Focus on implementation of EPC frameworks, use of cohesion policy funds, and practical examples of EPC benefits Focus on forthcoming changes to regulatory framework and potential replication of EPC projects Focus on barriers encountered, solutions, and practical ways to rollout more EPC projects locally Energy WHAT CAN YOU DO? You can assist in facilitating the development of the energy services market, by understanding the financial and regulatory frameworks necessary to overcome barriers to EPC • Identify stakeholders in your MS, including possible speakers • Highlight best practice examples for dissemination • Facilitate and present at workshops Energy Thank you very much! For further information on the EPC Campaign please consult our website: http://ec.europa.eu/energy/efficiency/f inancing/campaign_en.htm Energy