Financial Stability: A Governing Board`s Perspective

advertisement

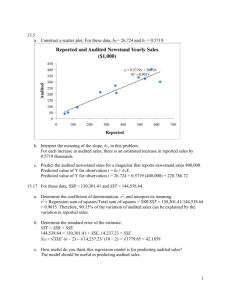

Community Health Centers and Other Primary Care Service Organizations FINANCIAL STABILITY A Governing Board’s Perspective Presented by: Cynthia Prorok - October 2010 Kentucky Primary Care Association 2010 Annual Meeting www.kypca.net Goals of Learning Session: Review Importance of Financial Stability for Health Centers Board’ Fiduciary Oversight Business Plan Changes Purpose of the Changes When the Changes Apply BPHC Required Financial Measures Focus on Financial Viability and Costs What the Measures/Ratios Mean Sample Business Plans Alignment of Grant Applications, PAR, UDS, OPR, & BPHC TA SAC 2010 - Update on Governance Requirements 2 Importance of Financial Stability: To provide for: ACCESS: Maximize capacity to serve patients QUALITY CARE: Sufficient resources for service delivery ACCOUNTABILITY: Oversight of federal grant funds VIABILITY: Pay staff, vendors, and creditors on time To Remain a ‘good credit risk’ Continue/Expand Health Center Mission Board’s Fiduciary Responsibility: Approve Policies/Procedures/Budgets, Review Results, Ask Questions 3 Measuring Financial Performance: Measuring Financial Results: Systems & Strategies Accounting and practice management systems Full accrual-basis of accounting (GAAP) Base-line budgeting - “Where are we now if nothing changes” Accrual & cash flow forecasts, Develop “What if” forecasting tools Managing by with the Numbers: Keeping Score Maintaining the historical record - timely, accurate Designing the chart of accounts to facilitate analysis Set up of practice management system “master files” Report writer - capability, training, utilization 4 Monitoring Financial Performance: Turning Raw Data into Decision-making Data Identify key measures/ratios to track Designing reports to monitor performance – Board & Sr. Management Variance Analysis & Determining the Underlying Story Identify underlying cause(s) for poor results Develop action plans to: Improve Performance POLICIES PEOPLE PROCEDURES RESULTS SYSTEMS “The Business Plan is an Important Tool” 5 Business Plan: BPHC Business Plan Changes Purpose of the Changes: Change and simplify the business plan Track basic measures of financial viability & costs Focus on individual improvement versus standards When the New Business Plan Changes Apply: Service Area Competition (SAC) Applications All grantees with SAC applications starting in 2009 - required New Business Plan Mid-Project Period Grantees New Business Plan Format & Financial Measures are OPTIONAL, but encouraged Uniform Data System Reports Starting in 2009 – Measures from Audited Data Added to EHB UDS Trend Reports 6 Business Plan: BPHC Required Financial Measures Focus on Financial Viability & Costs: Change in net assets as a percent of expense Financial results from operations in relationship to total expenses Working capital to monthly expense ratio Liquidity in # of months - ability to pay bills on time - current financial condition Long-term debt to equity ratio Portion of net assets tied up in long-term debt - long-term financial condition Total cost per patient Annual average cost per patient served - value of service provided based on costs Medical cost per medical encounter Average cost per billable medical encounter (less: lab & pharmacy) - cost efficiency 7 New BPHC Required Financial Measures “Calculations and Samples” 8 Change in Net Assets as a Percent of Expense Measures Financial Results in Relationship to Expense Calculation: Change in Net Assets (Audited Stmt of Activities) - divided by - Total Expenses (Audited Stmt Activities) The Change in Net Assets can be positive (a net surplus) or negative (a net loss) for the period being measured. The measure includes non-operating changes to net assets. This measure can be calculated for month -to-date & year-to-date results utilizing the Interim Statement of Activities. A breakeven or better performance is needed for financial stability. If the trend shows decreases in net assets, particularly when the balance sheet reports a weak financial condition, there is cause for concern. 9 National Average Trend Change in Net Assets as a % of Expense 2004 Change in Net Assets as a Percent of Expense 4.99 National average Positive Stable Reasonable 2005 2006 4.80 2007 4.95 2008 5.71 4.21 7 6 4.99 5 4.8 4.95 5.71 4.21 4 2004 2005 2006 2007 2008 Change in Net Assets as a % of Expense 10 Working Capital to Monthly Expense Ratio Measures Financial Liquidity Minimum of 1 month - with 2 months preferred Calculation: Working Capital (Audited Balance Sheet) - divided by - Average Monthly Expense (Audited Stmt Activities) (Total Expense - divided by 12 Months) This measure can be calculated for month -to-date & year-to-date results utilizing the Interim Statement of Activities. If Working Capital is negative then current liabilities exceed current assets, liquidity is very tight, and financial stability is in question. 11 Working Capital Measures Financial Liquidity $ Range Based on Size - Sufficient to Meet Current Obligations Calculation: Current Assets (Audited Balance Sheet) - minus - Current Liabilities (Audited Balance Sheet) 12 Definition of: Current Assets & Current Liabilities Current Assets - Cash or Readily Converted to Cash Cash Net Patient Services Accounts Receivable Grants and Contracts Receivable Prepaid Expenses (rent, insurance, etc.) Current Liabilities - Expenses/Obligations Due in 1 Year Accounts Payable Accrued Expenses (payroll taxes/withholdings, uncompensated absences, etc.) Capital Leases - Current Portion Lines of Credit Notes/Mortgage Payable - Current Portion 13 National Average Trend Working Capital to Monthly Expense Ratio 2004 Working Capital to Monthly Expense Ratio 1.86 2005 2006 1.95 2007 2.10 2008 2.25 2.35 2.6 National average Good Improving 2.35 2.4 2.25 2.2 2 1.95 2.1 1.86 1.8 1.6 2004 2005 2006 2007 2008 Working Capital to Monthly Expense Ratio 14 Long-term Debt to Equity Ratio: Measures Long-term Debt Leverage - Long-term Financial Condition Calculation: Long-term Liabilities (Audited Balance Sheet) - Divided by - Net Assets (Audited Balance Sheet) The preference is a Long-term Debt to Equity Ratio below 0.50 (or less than 50% of Total Assets tied up in Long-term Debt). A Long-term Debt to Equity Ratio in excess of 0.80 (80%) indicates excessive long-term debt, the organization may not be able to borrow funds, and is an indicator financial viability may be in question. 15 National Average Trend: Long-term Debt to Equity Ratio 2004 Long-Term Debt to Equity Ratio 2005 0.49 National average Acceptable Improving 2006 0.62 2007 0.30 2008 0.42 0.46 0.8 0.62 0.6 0.4 0.46 0.42 0.49 0.3 0.2 2004 2005 2006 2007 2008 Long-Term Debt to Equity Ratio 16 Total Cost Per Patient: Value of Services Provided to Patients Calculation: Total Accrued Costs before Donations (UDS Table 8A) - Divided by - Total Patients (UDS Table 4) If the total average cost per patient is growing at a rate faster than net patient services revenue, the financial performance is insufficient to sustain financial stability and “ACTION” is needed to reverse the trend. 17 Total Cost Per Patient: UDS Data All Grantees CY 2007 Total Cost Per Patient $700 $652 $650 $600 $597 $562 $560 $550 $568 $517 $504 $500 $450 $405 $400 $350 $300 Nat ion al Urban Rur al Large Small 25th Median 75th 18 National Average Trend: Total Cost Per Patient Total Cost Per Patient 2004 2005 2006 2007 2008 $ 504 $ 515 $ 538 $ 562 $ 588 $640 National Average Cost increasing Increase reasonable $588 $590 $562 $538 $540 $504 $515 $490 $440 2004 2005 2006 2007 2008 Total Cost Per Patient 19 Medical Cost Per Medical Encounter: Measures Medical Cost Efficiency (excluding lab & Pharmacy) Calculation: Total Medical Costs (UDS Table 8A) - Divided by Total Billable Medical Encounters (UDS Table 5) Medical costs are after the allocation of overhead and do not include lab or pharmacy costs. Billable medical encounters do not include nursing encounters or psychiatrist encounters. If the average medical cost per medical encounter is growing at a rate faster than net patient services revenue, the financial performance is insufficient to sustain financial stability and “ACTION” is needed to reverse the trend. 20 Medical Cost Per Medical Encounter: UDS Data All Grantees CY 2007 Medical Cost Per Medical Encounter $200 $146 $150 $123 $129 $115 $121 $130 $121 $103 $100 $50 $0 Nat ion al Urban Rur al Large Small 25th Median 75th 21 National Average Trend: Medical Cost Per Medical Encounter 2004 Medical Cost Per Medical Encounter $ 109 $ National average Increasing Increasing faster than total cost per patient 2005 2006 111 $ 2007 117 $ 2008 123 $ 129 $140 $129 $130 $123 $120 $117 $111 $110 $109 $100 2004 2005 2006 2007 2008 Medical Cost Per Medical Encounter 22 Business Plan: Getting Started Business Plan: Development and Reporting Sources of data Audited and interim financial statements; UDS and interim PMS reports Establishing the baseline measure The health centers current measures serve as the basis to track improvement Calculating measures for past three years - trends Not required, but encouraged - Trended UDS data is available Setting realistic goals Quantitative and Qualitative progress statements Reporting and Monitoring Baseline & progress - future grant submissions, POs, UDS, EHB, OPR, & BPHC TA 23 Sample Business Plan Service Area Competition Please Refer to Sample SAC - Business Plan Components: Performance Measure Costs, Financial Viability, Other (Access, Maximize Revenue, etc.) BPHC Required or Other Measure, Is this PM applicable to your organization? Target Goal Description, Numerator, & Denominator Baseline Data Baseline, Measure Type, Numerator & Denominator, and Projection (5-year Goal) Data Source and Methodology Key Factor and Major Planned Action Key Factor Type: Contributing, Restricting, or Not Applicable Key Factor Description Major Planned Action Description 24 Sample Business Plan Service Area Competition Please Refer to Sample Performance Measure: Change in Net Assets as a Percent of Expense Is this Performance Measure Applicable to your Organization? Target Goal Description Numerator Description Denominator Description Baseline Data Data Source & Methodology Key Factor and Major Planned Action #1 Yes Achieve a Change in Net Assets to Expense Ratio of 3.6% in years 1 and 2, then 4.5% in years 3 through 5 to result in Net Assets of $175,000 by year 5. Change in net assets (ending net assets - minus - beginning net assets) Total expense Baseline Year: 2008 Projected Data (by End 4.5% and Net Assets Measure Type: Percent of Project Period) of $175,000 Numerator: 143610 Denominator: 6746490 Audited Financial Statements Key Factor Type: [X] Contributing [_] Restricting [_] Not Applicable Key Factor Description: Implemented a Financial Recovery Plan including additional RIF of 3 administrative staff, wage freeze, and new employee health plan with 14.6% lower premium costs (see detailed FRP). Major Planned Action Description: Continue FRP activities with focus on increasing provider productivity, improving patient enrollment in public health plans, and improving collections. Key Factor and Major Planned Action #2 Key Factor Type: [_] Contributing [X] Restricting [_] Not Applicable Key Factor Description: A high debt load with corresponding interest expense. Major Planned Action Description: Negotiate debt forgiveness/discounts on balances owed and seek State grant to liquidate debt on Facilities. Key Factor and Major Planned Action #3 Key Factor Type: [_] Contributing [X] Restricting [_] Not Applicable Key Factor Description: Records management problems resulting in accuracy and timeliness problems with financial and operating performance data, and a Medicaid overpayment. Major Planned Action Description: Improve financial records management and reporting including practice management system billing and collections functions. Comments 25 Coordinated Approach: Performance Improvement Alignment of Program Requirements with: SAC Grant Applications and Project Period Updates Future Grant Applications will Incorporate the Business Plan Changes & Measures Project Officer Working with Grantees Will Utilize Grant Applications, UDS Reports, and Audited Financial Statements UDS and EHB Will Required Reporting on Measures and Data will be Included in EHB BPHC Technical Assistance Consultants Will Evaluate Financial Condition, Review Business Plan Progress, & Report on Findings and Recommendations in the Site Visit Report 26 Trend & Comparative Analysis: Why trend & comparative analysis is important: Raw data and data in isolation does not tell the story Comparing results to plans identifies trends + or Monitoring trends identifies problems quickly Timely action can be taken when trends are known Monitoring trends helps management decision-making Comparative analysis - to budgets, targets, & industry standards Establishing Baseline and Goal Setting Trend analysis over time - by month, by quarter, year-to-year Formatting reports makes a difference to usefulness Use of tables, charts, and graphs Summary vs detailed analysis - by site, service, payer, provider 28 Trend & Comparative Analysis: Other Considerations All of the measures discussed can & should be: trended by month, by quarter, from year-to-year compared to baseline, targets/goals - including variance analysis compared to national, state, size, & rural/urban standards compared to other industry standards - financial measures compared to other industry standards - practice performance Reports should be user friendly & easy to read Level of data reported vs audience Board, Finance Committee, Senior Management, Site Managers Frequency of reports - daily, weekly, monthly, quarterly, annually Sample CHC Financial Scorecard (available on request) 29 Monitoring Marketplace & Other Changes Market Competition and Economic Trends Market Competition and Economic Trends Have urgent care or other walk-in clinics opened in service area? Third Party Payer, Regulatory, & Policy Changes Have private practices opened or closed, services provided? Have major employers opened or closed? Are under-served populations increasing or decreasing? Has weather/disasters negatively impacted local economy/pop? Third Party Payer, Regulatory, & Policy Changes Has Medicaid eligibility criteria changed, processing procedures? Is Medicaid implementing managed care, enrollment process? Have coding, billing, electronic submission procedures changed? Is the State implementing new billing system, fiscal intermediary? 30 Strategies to Remain Financially Viable Develop an operating reserve Maintain current ratio > 2.0 & debt management ratio < 0.50 Maintain general ledger on full accrual basis of accounting Closely monitor & manage cash flow & financial performance Monitor performance - baseline, targets/goals, & industry standards Track BPHC Required Financial Measures Improve Payer Mix - increase/maintain Medicaid patients Monitor changes in marketplace, economy, & other trends Analyze opportunities to add/increase providers/services Closely monitor regulatory and policy changes Operations must result in financial surpluses, TAKE ACTION 31 “Good, Better, Best” What Gets Measured, Gets Done What Gets Incentivized, Really Gets Done Be Sure You Are Measuring What is Important; and Incentivizing the Right Activities 32 Governance Requirements Board of Directors Composition and Responsibilities: Composition: 51% Majority - “Consumers/Patients” who receive their primary care from the organization As a “Group” represent the individuals being served by the organization - including race, ethnicity, gender, service area, target population, & special populations HCH, PHPC, and MHC must have at least 1 “Consumer/ Patient” from each Special Population Special Population requirement can be “waived” by BPHC (Form 6-B) 33 Governance Requirements Continued Responsibilities: Meet at least once a month - can be “waived” (Form 6-B) Selects services and schedules the hours during which such services will be provided by the organization Measures and evaluates progress in meeting annual and long-term programmatic and financial goals Develops plans for long-range viability by engaging in strategic planning, on-going review of the mission and bylaws, evaluating patient satisfaction, and monitoring assets and performance Approves the annual budget and applications for subsequent grants Approves the selection of a director (Program Director or CEO) Establishes general policies, except in the case of a governing board of a public center 34 Governance Requirements Continued Structure of the Board is Appropriate: Size - number of members for needs of organization Expertise includes a broad range of skills and perspectives, including finance, legal affairs, business, health, social services, etc. A co-applicant health center board must meet all the size and composition requirements, perform the duties of, and retain all the authorities expected of governing boards, except a public center is permitted to retain responsibility for establishing general policies (fiscal and personnel) 35 Q & A SESSION Contact Information: Cynthia L. Prorok Management Solutions Consulting Group, Inc. cprorok@mscginc.com (724) 355-3188 (cell) 36