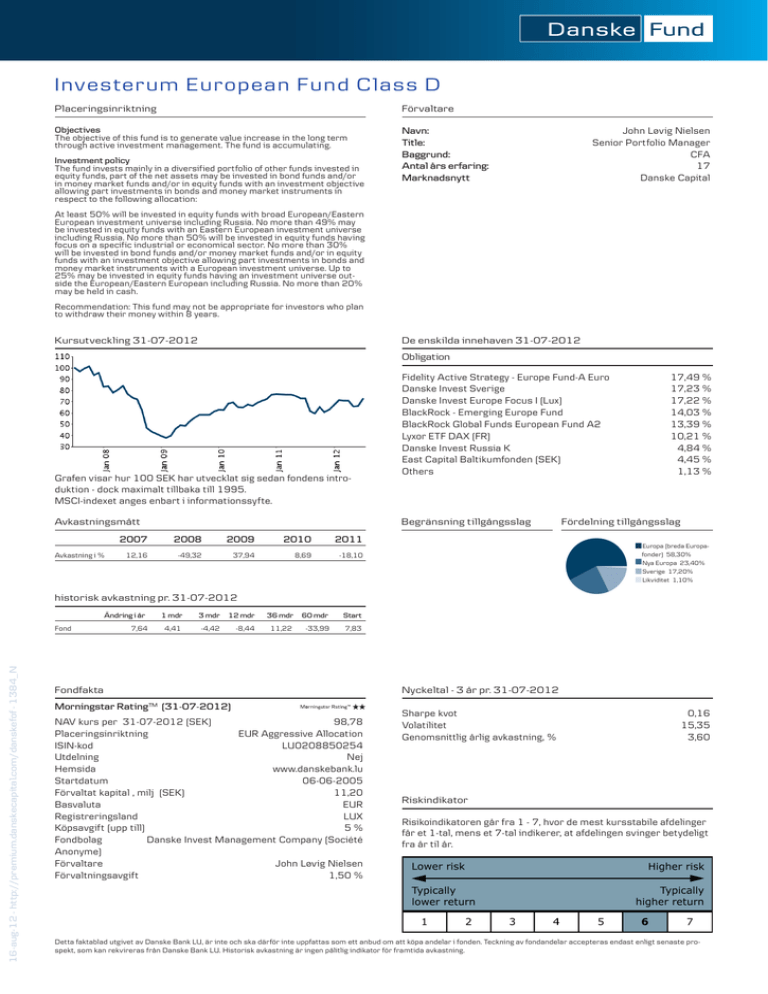

Investerum European Fund Class D

advertisement

I nv e ste rum Eu ropean Fu nd Clas s D Placeringsinriktning Förvaltare Objectives The objective of this fund is to generate value increase in the long term through active investment management. The fund is accumulating. Navn: John Løvig Nielsen Title: Senior Portfolio Manager Baggrund:CFA Antal års erfaring:17 Marknadsnytt Danske Capital Investment policy The fund invests mainly in a diversified portfolio of other funds invested in equity funds, part of the net assets may be invested in bond funds and/or in money market funds and/or in equity funds with an investment objective allowing part investments in bonds and money market instruments in respect to the following allocation: At least 50% will be invested in equity funds with broad European/Eastern European investment universe including Russia. No more than 49% may be invested in equity funds with an Eastern European investment universe including Russia. No more than 50% will be invested in equity funds having focus on a specific industrial or economical sector. No more than 30% will be invested in bond funds and/or money market funds and/or in equity funds with an investment objective allowing part investments in bonds and money market instruments with a European investment universe. Up to 25% may be invested in equity funds having an investment universe outside the European/Eastern European including Russia. No more than 20% may be held in cash. Recommendation: This fund may not be appropriate for investors who plan to withdraw their money within 8 years. De enskilda innehaven 31-07-2012 Kursutveckling 31-07-2012 Obligation Grafen visar hur 100 SEK har utvecklat sig sedan fondens introduktion - dock maximalt tillbaka till 1995. MSCI-indexet anges enbart i informationssyfte. Begränsning tillgångsslag Avkastningsmått Fidelity Active Strategy - Europe Fund-A Euro Danske Invest Sverige Danske Invest Europe Focus I (Lux) BlackRock - Emerging Europe Fund BlackRock Global Funds European Fund A2 Lyxor ETF DAX (FR) Danske Invest Russia K East Capital Baltikumfonden (SEK) Others 2007 2008 2009 20102011 Avkastning i % 12,16 -49,32 37,94 8,69 17,49 % 17,23 % 17,22 % 14,03 % 13,39 % 10,21 % 4,84 % 4,45 % 1,13 % Fördelning tillgångsslag nEuropa (breda Europafonder) 58,30% -18,10 nNya Europa 23,40% nSverige 17,20% nLikviditet 1,10% historisk avkastning pr. 31-07-2012 16-aug-12 - http://premium.danskecapital.com/danskefof - 1384_N Fond Ändring i år 1 mdr 3 mdr 12 mdr 36 mdr 60 mdr Start 7,64 4,41 -4,42 -8,44 11,22-33,99 7,83 Fondfakta Morningstar Rating™ (31-07-2012) NAV kurs per 31-07-2012 (SEK)98,78 Placeringsinriktning EUR Aggressive Allocation ISIN-kodLU0208850254 UtdelningNej Hemsidawww.danskebank.lu Startdatum06-06-2005 Förvaltat kapital , milj (SEK)11,20 BasvalutaEUR RegistreringslandLUX Köpsavgift (upp till) 5% Fondbolag Danske Invest Management Company (Société Anonyme) Förvaltare John Løvig Nielsen Förvaltningsavgift 1,50 % Nyckeltal - 3 år pr. 31-07-2012 Sharpe kvot0,16 Volatilitet15,35 Genomsnittlig årlig avkastning, %3,60 Riskindikator Risikoindikatoren går fra 1 - 7, hvor de mest kursstabile afdelinger får et 1-tal, mens et 7-tal indikerer, at afdelingen svinger betydeligt fra år til år. Detta faktablad utgivet av Danske Bank LU, är inte och ska därför inte uppfattas som ett anbud om att köpa andelar i fonden. Teckning av fondandelar accepteras endast enligt senaste prospekt, som kan rekvireras från Danske Bank LU. Historisk avkastning är ingen pålitlig indikator för framtida avkastning.