taxes - Americanjourney.net

advertisement

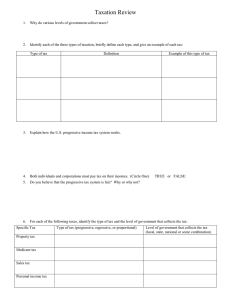

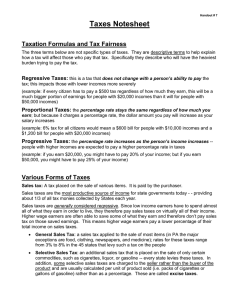

Chapter 9 Sources of Government Revenue 15 Vocabulary words Who and what should be taxed? 1966 “The Taxman” The Beatles School House Rock Tax Man Economics of Taxation • Taxes Why do we pay them? • Govt. tries to Raise Revenue by- income, sales, and property taxes are the main categories • Other ways- college tuitions, social security tax, unemployment, insurance contributions, and drivers license fees. What is the economic impact of taxes? • Resource Allocation: Taxes increase the prices of goods. • Behavior Adjustment: Sin Tax is levied against people who buy cigarettes to discourage smoking. • Productivity and Growth: Do taxes encourage or discourage people to make money? Not sure. CRITERIA FOR EFFECTIVE TAXES • 1. Equitable: It must be fair • 2. Simplicity: The taxpayer and tax collector must be able to understand the laws. • 3. Efficiency: It should be easy to administer and effective in generating revenue. 2 Principles of Taxation: What do you think? • Benefit Principal: Those who BENEFIT from the government goods and services should pay in proportion to the amount they receive. • IE: What about immigrants? • Ability to Pay Principal: the belief that people should be taxed according to their ABILITY to pay, regardless of the benefits they receive. What types of taxes are there? • 1. Proportional Tax: it proposes the same proportion of taxation on everyone, regardless of income. IE: 20% for everyone. • 2. Progressive Tax: is a tax that imposes a higher % rate of taxation on persons with higher incomes. IE: 10,20, and 30% of income. • 3. Regressive Tax: is a tax that imposes a higher % of taxation on low incomes than on high incomes. IE: It pays to make more. • (see graph on page 228) The Federal Tax System Section 2 • AS: In 2001 the US collected $11,800 for every man woman and child in the US. • How many people live in the US and how much money is that? • 350 million people • 4.13 TRILLION DOLLARS!!!! WHOA! Income Taxes: • In 1913 the 16th Amendment was ratified allowing the government to levy an income tax. • This is a tax on peoples earnings to finance its operations. • The federal government has collected nearly 50% of its total revenue from taxes. TAXES: • IRS (Internal Revenue Service): This is who receives the tax and it is done through a payroll withholding system. • On April 17th (usually 15th) you file a tax return which is an annual report of total income and deductions. • If for some reason you cannot file you must file an extension. OUR TAX SYSTEM IS PROGRESSIVE 2011 This is for a single individual • 10% is paid on income up to $8,500.00 • 15% is paid on income $8500-34,500 • 25% is paid on income $34500-83,600 • 28% is paid on income $83600-174,400 • 33% is paid on income $174,400-379,150 • 35% is paid on income over $379,150 OUR TAX SYSTEM IS PROGRESSIVE 2011 This is for a Married individual filing Joint • 10% is paid on income up to $17000.00 • 15% is paid on income $17000-69,000 • 25% is paid on income $69000-139,350 • 28% is paid on income $139,350-212,300 • 33% is paid on income $212,300-378,150 • 35% is paid on income over $379,150 FICA TAXES What is a FICA tax? • Federal Insurance Contributions Act tax • Levied on employers and employees • Pays for Social Security and Medicare What is the % of Social Security and Medicare (started in 1965)? • Social Security is 6.2 it is capped at $84,900 • Medicare is 1.45% no cap. Corporate Income Taxes 2011 • CORPORATE INCOME TAX: • 15% of all income under 50,000 • 25% of all income between 50000-75000 • 34% of all income between 75000-100,000 • 39% of all income between 100,000-335,000 • 34% of all income between 335,000-10 million • 35% of all income between 10 mill-15 mill • 38% of all income between 15 mill-18.333333 mill • 35% of all income between 18.333333 mill - Excise Tax: • A tax on the manufacture or sale of selected items, such as gasoline, and liquorthis is the 4th largest revenue maker for the US. Estate and Gift Taxes: • Estate tax: is a tax on the transfer of property when a person dies. Estate taxes can range from 18-50% of the value of the estate. • Estates worth less than $675,000 were exempt in 2002, although this limit will soon be raised to 1 million. • You must QUIT CLAIM the house to your children 3 years prior to their death to avoid the tax. (see ehow: get the form get it notarized) GAMBLING and GREED • "Las Vegas was built for people who are really bad at math...." ...Penn Jillette • Casino gambling: $50 billion business • 20 % comes from Nevada • 1/3 of all tax is generated by gambling (NV) • Taxes: 25% is withheld if you win over 1200-. • If you are foreign 30% is withheld. • http://lasvegas4newbies.com Customs and Duties • Customs: A charge levied on goods brought from another country. • The President has the ability to raise or lower the customs tax by as much as 50% • Customs taxes produce very little revenue although prior to 1913 it was the highest. User Fees • President Ronald Reagan made a huge push for USER fees. • The fees would include entrance charges you pay to visit national parks, fees that ranches pay to graze on federal land. (125- / yr. 10-/day) • These are taxes based on the benefit principal. See page 232, and 239. State taxes Section 3 • Intergovernmental Revenues: Revenues collected by one level of government that are distributed to another level for expenditures. • Taxes and Fees: (7.0% “state” tax + 0.25% “county” tax + “combined state and local” tax of 1.0% = 8.25% CA.) • Only 5 states have no sales tax. Alaska, Oregon, New Hampshire, Montana, and Delaware. • The choice of tax: Lotteries, the states spend ½ the money on prizes and 6% on administration. #1 money maker. Local Government Taxes Section 3 • Intergovernmental Revenues: Transfers from state governments. 1st and largest. • Property Taxes: 2nd largest revenue. 1.2-2.0% of the price of the home. • Public Utilities: This is the 3rd largest contributor. Current Tax Issues Section 4 • Tax Reform 1986, 1993: • Surcharge: 5% or additional tax above and beyond the base rate for the companies in the top 31%. • Taxes: Either a 15% tax or 28% tax. • Tax Reform 1997: • Capital gains: Tax on the sale of an asset held for 12 months was reduced from 28% to 20%. • Tax reform 2001: • Refunds for Individual/married couples of $300/$600.00. Also higher child tax credits. THE END The nation should have a tax system that looks like someone designed it on purpose. ~William Simon Taxes: Of life's two certainties, the only one for which you can get an automatic extension. ~Author Unknown Indoors or out, no one relaxes in March, that month of wind and taxes, the wind will presently disappear, the taxes last us all the year. ~Ogden Nash It's income tax time again, Americans: time to gather up those receipts, get out those tax forms, sharpen up that pencil, and stab yourself in the aorta. ~Dave Barry Man is not like other animals in the ways that are really significant: animals have instincts, we have taxes. ~Erving Goffman Are Taxes Voluntary? • 2009 Federal Tax Laws • 2009 State Tax Changes • Create your own tax system see www.mrpillsbury.com click here