Leicestershire County Council Pension Fund

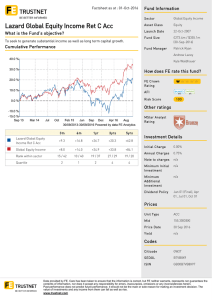

advertisement

Leicestershire County Council Pension Fund Annual General Meeting Brian Roberts Director of Corporate Resources Scheme Administration Large increase in number of scheme employers as schools convert to Academies Significant decrease in active members Importance of accurate and timely data to be provided by employers Monthly electronic returns been developed with employers help Increasing reliance as new scheme beckons Scheme Administration Improvements and developments Website accredited by the plain english campaign Member on line services to be introduced this year Improved reporting features to be developed to help data quality Pension Reform – LGPS 2014 Consultation document issued 21 December. Closes 8th February 2013 This covers membership, contributions and benefits. Further consultation to follow on the remaining items of new scheme, plus cost control, governance and councillors’ pensions etc. Investments Considerable efforts have been made to diversify types of asset held over recent years, without impacting on long-term returns Appointments since the end of 2011/12 year end have ‘completed’ the work in progress A period of relative stability in terms of investment portfolios is now expected But manager underperformance will still have to be dealt with! Asset types held by the Fund UK equities Overseas equities Property Targeted return Global index-linked bonds Private equity Commodities Global Credit Managed Futures Infrastructure Timberland Currency Strategic Asset Allocation Developed Market Equities Emerging Market Equities Private Equity Alternative Assets 35-46% 6-10% 4% 20-30% (including targeted return, global credit and special opportunities) Inflation-Linked 5-10% (including global index-linked bonds, infrastructure and timberland) Property Commodities 12.5% 2.5-5% Investment returns 2011/12 - - Fund return +0.7% Market returns variable, for example; UK equities +1.4% European equities -11.4% UK Property +6.6% UK Index-Linked +18.1% UK Government Bonds +14.5% LOW RISK ASSETS GENERALLY PERFORMED BEST Medium-term investment returns Over 5 years, the Fund’s return has been +0.4% p.a. 0.8% below benchmark, due mainly to manager underperformance within markets Manager underperformance has brought a number of dismissals Return is well below that anticipated by the actuarial valuation (mainly because equity markets have performed poorly over this period) This puts upward pressure onto employer’s contribution rates Returns since year end Equity markets were sharply down until midJune, mainly on fears about Europe Significant recovery since the low point Returns from low point to end-of-December have been good But still the return for the 9 months is only around 5% Outlook for actuarial valuation Still likely to be upward pressure on employer’s contribution rates New slightly cheaper 2014 scheme is unlikely to change this But there has been a big improvement since the position at the end of June Still almost 3 months to go before valuation date, and things can change significantly over this timescale Annual General Meeting Any questions ?