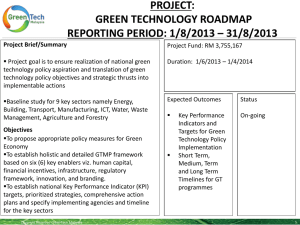

joint presentation attached - IFA-UK

advertisement

www.pwc.co.uk Information exchangeThe Real Story Diane Hay Kay Kimkana October 2012 Quiz – what links the following? • Gordon Brown? • Osama bin Laden? • Nicolas Sarkozy? • Senator Obama? • The man who was Heinrich Kieber? • Bradley Birkenfeld? PwC 2 Agenda • What is it about exchange of information? • Introduction to exchange of information • Recent developments • The UK picture • What happens in practice…the real story PwC 3 What is it about exchange of information? PwC 4 What is it about exchange of information? “tax havens, banking secrecy, that’s all over” “we agree to take action against non-co-operative jurisdictions, including tax havens. We stand ready to deploy sanctions to protect our public finances and financial systems. The era of bank secrecy is over.” PwC 5 What is it about exchange of information? “ what we are witnessing is nothing short of a revolution. By addressing the challenges posed by the dark side of the tax world, the campaign of global tax transparency is in full flow…. With the crisis, global public opinion’s expectations are high, their tolerance of non-compliance is zero and we must deliver” PwC 6 Introduction to exchange of information PwC 7 Exchanges of information Three main types of information exchanges • Information on request – request for specific information. • Spontaneous exchanges – where one fisc believes the information it has obtained may be of interest to one of its treaty partners. • Routine/electronic exchanges – typically information comprising many individual cases of the same type eg interest, royalties. Usually a prior agreement between the fiscs as to what information they want and the format to send it. OECD has designed standard paper and electronic formats. PwC 8 Legal bases for exchanging information • Bilateral tax treaties – usually based on Article 26 of OECD Model Convention (basis of exchanges under JITSIC as well) • Tax Information Exchange Agreements (TIEA) – usually based on the 2002 OECD Model Agreement on Exchange of Information on Tax Matters . • Multilateral instruments such as the Council of Europe/OECD Convention (signed by only 21 countries prior to 2011 G20 meeting) Nordic Assistance Convention etc. • EC Directive on Mutual Assistance 1977 – now repealed and replaced by EU Directive 16/2011 on Administrative Cooperation in the field of taxation. PwC 9 OECD Exchange of Information models Article 26 • Most widely accepted legal basis for bilateral exchange of information for tax purposes. More than 3,600 bilateral treaties are based on the Model Convention. • Updated in 2005 when paragraphs 4 and 5 added to cover bank secrecy. • Commentary last updated July 2012. TIEAs • Introduced in 2002 as a stand-alone agreement following work of OECD’s Global Forum. • By 2008, only 23 TIEAs signed! • Numbers have rocketed since then. PwC 10 TIEAs signed annually 197 200 67 0 PwC 1 1 6 1 0 2 0 12 24 11 TIEAs signed between G20 Summits (cumulative) 600 505 500 421 400 366 300 200 159 100 0 PwC 518 44 TIEAs Signed between G20 Summits (cumulative) 65 12 160 140 120 100 80 60 40 20 0 Israel Italy Jamaica Japan Jersey Kenya Republic of Korea Liechtenstein Luxembourg Macao, China Mayalsia Malta Marshall Islands Mauritius Mexico Monaco Montserrat Netherlands New Zealand Nigeria Norway Panama Philipines Poland Portugal Qatar Russian Federation St Kitts and Nevis St Lucia Sint Maarten Saint Vincent and… Samoa San Marino Saudi Arabia Seychelles Singapore Slovakia Slovenia South Africa Spain Sweden Switzerland Turkey Turks and Caicos United Arab… United Kingdom United States Uruguay Vanuatu Andorra Anguilla Antigua and Barbuda Argentina Aruba Australia Austria The Bahamas Bahrain Barbados Belgium Belize Bermuda Botswana Brazil British Virgin islands Brunei Darussalam Canada Cayman Islands Chile China Columbia Cook Islands Costa Rica Curaçao Cyprus Czech Republic Denmark Dominica Estonia Finland F.Y.R. Macedonia France Georgia Germany Ghana Gibralter Greece Grenada Guernsey Hong Kong, China Hungary Iceland India Indonesia Ireland Isle of Man TIEAs/DTCs signed with OECD/G20 countries 160 140 120 100 80 60 40 20 0 PwC TIEAs/DTCs with OECD/G20 countries TIEAs/DTCs with non OECD/G20 countries 13 Article 26 and TIEAs Similar features – foreseeable relevance • In both instances ‘shall’ means it is mandatory to exchange information. • Both envisage information exchange to ‘ the widest possible extent’ but do not allow ‘fishing expeditions’. • Balance between these two is captured in the standard of ‘foreseeable relevance’. • ‘Foreseeable relevance ‘replaces previous Art 26 wording of ‘necessary’. Not intended to be very different – but it is! A lower standard and moves the burden of proof from the tax authority to show that the information is ‘necessary’. • July 2012 guidance – reasonable to suppose that the information requested will be relevant. Requesting authority best-placed to determine this. PwC 14 Article 26 and TIEAs Similar features - reciprocity • Another key concept is the principle of ‘reciprocity’. • A tax authority is obliged only to obtain and provide such information that the requesting tax authority could obtain under its own laws under similar circumstances. • Art 26 – extends this to information that the requesting authority could obtain in the normal course of administration i.e. the requesting authority should not be able to take advantage of an information system that is wider than its own. • Could even lead to a refusal to provide information where the requesting authority’s lack of resources effectively results in a lack of reciprocity. • July 2012 update - to be interpreted in a broad and pragmatic way. PwC 15 Article 26 and TIEAs Similar features –use of powers • The requested tax authority must use its information gathering powers if information not already available (subject to other conditions). • A tax authority cannot refuse information exchange solely because it has no domestic tax interest in the information (Art 26(4) and TIEA Art5 (2)). • TIEA sets out the type of information that a requesting fisc should provide (Article 5 (5)), Art 26 more vague – OECD manual (2006) gives list of items that should be included in an information request. • May be able to exchange information on third country residents, but only if already have it or there is ‘power or possession’. PwC 16 Article 26 and TIEAs Limitations • Limitations on exchange - Art 26(3) and TIEA (but not a prohibition) • If not in accordance with domestic laws or administrative practice. • If not obtainable under the laws in normal course of administration. • Trade or business secrets or (in extreme cases)contrary to public policy (ordre public). • Time limits for making exchanges? July 2012 commentary update suggests default of two months from receipt of request (!) PwC 17 Tackling bank secrecy Article 26 (5) changes and TIEAs • State cannot refuse a request for information solely because it is held by a bank or other financial institution (Art 26 (5) and TIEA Art 5(4). • Bank secrecy is not incompatible with the requirements of Article 26 or TIEA. • Austria, Belgium, Luxembourg and Switzerland entered reservations to Article 26 in 2008, subsequently withdrawn in 2009. • But limitations in both Art 26 and TIEA have contributed no doubt to introduction of FATCA rules by US. PwC 18 Article 26 and TIEAs Important differences • Taxes covered • TIEA applies to the administration and enforcement of taxes covered by the TIEA. • Art 26 applies to all taxes ‘of every kind and description’ and not limited by Art 2. • Scope - TIEA only covers information on request! But could be expanded to other types. • Confidentiality - no obligation under TIEA to exchange information that would reveal client/lawyer communications. PwC 19 Recent developments PwC 20 Foreign Account Tax Compliance Act U.S. persons are using foreign entities to invest and avoid U.S. reporting and back-up withholding. • Certifying to be foreign persons • Availing themselves of treaty benefits • U.S. loses an estimated $100 billion in tax revenues annually due to offshore tax abuses. • Financial institutions may be facilitating international tax evasion • The provisions are intended to provide the Internal Revenue Service (“IRS”) with an increased ability to detect U.S. tax evaders hiding their money in foreign accounts and investments; PwC 21 Joint International Tax Shelter Information Centre • Formed by the Tax Commissioners of Australia, Canada, the United Kingdom and the United States in April 2004. • Now includes Japan, Korea and China and observers from France and Germany • A joint task force to identify and curb abusive tax transactions • Share expertise, best practices and experiences to combat abusive tax schemes • Exchange information on abusive tax schemes, in general, and on specific schemes, their promoters, and investors within vires of Art 26 • Successful because of physically co-located, develop relationships and understandings PwC 22 The UK picture PwC 23 Overview The UK signed 6 new agreements in the year ended 31 March 2012. 145 agreements in total which provides for the exchange of information (121 double tax agreements and 24 TIEAs ). PwC 24 Article 26 (4) and (5) • UK treaties have a version of Article 26, which provides for the exchange of information. • Paragraphs 4 and 5 of the OECD model were updated in July 2005 which set out the following: • Paragraph 4 – state cannot refuse information request because it has no domestic tax interest. • Paragraph 5 – information held by a bank or other financial institution. • Updated paragraphs 4 and 5 reflected in the double taxation agreement between the UK and the following states: • the Netherlands (in force 2010) • Switzerland (in force 1978, updated) • Mauritius (in force 1981, updated) • Luxembourg (in force 1968, updated) PwC 25 Article 26 (4) and (5) • The following agreements do not reflect the updated paragraphs 4 and 5 (and these tend to be the older agreements): • Cyprus (in force 1974) • Austria (in force 1970) • Belgium (in force 1989) • Can HMRC get around the issue by using the Multilateral Convention on Mutual Assistance in Tax Matters or for EU Member States, the Council Directive (2011/16/EU)? PwC 26 TIEAs signed by the UK •Liberia •Liechtenstein •San Marino •Antigua and Barbuda •St Christopher and Nevis •St Lucia •St Vincent and the Grenadines •Bermuda •Isle of Man •Jersey •Guernsey •British Virgin Islands •Gibraltar •The Bahamas •Anguilla •Turks and Caicos Islands •Belize •Dominica •Aruba •Grenada •St Kitts and Nevis •Grenada* •Liberia* •Netherlands Antilles* *not entered into force PwC 27 FATCA • On the day the FATCA regulations were released (Feb 2010), the US Treasury released a joint statement with the governments of the UK, France, Germany, Italy, and Spain announcing an intergovernmental framework for FATCA implementation and international tax compliance. ? ? ? PwC 28 FATCA • Under this approach, "FATCA Partner" countries will enter into agreements with the US to collect information from financial institutions and automatically forward this to the IRS. Bilateral automatic exchange of information • US commits to reciprocity [with the 5 FATCA partners] with respect to collecting on an automatic basis to the authorities of the 5 FATCA partners on US accounts of resident FATCA partner. PwC 29 FATCA • First agreement signed 18 September 2012 between the US and UK. • Financial institutions in the UK will comply with FATCA by reporting to HMRC, who will send the details on to the IRS. • Provides for: • Annual exchange on an automatic basis; and • Aims for reciprocity – equivalent levels of information exchange between FATCA partners. • Isle of Man, Jersey and Guernsey to negotiate FATCA agreement with the US based on the UK agreement. PwC 30 What happens in practice .... the real story PwC 31 The real picture? “Information exchange under the standard agreement is sporadic, difficult, and unwieldy for tax administrators even under the best of circumstances” “ It is common knowledge that the OECD TIEA has been ineffective in limiting international tax evasion and aggressive tax avoidance’ PwC 32 Peer Reviews - Putting the teeth into information exchange • Phase 1 examines the legal and regulatory framework of member jurisdictions • Phase 2 looks at the actual implementation of the international standard of transparency and exchange of information in practice • Key areas • availability of any relevant information in tax matters • the power of the administration to access the information • the administration’s capacity to deliver this information to any partner which requests it. • Phase 1 nearly completed – 96 reviews. Phase 2 just beginning • Nearly all peer reviews show improvement needed and 32 countries lack one or more essential element. 13 held back from phase 2 PwC 33 Some real life observations • Volumes of requests – more than you think, the angry Belgians • Rubbish in, nothing out – requests need to be well formulated • Tax authorities need for effective electronic interfaces to make routine exchanges work, the stolen bank discs • Also need universal identification – not NINOs! • Good responses from Crown Dependencies – unless one of their residents – in their interests to be above board • ‘One can always find a reason and a way to answer a request if one wants to’ – enthusiasm and experience • ‘What is the best information an investigator can have-that which a taxpayer in his worst nightmare could never imagine the tax authority could get hold of. And that happens more often than people realise.’ PwC 34 Final Thoughts “but being as this is a .44 Magnum, the most powerful handgun in the world, and would blow your head clean off, you've got to ask yourself one question: Do I feel lucky? Well, do ya, punk?” PwC 35