Determination of Exchange Rates

advertisement

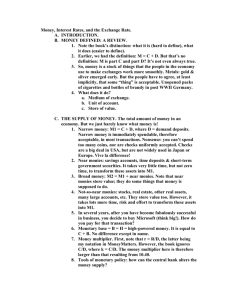

Determination of Exchange Rates International Finance Dr. A. DeMaskey 1 Learning Objectives How are exchange rate movements measured? How is the equilibrium exchange rate determined? What factors affect the equilibrium exchange rate? How do central banks intervene in the foreign exchange market? How do expectations affect exchange rates? 2 Measuring Exchange Rate Movements Appreciation Depreciation Percent Change in the Foreign Currency Value Percent Change in the Home Currency Value 3 Exchange Rate Equilibrium Demand Supply Equilibrium Exchange Rate 4 Equilibrium Exchange Rate Dollar Value of £ S£ $1.50 D£ Quantity of £ 5 Macro-Economic Factors Influencing Exchange Rates Relative Inflation Rates Relative Interest Rates Relative Income Levels 6 Impact of Rising U.S. Inflation on the Equilibrium Value of the British Pound Dollar Value of £ S£ $1.50 D£ Quantity of £ 7 Impact of Rising U.S. Interest Rates on the Equilibrium Value of the British Pound Dollar Value of £ S£ $1.50 D£ Quantity of £ 8 Impact of Rising U.S. Income on the Equilibrium Value of the British Pound Dollar Value of £ S£ $1.50 D£ Quantity of £ 9 Government Controls Foreign Exchange Barriers Foreign Trade Barriers Government Intervention in Foreign Exchange Market Affecting macro variables, such as inflation, interest rates, and income levels 10 Expectations Foreign exchange markets react to any news that may have a future effect. Institutional investors often take currency positions based on anticipated interest rate movements in various countries. Because of speculative transactions, foreign exchange rates can be very volatile. 11 Role of Expectations Signal Impact on $ Poor U.S. economic indicators Fed chairman suggests Fed is unlikely to cut U.S. interest rates A possible decline in German interest rates Central banks expected to intervene to boost the euro 12 Interaction of Factors Trade-Related Factors Financial Factors Trade-related factors and financial factors sometimes interact. 13 Factors Affecting Exchange Rates Inflation Differential U.S. Demand For Foreign Goods U.S. Demand For FC Foreign Demand For U.S. Goods Supply of FC For Sale Income Differential Gov’t Trade Restrictions Interest Rate Differential Capital Flow Restrictions U.S. Demand For Foreign Securities U.S. Demand For FC Foreign Demand For U.S. Securities Supply of FC For Sale Exchange Rate Between the Foreign Currency And the Dollar 14 Government Intervention Reasons Direct Sterilized Non-Sterilized Indirect Government Policy Government Barriers 15 Central Bank Intervention Nonsterilized Intervention To Strengthen the C$ Federal Reserve $ C$ Banks Participating In the Foreign Exchange Market Sterilized Intervention To Strengthen the C$ Federal Reserve $ Treasury Securities C$ Banks Participating In the Foreign Exchange Market $ Financial Institutions That Invest In Treasury Securities 16 Effect of Expectations Currency values are determined Inflation Interest rates Economic and political stability GDP growth Reputation of central bank by: In reality, however, exchange rates are affected by expectations of these variables. 17 Asset-Market Model Currencies behave like other financial assets: A nation’s currency can be thought of an asset whose value is determined by the (expected) economic performance of that nation... Economic Factors Affecting the Value of a Currency: Store of Value Demand for Liquidity Demand for Assets Denominated in the Currency 18 Central Bank Behavior Reputable central banks: Are trusted by markets to maintain a currency’s purchasing power through sound monetary policy. Tend to be independent. Have currencies that are more highly valued than those issued by less reputable banks. 19 Currency Board System A currency board is a system for maintaining the value of the local currency with respect to some other specified currency. Characteristics No Central Bank No Discretionary Monetary Policy For example, Hong Kong has tied the value of the Hong Kong dollar to the U.S. dollar (HK$7.8 = $1) since 1983. 20 Dollarization Dollarization refers to the replacement of a local currency with U.S. dollars. Dollarization goes beyond a currency board, as the country no longer has a local currency. For example, Ecuador implemented dollarization in 2000. 21