PCG Panellist Allan Wilen, Glenigan

advertisement

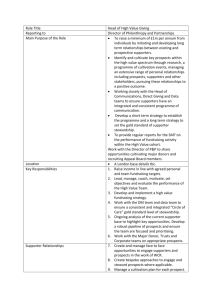

UK Construction Prospects Presented by: Allan Wilén, Economics Director Date: 23rd October 2012 Market Conditions Double dip recession Renewed pressure from public sector cuts in 2011 & 2012 Gradual private sector recovery 110 100 Current Prices - Index 2006 = 100 Sharp falls in private sector construction in 2008 & 2009 Construction Activity 120 90 80 70 New Orders Output Underlying Project Starts New Work Output 60 50 2006 2007 2008 Sources: ONS, Glenigan 2009 2010 2011 2012 ytd Construction’s clients Government funded work has supported output Recession hit private sector workload hard Private non-residential building still a third of output Private housing stabilised Infrastructure & Utilities growth sectors Government Policy: Key Department Spending 45% Education NHS (Health) 30% Transport % Change on previous year CLG Communities 15% 0% 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 -15% -30% -45% -60% Source: HM Treasury 4 Government Policy Looking to private sector investment to lead recovery Government prioritising investment in infrastructure Value of publicly funded new builds to fall over coming years Focus on refurbishment and improvements Return of PFI to bridge the gap Social Housing Education Brighter Consumer Prospects? ■ Consumers hard hit since 2007 ■ Households hit by: ■ ■ ■ ■ ■ Weak earnings growth Tax rises Higher inflation Debt levels remain high Uncertain employment prospects ■ Restricted bank lending ■ Improved consumer confidence from late 2012? ■ Lower inflation ■ Moving out of recession Housebuilders revisit sites Private Housing ■ Positive start to 2012 ■ Further recovery anticipated ■ Gradual rise in household incomes and confidence ■ Improved mortgage finance availability ■ Government initiatives to lift market 12,000 Project Starts 160,000 Unit Starts 10,000 Unit Completions 140,000 Value of Project Starts £m ■ Hesitant recovery in 2010 faded last year 180,000 120,000 8,000 100,000 6,000 80,000 60,000 4,000 40,000 2,000 20,000 0 0 2008 2009 2010 2011 Sources: DCLG, CPA, Glenigan 2012f 2013f 2014f Thousands of Units ■ Sharp fall in project starts during 2008 & 2009 Office Construction Industry Prospects Public sector squeeze as capital funding cut Slow private recovery – Offices, retail and industrial upturn – Increase in private housing starts Private sector recovery hampered by access to capital Improved consumer confidence Refurbishment & retro-fit Regional divide Customer Satisfaction Client Satisfaction 90% Proportion of scorign 8/10 or more 85% 80% 75% 70% 65% 60% Product Service Defects 55% 50% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 On time & to budget Time Predictability Cost Predictability Project 80% 90% Project Design Design 80% Construction 70% Construction 70% Proportion on time or better Proportion on time or better 60% 50% 40% 30% 60% 50% 40% 30% 20% 20% 10% 10% 0% 2005 2006 2007 2008 2009 2010 2011 2012 0% 2005 2006 2007 2008 2009 2010 2011 2012 Any Questions?