Big Issue Invest SEIF

advertisement

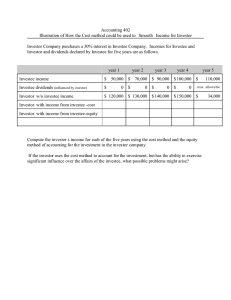

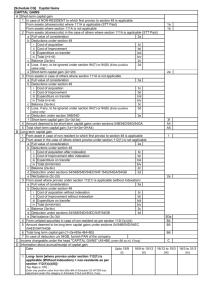

Social Enterprise Northwest Social Finance Fair February 2014 Big Issue Invest For social entrepreneurs – by social entrepreneurs Big Issue Invest was founded in 2005 as the social investment arm of The Big Issue It provides a range of investment options, from debt to equity and quasiequity finance to social enterprises from £50,000 to £1 million Lending business: Loans from £50,000 to £250,000 Typically up to ten years Over £20 million lent to 180 social enterprises with c. 3% loss rate June 2010 launched the BII Social Enterprise Investment Fund limited partnership investment vehicle for ‘equity like’ risk capital finance £9.2 million raised from a diverse range of social impact investors Can invest from £100,000 to £1,000,000 BII – Approaches to investing ‘Conventional’ lending Convince me that you can pay me back Security – secondary source of repayment ‘Risk capital’ investing Convincing case for growth More intensive due diligence More active involvement post-investment Higher potential loss, higher potential return Investment Targets BII SEIF - Investment Targets Social Impact Clearly identifiable, high social or environmental value creation Growth Potential and Ambition Viable business model which is either scalable or replicable People, Products and Projections Strong management team with proven capability to deliver High value-for-money product or service History of positive cash generation or a clear near term path to cash and surplus generation Example ‘patient capital’ investment Sandwell Community Caring Trust Total financing requirement: £4.25 million to acquire a newly built residential care facility Source of funds: Senior secured debt (first mortgage, 75% LTV) Unity Bank £3,250,00 (83%) Subordinated term loans (secondary security) Consisting of: Big Issue Invest £725,000 (17%) - Fixed rate term loan - Term: 7 yrs, 4 yrs interest only - Rate: 7.5% fixed £362,500 - Revenue participation loan £362,500 - Term: 7 yrs, bullet repayment - Rate: 1.8% of the uplift in “Trading Income” from the base year, with annual cap BII’s Impact Assessment Scorecard Dimensions 1. Mission & Vision Weight Grade ranges 35% 91-100 Excellent Performance 2. Scale of impact 40% 81-90 Very Good Performance 71-80 Good Performance 3. Transparency 10% 55- 70 Low Performance 0-54 Inadequate Performance 4. Market transformation 15% Investee Performance Metrics Agreed, not imposed (but required) Simple, verifiable Usually, 4-8 quantitative output measures Relevant to the business SROI if relevant and desirable Metrics + targets Targets reported quarterly, reviewed and reset annually (concurrent with financial budgeting process) Discuss progress with Boards and work to drive improvement Annual social impact report Investee Performance Metrics (example) Investee is on target, within a negative variance of 25%, to meet the following social performance targets for the 12 month accounting period to 31 March 2012: 3.1.1 Health 600 service users with mental health problems demonstrate improved well-being and have reduced dependency on state services; 3.1.2 Safety 150 service users with long-term mental health issues live independent of acute care; 60 service users who are homeless or have inadequate housing needs are re-housed; 45 families with children in care or at risk of going into care receive support; 50 victims of domestic violence receive support; 30 perpetrators of domestic violence are no longer considered a threat to their families; 30 children gain safe access to a non-resident parent; and 20 services users that have been offenders within the criminal justice system do not reoffend. 3.1.3 Inclusion: 300 service users for whom English is not their first language use Investee’s services. 3.1.4 Economic well-being: 100 service users become more economically independent or useful either through employment or a return to work after sick leave. Thank you!