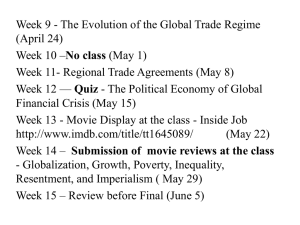

1945-1970 - Prof. Ruggero Ranieri

advertisement

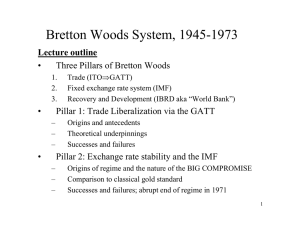

From Bretton Woods to the new global economy The global economy before 1914 Free Trade and protectionism The classical economists and free trade: from Smith to Ricardo. The growth of world trade Foreign direct investment The gold standard and the primacy of the poundsterling The great overseas migrations Technological innovation and the industrial revolutions: railways, wireless telegraph, telephone, radio. The disintegration of the world economy (1914-1945) Early signals: late 19° c. protectionism. World War I and its consequences Soviet Revolution the USSR The decline of Britain and the uncertain rise of the US as a global power The Great Depression (1929-1932) and its consequences Nationalism and autarchy in the 1930s. The rebirth of the world economy after 1945. Bretton Woods(1944) the IMF and the World Bank. The Cold War. The Marshall Plan and the reconstruction of Western Europe Liberalization through GATT The economic boom in Western Europe and Japan Bretton Woods: a new architecture for the international economic system Liberalization of trade and non discrimination principle Convertible currencies Fixed exchange rates against the dollar. The dollar linked to gold. Free transfer of payments in current account, but restrictions allowed to free flow of capital. International Monetary Fund as enforcer and regulator. The IMF acts as lender of last resort through its reserves, which are supplied by member states (gold and currencies) World Bank to supply investment finance. Bretton Woods: how the system developed Huge post WW2 imbalances prevent the implementation of currency convertibility The dollar gap. The American loan to the UK is followed by the failure of sterling to remain convertible (summer 1947) The Marshall Plan: a new US route for the reconstruction of Western Europe in the context of the Cold War. Bretton Woods: how the system developed The US accept the temporary creation of a preferential trade and payments area in Western Europe. Trade: gradual liberalization within the OEEC Payments: the creation of the European Payments Union, a multilateral payments system for European currencies (1951-1958) Dollar convertibility is achieved in 1958 as the EPU is wound down. Between 1958 and 1970 the Bretton Woods system is operational. Bretton Woods in action How the system worked: - Countries hold dollars: the system is based on confidence in the USA and on its military leadership in confronting the USSR in the Cold War. - US superiority overshadows any possible international competition. - The key role of the dollar as a reserve currency, confers to the US a seignorage, i.e. the privilege of detaining a currency backed by gold. Holding dollars, convertible in gold, amounted to free interest loan to the Fed. Bretton Woods: how the system developed - The international sphere is separated from the national sphere. Single countries could run independent economic policies. This is possible because national economies were relatively closed: especially international capital flows were limited and controlled. - Distinction between trade, finance and industry, each moving in a separate sphere. - Strong partnership between the USA and West Germany. West Germany hold dollars and US government securities. Bretton Woods: factors undermining it in the 1960s. Growing weakness of US balance of payments, At the end of the 1960s it has fallen into the red (see increased borrowing to finance ambitious welfare programs and the Vietnam war) Growing doubts on the dollar-gold fixed link. Speculative movements on the price of gold. Eurodollar market emerges. This gives rise to short term speculative flows. Short term money flows makes countries more dependant on the international system. They are less able to separate their domestic economic policies from their international engagements. Growing challenge by W. Germany, France and Japan to US economic predominance. The international trading system and the GATT At Bretton Woods it was decided to create an International Trade Organization. However this was rejected by the US Congress in 1950. It was decided to proceed in a piecemeal fashion through the GATT / General Agreement on Trade and Tariffs, created in Geneva in 1947. The GATT was not formally an international organization, it had no powers or standing organization. It had no dispute settlement mechanism. It was just a forum for talks. The GATT was designed to bring about a concerted reduction of tariffs on manufactured goods. It did not concern itself with quotas. It had little influence over agricultural products, services, investments and intellectual property. The GATT The GATT initiated multilateral negotiating sessions known as GATT Rounds. Tariff reductions agreed by two or more countries with each other were automatically extended to all member states, according to the principle of reciprocity. GATT Rounds taking place between 1947 and 1961 produced a considerable reduction of tariff barriers. During the Kennedy Round (1963-7) in which the European Community negotiated on behalf of its six member states, there was a further reduction by 33% on tariffs on manufactured goods. The GATT The Tokyo Round (1973-1979) tackles for the first time non-tariff barriers, but progress is uneven. In the 1970s services, FDI and intellectual property rights become important and the rules of the GATT were unable to cope with these issues. Post WW2 growth and development: different models. Economic boom in Western Europe and Japan. The mixed economy. Factors accounting for economic growth in the West. ISI (import substitution industrialization) in developing countries and its mixed results Stalinism and the socialist bloc. High rates of growth cover structural flaws. The great boom in developed economies High rates of growth were the result of: Low cost of raw materials (see oil) Technological catch up with the US after 1945 Large supply of cheap labour Stability due to unchallenged US leadership Labour-capital pact: no labour conflict in return for employers sharing out productivity gains Commercial liberalization The beginning of European integration The Europe of the Six: The European Coal and Steel Community The Treaties of Rome: The EEC and the Customs Union The EEC and common policies The Cap Common Commercial policy. Developing countries after WW2 Imports Substitution industrialization - See Latin America. The Communist bloc after WW2 Success - high rates of growth and industrialization Attempts at reform Failures in intensive growth