Presentaion on - National Housing Bank

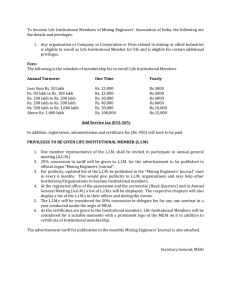

advertisement

Data on Slab-wise Housing Loans of PSBs and HFCs - Importance and Uses Helps in analyzing the trend of institutional credit in Housing Sector. Indicates flow of the institutional credit to various Slab-wise borrower segments. Helps in analyzing movement of NPA, in slabwise Housing loans. Analysis of the data helps in recommending the required Policy Interventions by the GoI or RBI. Helps in forecasting the requirement of funds under various Interest Subvention Schemes. National Housing Bank (NHB) is collecting the slab-wise housing loan data from Public Sector Banks (PSBs) and Housing Finance Companies (HFCs) on quarterly and yearly basis. The data is collected in five different slabs namely: housing loans upto 2 lakh, Above 2 lakh and upto 5 lakh, Above 5 lakh and upto 10 lakh, Above 10 lakh and upto 25 lakh and above 25 lakh . The slab wise data so collected captures following attributes: • Total housing loans disbursed during the quarter. • Total Housing loans outstanding as on last day of the quarter. • % of NPA in respect of the slab-wise loans. The format for submitting the Data has been designed and forwarded to all the Banks. NHB has requested all Public Sector Banks (PSBs) to appoint Nodal Officers as one-point contact for submission of the data. 15 PSBs out of 26 PSBs have appointed the Nodal Officers. The data so collected is shared with Ministry of Finance regularly on monthly basis. Collection of such data will help in building a strong and broad based data for the Industry. Such database will help in undertaking various sector-related studies which can be shared with industry players. Sharing of data/study findings, will facilitate Banks & HFCs in designing their future Business Strategies/Targets. Data pertaining to NPA across the various slabs may help Banks & HFCs in further improving their recovery mechanism and NPA Management System. Availability of Data will serve as a vital input for the Government, RBI and NHB for appropriate policy and regulatory interventions.