Loreal Case

advertisement

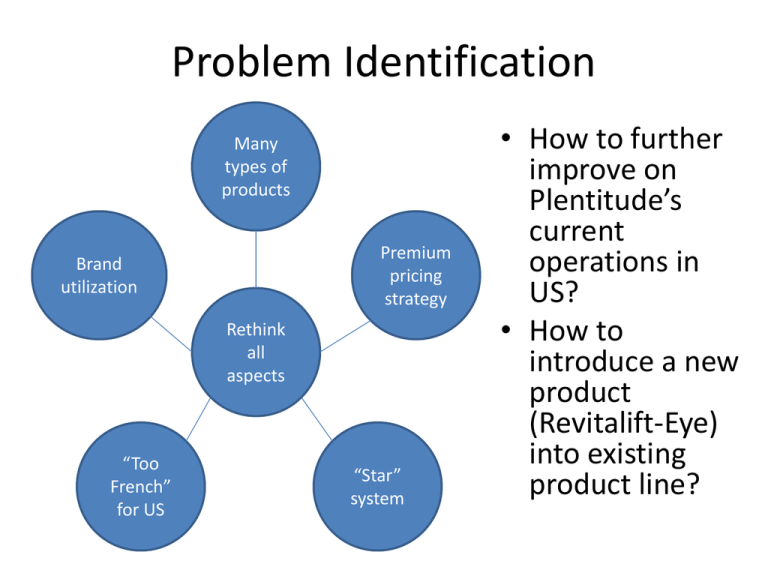

Problem Identification Many types of products Premium pricing strategy Brand utilization Rethink all aspects “Too French” for US “Star” system • How to further improve on Plentitude’s current operations in US? • How to introduce a new product (Revitalift-Eye) into existing product line? L’Oreal Background • L’Oreal started in Clichy, France in 1907 by Eugene Schiller • Annual revenue of 53.4 billion French Francs in 1996 ($1.09 billion US) from over 2000 products • Owns 25 global brands – Cosmetics – Hair color – Skincare • High-end: Lancome, Biotherm • Mass market: Plenitude L’Oreal Background • Cosmetics represent 81% of revenues • $300 million spent on research & 300 new patents worldwide in 1996 • Acquired Maybelline to broaden participation in the mass market • Combining hair care & cosmetics division Case Background • • • • • Plentitude line launched in 1982 Very successful in the French market Strong introduction in US market US sales grow up until 1991 After 9 years in the US, sales become stagnant in the US Plentitude Line • Launched in France in 1982 • Positioned as: – High end – Superior performance – Accessible (Class to Mass strategy) L’Oreal Marketing Strategies • Golden Rules of Advertising – Focus advertising on star product – Provide evidence of technological superiority – Depict an executive, up-to-date and assertive executive woman • “Trickle Down and Fire Up” – Revenue from mass market products to fund their R&D for high end products – “Maintain premium pricing to reinforce quality and performance” Plentitude US Launch • Test launch in Atlanta & Dallas in ’88 under “class to mass” strategy • Positioning was to “reduce signs of aging” • L’Oreal brand recognition was critical to selling products • Used same “star” philosophy formula as used in France SWOT Analysis Strengths •Innovative technology •L’Oreal brand recognition •Product potential with Revitalift line •Mature skin market segment •Great research & development department •Experience in consumer cosmetic products Opportunities •Large US market •Opportunity to tap into younger consumer segment •Many channels for L’Oreal product •Revise pricing/marketing strategy to increase consumer appeal •Opportunity to develop mature market with Revitalift product Weaknesses •No differentiation in daily moisturizer/cleanser market •High advertising costs •Lack of profitability •Consumer behavior in US unknown •Unattractive product cover •No awareness in US market Threats •Competition with Olay’s similar product •Consumer loyalty to competitor product •Expensive product image •Lack of acceptance from younger market •Domestic products more widely known