Life on the Global Commodity

Frontier

What is a commodity?

Literally, something sold in quantity

There must be a demand for it.

It must have a price in the market

Commodification involves:

Turning something into a commodity

Creating demand for a good or service

Ensuring that demand continues,

either through replacement or

upgrading

$100/bbl??

The price of

the marginal

barrel of oil is

the price of

oil everywhere

Consumer spending

is 60-70% of U.S.

economic activity

A lot of consumer

spending has been drawn

from home equity

$ 9 trillion or about $30k/person—

more than $4 trillion might be foreign

debt

Under the classical understanding of economic

accounts

•Consumers spend savings or surplus income—not equity

•Consumers stop spending when these are exhausted, or they borrow

funds in credit markets

•The government gets revenues from taxes

•If spending exceeds taxes, the government must borrow from

credit markets

•To pull funds into credit markets, interest rates must be

sufficiently high

•If interest rates are too high, they will squelch consumer spending

and other economic activity

•The economy will go into recession, employment & income will decline,

and tax revenues will go down

•How can the economy be restored?

•Through Keynesian pump-priming or

•Fiscal discipline—squeeze the economy

This pattern began to change in the 1990s

• Cheap imported goods low wage pressurelow inflation

•Dollar flows abroadChina & others buy Treasury bondsloans to government for defense

& wars

•Foreign reserve overhang unpayable IOUsdeclining dollar investment in other

currencies

•Low inflationLow interest ratesconsumer borrowingrising real estate pricesasset

inflation

•Housing bubblehigher returns than Treasury bondsMortgage bundlingselling &

speculation

•To maintain inflow of dollars requires higher interest rates; to reflate the economy

requires lower interest rates

•Oil is denominated in dollarsdeclining dollar motivates higher oil pricesmore dollars

flowing abroadfor. Reserves up

•Speculators can get higher returns betting on future oil price increases affects

price of oil today

•Attack on Iran could lead to oil shortages higher oil prices in the future

•Oil-producing countries and U.S. oil companies are benefiting from higher oil prices

•U.S. arms sales to Saudi Arabia is one way to extract some of that surplus

A commodity frontier involves:

Finding new goods for which a demand

exists or can be created

Commodifying new products for profit

If possible, establishing monopolies on

new goods through property rights

The trick is to make things with no

apparent value both scarce and costly

Create demand for new

products, e.g., MP3 players

Commodity frontier relies

on the creation of scarcity

Privatize a public resource

through enclosure, e.g.,

pollution permits

Develop new services that

people seek, e.g., medical

interventions

If you can create a monopoly, even for a limited amount of

time, you can generate windfall rents on the good or service

Some commodities last a very long

time—1968 Volvos—which tends

to limit the market for new sales

and can lead to overproduction

Hence, commodity frontiers can

involve redesign, new features,

sex appeal, all in order to get a

buyer to dump the old and buy the

new.

Planned or intentional obsolescence

is another way to maintain a

commodity frontier: new computers

run only new software which

requires prodigious quantities of

memory not available on older

models.

Information and knowledge can be

transformed into new commodities,

to be bought and sold

Consumer preferences

Software revisions

Segmented markets

DNA

Organ trade

New commodity frontiers are being

explored in knowledge, culture, and

the body

Knowledge

Software, biotech, nanotech,

consumer preferences,

personal data

Culture

Music, media, dress, food,

lifestyles, identities, living

spaces, religions, travel

Bodies

Genetic modifications, body

modification, organs, appearances, sex tourism & workers

Private property (PP) is at the heart of capitalism:

With any new product, it is important to establish proprietary rights

John Locke

Improving nature through labor

entitles one to ownership

Returns from property encourage

effort to be more productive

Milton

Friedman

Kenneth

Arrow

Only private property provides

returns required to foster individual

initiative and invention

If "information is not property, the incentives to

create it will be lacking. Patents and copyrights

are social innovations designed to create artificial

scarcities where none exist naturally... These

scarcities are intended to create the needed

incentives for acquiring information. (p. 125, in: "The

economics of information: an exposition," Empirica 23, #2 (1996):119-28.)

Intellectual property rights (IPRs) create private

property, scarcity, monopoly, and incentive—or so it is

said—which allows owners to reap “appropriate” profits

IPRs are title to forms of

knowledge that prevent

non-owners from use without payment or license

Trademarks

Patents

Copyrights

Historically, IPRs were granted nationally

One had to apply for a patent

or copyright in every country

Failure to patent meant your book

or invention could be pirated

Paris Convention of 1882

est. uniform int’l patents

Berne Convention of 1886

est. uniform copyrights

Until well into the 20th century, the

U.S. was a signatory to neither

Sometime during the 1960s and 1970s, the economic potential of

technological and biological patents became of central concern to

the U.S. government

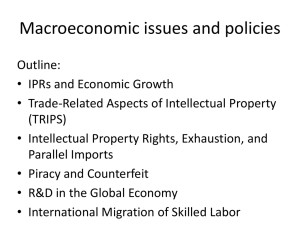

TRIPS (Trade-Related Aspects of Intellectual

Property Rights) was a political and social

innovation by the United States to enable

corporations to assert control over products

•S/he who can establish binding rules of the global political

economy can do so to his/her advantage

•Trade-related Intellectual Property & Services (TRIPS) was the

brainchild of U.S. govt. & pharmaceutical entrepreneurs

•TRIPS sets minimum standards for protection of intellectual

property, which WTO members must follow

•WTO Dispute Resolution System as well as national courts can

enforce IPRs under the terms of TRIPS

What are the effects of IPR monopolies?

Owners of IPRs enjoy a monopoly

for a specified period of time

Others must buy a license

and pay royalties to use or

produce the good

The high costs of some innovations

are impossible for the poor to pay

Monopoly prices may make

some goods inaccessible to

the poor

New technologies remain under

control of corporations in rich

countries

Power relations are maintained via

the control of knowledge and goods

Poor countries have

access only to older

generation technologies

Open-source intellectual

goods are faced with a

restrictive environment

Global political implications of living on

the commodity frontier

• People & things come to be valued in the

market rather than for their social roles

• Since commodities have limited use value,

they tend to be discarded rather easily

• A focus on consumption foregrounds selfinterest and devalues common good

• Bonds of trust and mutual obligation are

eroded and destroyed

• This feeds back into social relations within

and among groups, and into insecurity