Globalization and growth

advertisement

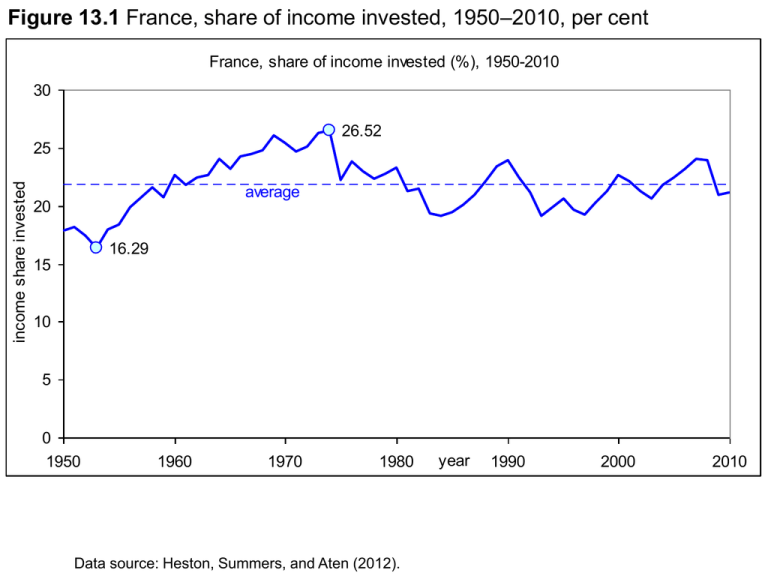

Figure 13.1 France, share of income invested, 1950–2010, per cent France, share of income invested (%), 1950-2010 30 26.52 income share invested 25 average 20 16.29 15 10 5 0 1950 1960 1970 1980 Data source: Heston, Summers, and Aten (2012). year 1990 2000 2010 Figure 13.2 Income levels and capital accumulation (Solow) output 5 4 Equilibrium capital available from savings = investment 3 A 2 B capital needed for depreciation and population growth 1 0 0 5 10 15 20 25 capital-labour ratio k* 30 35 40 Figure 13.3 USA: GDP per capita, 1870-2010 (log scale) USA; per capita GDP, 1870-2010 (log scale) per capita GDP 100,000 10,000 1,000 1870 1890 1910 1930 year 1950 1970 1990 2010 Data sources: Maddison (2010) for the period 1870-2008, combined with Heston, Summers, and Aten (2012) rgdpch for 2009 and 2010, normalized at 2008. Notes: measured in international 1990 Geary-Khamis $; the thin line is a trend line Figure 13.4 Income per capita and secondary schooling rate, 2010 GDP per capita and secondary schooling, 2010 GDP per capita (log scale) 100,000 Australia 10,000 1,000 Niger 100 0 20 40 60 80 100 secondary schooling rate (gross) 120 Data source: World Development Indicators online; GDP per capita measured in constant 2000 US $. 140 Figure 13.5 Income per capita and years of schooling; World Bank regions, 1960-2010 Years of schooling and per capita income per capita income (log scale) 10,000 LAC ECA MENA 1,000 SSA SA EAP 100 0 1 2 3 4 5 6 7 8 9 years of schooling Data sources: Cohen and Soto (2007) for years of schooling (population 15-64; population-weighted averages) and World Bank Development Indicators online for per capita income (GDP in constant 2000 dollars); World Bank regions (developing countries only) are: MENA = Middle East & North Africa; LAC = Latin America & Caribbean; SSA = Sub-Sahara Africa; SA = South Asia; EAP = East Asia & Pacific; ECA = Eastern Europe & Central Asia; data for 1960, 1970, 1980, 1990, 2000, 2010 Figure 13.6 Japan and Indonesia: income per capita, 1970-2010 Japan and Indonesia; per capita income 1870-2010 per capita income (log scale) 100,000 Japan 10,000 trendline Japan trendline Indonesia 1,000 100 1870 Indonesia 1890 Data sources: see Figure 13.3. 1910 1930 1950 year 1970 1990 2010 Figure 13.7 Overview of technology spillovers in an open developing economy North 1 North 2 FDI14 FDI13 FDI24 Trade13 Trade24 Trade14 a Trade23 South 3 E3 South 4 education d -related b FDI23 Trade34 North-South trade-related spillover E4 c spillover South-South traderelated spillover b North-South FDI-related spillover Figure 13.8 Intertemporal adjustments in Singapore, 1972–2010, current account balance, per cent of GDP current account balance Singapore; current account balance, 1972-2010 (% of GDP) 28.73 30 20 10 0 1970 1975 1980 1985 1990 -10 -20 1995 2000 2005 2010 year -19.58 -30 Data source: World Bank development indicators online Figure 13.9 Rapid growth in Europe – Asia trade, 1500-1800 Number of ships sailing to Asia from Europe, 1500-1800 3,000 2,500 2,000 1,500 1,000 500 0 1500-99 Portugal 1600-1700 Netherlands England 1701-1800 France Other Data source: Maddison (2001); “Other” refers to ships of the Danish, Swedish trading companies, and the Ostend company Figure 13.10 Multinational trade composition a. Portugal; Estado da India (per cent by weight) 80 60 1513-19 40 1608-10 20 0 Pepper Moluccan Spices Other Spices Textiles Indigo Other b. Netherlands; Dutch East India Company (VOC,per cent by value) 80 60 1619-21 40 1778-801 20 0 Pepper Other Spices Textiles & Raw Silk Coffee & Tea Other c. England; English East India Company (EIC, per cent by value) 80 60 1668-70 40 1758-60 20 0 Data source: Maddison (2001). Pepper Textiles Raw Silk Tea Other Figure 13.11 A Dutch ship in Nagasaki, 1859 Text (right to left): A long time ago the Dutch already were very skilled in navigation, and Dutch ships sailed around the world. The Dutch were very well versed in shipbuilding and of how to use ships profitably for foreign markets. They chose good materials and worked like when building up stone walls; they used iron nails and filled up cracks with tar and hemp. In the fourth month they sailed from their country (from Indonesia, the journey from Indonesia lasted much longer) and in the sixth month they arrived here. When (the ship arrives) in Nagasaki and the cannons, which are placed side by side, are fired, clouds appear and make the ship invisible. When the smoke has risen, the sails that had been visible in large numbers suddenly appear to have been rolled up. Upon departure they also fire cannons, and before the smoke has risen they have already hoisted the sails, astonishing the spectators. Their manoeuvring is truly miraculously fast and mysterious. Oranda fune no zu, 1859. Artist, Yoshitora; Publisher, Yokohama, Shimaya, 36.5 × 25.5 cm. Inv.nr.: NEHA SC 477 nr. 31, IISG. Figure 13.12 The Japanese economy, 1500–2008, GDP & exports, percent of world total Japan: GDP and exports, percent of world total 9 Portuguese expelled end of shogun era 6 GDP 3 export Portuguese landing 0 1500 Dutch landing 1600 treaty of Kanagawa 1700 1800 WW II 1900 2000 Data sources: Maddison (2001, 2010) and World Development Indicators online for 2008 share of world exports (in current US dollars). Figure 13.13 Developments in Chinese income and trade flows, 1960–2011 Economic developments in China, 1960-2011 100 50 Export of goods and services (% of GDP, right scale) 10 25 GDP/cap (% of world average, log scale, left) GLF CR Mao ER 1 1960 SP&TS GR 0 1970 1980 1990 2000 2010 Data source: World Development Indicators online; GDP per capita measured in constant 2000 US dollars; GLF = Great Leap Forward; CR = Cultural Revolution; Mao = Mao’s death; ER = Economic Reform; SP&TS = Student protests on Tiananmen Square; GR = start Great Recession. Figure 13.14 The Dupuit triangle price pmax Dupuit triangle A p demand O q qmax quantity Figure 13.15 Dynamic costs of trade restrictions Welfare costs of an increase in trade restrictions 100 Romer expected costs welfare costs (per cent) 88 dynamic costs 50 45 static costs = Romer unexpected costs 25 17 8 0 0 T'1 = 0.20 T1 = 0.10 Source: van Marrewijk and Berden (2007) 1-exp(-T) 1