Accounting Systems for Small Businesses

advertisement

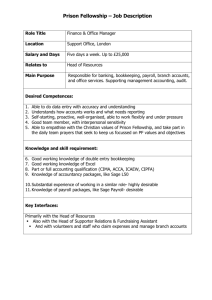

CS27510 Commercial Database Applications Thanks to Mathew Teague, Ian Matthews, Jack Jenkins, Lucy Wills and Sian Harper An accounting system is any system in place within a company that deals with the storage and analysis of financial information. This system can be either manual or computerised but manual systems are increasingly rare nowadays. Small Accounting Systems Small businesses can not afford high priced/high ended. Small business can also have a problem with affording sufficient security software for their accounting systems Small business may even have problems with keeping sufficient audit trails in their accounting systems. Large Accounting Systems Large businesses can afford high priced/high ended software to do their accounting systems which will make a difference in making them more efficient when dealing with customers. Large business have the fortune of being able to tailor software to suit their exact business requirements. Large business accounting software is frequently part of a wide-range suite of software that is often known as Enterprise Resource Planning or ERP software. A manual accounting or book keeping system is the traditional way of maintaining control over a business’s financial accounts and records. This system consists of various ledgers and files into which information must be written by hand. Those who have used this method of accounting in the past tend to prefer it to computerised systems. Though more common in the past manual accounting systems are still in use in many small businesses as their primary source of record keeping. In some cases a manual system may be in place in addition to the computerised system as a way to provide another form of backups or to keep internal control over the information. Advantages Keeping manual records means there is no risk or data corruption or disk errors leading to loss of data. Problems with duplicate copies of data don’t apply to manual systems. It is easy to erase or edit erroneous data. Secure against electronic attack Easy to learn Disadvantages Difficult to make backups. Books can be easily damaged by human error Easy to physically steal Sage Kashflow Intacct Epicor Financial management NetSuite Nolapro Merchants Mirror Oracle E-Business suite And many more! Wide range of software! Proprietary accounting systems There are Open Source accounting systems PC based accounting software Web based Accounting software There is a very wide price range! Some are open source! (Free!) Can be both Monthly payments, Yearly payments Generally around £200 a year for small businesses. Goes into the Thousands with bigger businesses! (e.g. Sage 50 Accounts Professional) Can be even more with very big businesses as the companies will want the software tailored for them! 6.2 million Customers worldwide Sage employs over 2000 people Mostly Accountants and entrepreneurs Well known specifically for payroll software Does general accounting software for small to large businesses Contains the following pieces of software: “Instant accounts” to manage finances, Customers and suppliers. Cash flow, Invoicing and VAT. “Instant payroll” For managing employee’s wages. Costs £215 for a year Kashflow is a web based accounting system, designed for small UK businesses. With this in mind - it is simple, and easy to use, but has some powerful features. Cost: £15.99 per month Good for small business as no annual contract, and 2 month free trial available. Easy to use: Can be accessed from anywhere You don't need to have any previous experience Basic descriptions, no complicated accounting terms Intuitive interface, and lots of guidance available in most of the modules Some features of KashFlow: Easily store and retrieve information about; Customers, Sales, Suppliers, Purchases, Bank balance and Quotes Create custom invoice templates (or use those provided) Automatic creation of invoices (e.g. monthly or annually) Generate VAT returns Paypal integration possible. Dashboard Sales record / invoice An invoice can be auto-generated using sales information Sage: Large customer base Good customer support General accounting for large and small businesses Desktop based Kashflow: Web based, no bulky software to store on the system Accessible from anywhere with an internet connection Designed for small businesses Simple and Easy to use Good customer support Cheaper Simple plain language used: No complicated jargon Templates for Invoices and so on available Option to link to other online accounts like PayPal All accounting software has a Database running in the background Kashflow uses MySQL Sage: also uses MySQL The whole point of the software is to store and manage financial information for the businesses There are several options out there for businesses of varying sizes, and there is the software out there tailored for this Two of the main ones that we have covered are Sage, and Kashflow Both of these pieces of software are widely used, and have large support bases Sage can be used for large or small businesses Kashflow is ideal for small businesses The options are out there, and there is a system out there for every system, the correct research just needs to be done by the business to find the right software for them .