Document

advertisement

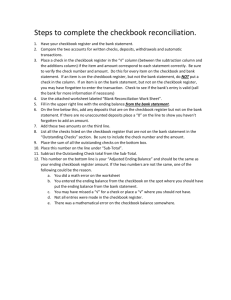

Balancing a Checkbook Or How you, too, can avoid Overdraught Charges!! GATHER YOUR MATERIALS BEFORE YOU START CAREFULLY COMPARE • ALL Your Statement’s: – Cleared Check numbers and amounts – Cleared Deposit dates and amounts – Cleared Withdrawal dates and amounts • To ALL Your Register’s: – Check numbers and amounts – Deposit dates and amounts – Withdrawal dates and amounts http://www.usu.edu/arc/idea_sheets/checking.htm THE LEFT OVER OR THE NOT CLEARED CHECKS THIS IS WHAT WE NOW WORK WITH ON THE BACK OF THE STATEMENT Carefully and accurately enter onto the back of the Statement • All uncleared check numbers and the amount of the check in the proper columns • All uncleared deposits in the proper column for totals • The ending balance from the front of the Statement in the totals column With the ending balance on the top add the total of uncleared deposits subtract the total of uncleared checks Which equals The Balance According to the Statement Or The reconciliated balance of your checkbook statement The End