Significance of RECs for Investment in Wind Power

advertisement

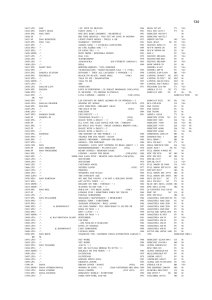

REC Mechanism: Opportunity for Investment in Wind Power Dr. Govind Bhagwatikar Siemens Limited: Wind Power Renewable Energy 2012 Wind Conference Pune, India 29 May 2012 Disclaimer: The views and opinions are of the presentator only. REC The CERC issued REC regulations in January 2010. The key objective of the REC mechanism is to promote the development of renewable energy and facilitate its inter-state flow. This would enable the obligated entities (distribution utilities and open access customers) across states to meet their RPO targets as recommended by the NAPCC. REC Mechanism Renewable Energy Generation Sale at Preferential / Feed-in Tariff Conventional Electricity Component (APPC) REC Component Obligated Entities: DISCOMs, Open Access & Captive Consumers Local / Host Distribution Company Obligated Entities: DISCOMs, Open Access & Captive Consumers The Obligated entities will have to replace approximately 5-7% of their total quantity of power consumed with power generated from renewable energy, or buy it on paper. *APPC – Av. Power Pooled/Procurement Cost RPO in Various States REC Accreditation The Process of getting the RECs: 1. 2. 3. 4. Accreditation Registration Issuance Trading & redemption State Nodal Agency (SNA) Central Agency (NLDC) Central Agency (NLDC) Power Exchange Features of REC RE GENERATORs: Wind, Solar, Small Hydro, Bio-mass, Bio-fuel, Cogeneration, Municipal Waste, Any GENERATOR approved by MNRE REC denomination: 1 MWh Categories: Solar & Non-solar Validity: 365 days after issuance Trading platform: Power Exchanges only Trading Calendar: Last Wednesday of the month Valid up to 2016-17 Eligibility Criteria for getting REC RE Generator not having any PPA at preferential tariff. RE Generator selling electricity to local/host distribution licensee at a price not exceeding the pooled cost of power purchase of such distribution licensee. OR RE Generator selling electricity to any other licensee or to an open access consumer at mutually agreed price or through power exchange at market determined price. RE Captive power producer (CPP) is eligible for the entire energy generated from such plant including self-consumption subject to condition that CPP has not availed any benefit in the form of concessional / promotional transmission or wheeling charges, banking facility benefit or waiver of electricity duty etc. Existing projects for which long-term PPAs are already in place will be allowed to participate in the REC scheme after the expiry of their existing PPAs. REC Traded Price in FY 2011-12 •REC Traded Price - INR 1.50 to Rs. 3.06 per unit •Av. REC price was Rs. 2.30 •During the year end – JanMarch, REC traded at higher price and volumes were increased. •This was the first year of REC trading in power exchanges. Case Study of 6 States State Wind Tariff APCC 2011-12 3 Cases of REC Price APCC + REC CERC order at 1.5 at 2.25 at 3 at 1.5 at 2.25 at 3 Gujarat 3.56 2.98 1.50 2.25 3.00 4.48 5.23 5.98 Maharashtra 5.37, 4.67, 3.97, 3.58 2.62 1.50 2.25 3.00 4.12 4.87 5.62 Andhra Pradesh 3.50 2.50 1.50 2.25 3.00 4.00 4.75 5.50 Tamil Nadu 3.39 2.69 1.50 2.25 3.00 4.19 4.94 5.69 Karanataka 3.70 2.66 1.50 2.25 3.00 4.16 4.91 5.66 Rajastan 4.46, 4.69 Note: GBI not considered 2.60 1.50 2.25 3.00 4.10 REC Floor Price – 1.50 REC Forbearance Price – 3.30 4.85 5.60 Rs/kWh Trend of APPC State Wind Tariff Ref:------- APPC 2009-10 APCC 2010-11 APCC 2011-12 CERC CERC CERC Andhra Pradesh 3.50 1.78 2.52 2.50 (2.00) Gujarat 3.56 2.21 2.53 2.98 Karnataka 3.70 1.85 2.61 2.66 5.37, 4.7, 3.97, 3.58 2.43 2.51 2.62 Rajasthan 4.46, 4.69 2.48 2.60 2.60 Tamil Nadu 3.39 2.62 2.37 2.69 Maharashtra APCC 2012-13 2.73 Dependability on Thermal Power India 65.34% In June 2011 Total Thermal Power 116 GW Coal Based 97 Gas Based 18 Oil Based 1 Coal Demand rising vis-à-vis its Price YoY. So the conventional electricity would be costly, as 60% power in India is generated by Coal-fired stations. Until 2005, the coal prices were upto Rs. 600 only. Coal India Limited fetched the price of Rs. 1800-2200 per ton in FY 2010-11 through auctions against the notified price of Rs. 800-1200 Cost of Generation APPC APPC will vary with the prices of Coal : Domestic / Imported Gas Diesel / Transportation Water Metal Maintenance charges Conclusion Due to dependability on coal, APPC will increase. This is in turn an opportunity for RE producers.