DWS13-20Nov-Yves_Gas..

advertisement

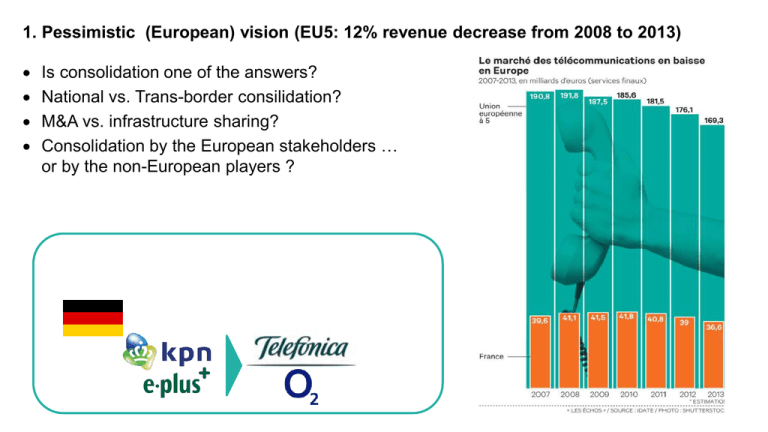

1. Pessimistic (European) vision (EU5: 12% revenue decrease from 2008 to 2013) Is consolidation one of the answers? National vs. Trans-border consilidation? M&A vs. infrastructure sharing? Consolidation by the European stakeholders … or by the non-European players ? 2. Optimistic vision : telecoms are not condemned to finish like the “polaroid cameras” … but they have to reinvent their footprint and business models in the Internet ecosystem Ex. : a “2 sided model” as one of possible scenarios Others $ service Telcos Platform & APIs Brokering Data sales (personal and network) QoS and interconnection (paid peering, CDN, QoS, data centres) $ service Users Popular services, telco devices New business models Personal information management, Up/cross sell Tiered pricing and OTT bundles Check up list : - consolidation Infrastructure sharing… Fixed-Mobile convergence 4G/aLTE –Fiber Differentiation/segmentation/tiered pricing Policy management and real time billing M2M Big data Cloud SDN … Questions: - Where are the short term priorities for the telcos? What are the most promising sources of new revenues? What roles will telcos play in the evolving digital ecosystem? What will be a telecom operator in 10 years? …