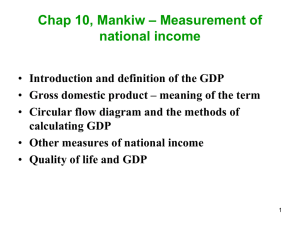

From Social Welfare Models to Social Investment Models

advertisement

La comparazione dei sistemi di welfare europei Prof. Maurizio Ferrera Università degli Studi di Milano Riprogettare il Welfare: uno sguardo al Mediterraneo Fondazione Cariplo e Compagnia di San Paolo venerdì 29 novembre, Milano Outline The way we were: the traditional “fordist” welfare state and its variants The possible future: a new Social Investment (SI) state Where are we now: summary data The role of SECOND WELFARE (“Second line allies”): a focus on the third sector and on private foundations 2 The way we were: the «Fordist» welfare state Common traits: 1. Emphasis on social protection (compensatory logic) 2. Ex post benefits for traditional risks/needs 3. Large role for «passive» transfers during non employment (pensions, unemployment, disability, sickness, maternity, family dependants etc.) 4. Residual safety nets (poverty) 5. Target: households with various family members (female carers) 6. Education & training: outside social protection 3 Variations in the «fordist» theme (regimes, models, families, clusters..) 1. Continental Europe: 4. Southern Europe: Bismarckian insurance schemes (BIS) insider/outsider divide transfer heavy, lean on services male breadwinner model (MBM) 2. Anglo-Saxon Europe: Beveridgean “encompassing” schemes, weak universalism Occupational/fiscal welfare for the middle classes Means-tested benefits for the poor (including working poor) poverty cum exclusion 3. Nordic Europe: Strong universalism Service rich (including Active Labour Market policies ) already a Social Investment element Dual earner model (DEM) female employment, gender equality Strong but limited safety nets low poverty, high inclusion BIS + national health services insider/outsider divide Transfer (pension) heavy, very lean on social services MBM + high familialism ( low “exclusion”) Weak/non existent safety nets ( very high poverty) 5. Central/Eastern Europe: Transition from socialist collectivism (productivist welfare model) to mixed models (social insurance + residual safety nets, poor services, female earner/carer model) high poverty and exlusion 4. Southern Europe: BIS + national health services insider/outsider divide Transfer (pension) heavy, very lean on social services MBM + high familialism ( low “exclusion”) Weak/non existent safety nets ( very high poverty) 5 Old Age benefits (1990) Benefits received at retirement as a % of average net earnings of manual workers in manufacturing (1990) Country Contributory pension ____________ Personal rate Minimum Benefit ____________ Personal rate Belgium 73 47 Denmark 60 52 Germany 77 39 France 88 46 Ireland 42 35 Luxembourg 78 46 Netherlands 49 49 United Kingdom 44 31 EUR 12 75 36 Greece 107 8 Spain 97 32 Italy 89 19 Portugal 94 30 Social minima in EU countries (1992) Old-age* Invalidity Unemployed Country ECU / month % GDP per head ECU/month % GDP per head ECU/month % GDP per head Belgium 442.7 32 924,4 67 442.7 32 Denmark 599.7 34 967.4 55 699.7 40 Germany 506.7 29 506.7 29 506.7 29 France 447.5 30 447.5 30 322.1 22 Ireland 329.3 38 329.3 38 329.1 38 Luxembourg 607.8 36 863.9 51 607.8 36 Netherlands 553.3 41 552.3 41 552.3 41 United Kingdom 363.2 30 376.3 31 263.4 22 EUR 12 377.03 28.75 511.51 38.00 310.33 21.67 Greece 49.1 10 79.3 16 0 0 Spain § 272.8 28 272.8 28 0 0 Italy § 230.5 16 695 49 0 0 Portugal 122.8 21 122.8 21 0 0 Notes: * A single person who has reached the age of retirement with no entitlement to contributory benefits and no other source of income A single person aged 40 with no entitlement to contributory benefits, no other source of income and who is unable to work A single person aged 40 with no entitlement to contributory benefits, no other source of income and who is available for work § In Italy and Spain, there is no formal minimum level of income support, but in a number of regions, people can receive social assistance from regional and local authorities Source European Commission (1993) 32,0 30,0 28,0 26,0 24,0 22,0 20,0 18,0 16,0 14,0 12,0 10,0 8,0 6,0 4,0 2,0 0,0 l rtu ga Po Ita ly Sp ai n G re EU -1 ec e 1995 2011 5 % GDP Social protection expenditure (1995-2011) Source: Eurostat 8 Nella slide precedente si può provare a inserire dentro gli istogrammi la quota pensioni? 9 The way we ought to be? The social investment state Was introduced in the debate by Esping Andersen et al. (Why We Need a New Welfare State, 2001) Became popular in the context of the Lisbon Strategy (20002010) …. … with different meanings: orientation, paradigm, analytic concept/framework, a rethorical platform Has been gradually endorsed by the EU, especially with the shift from the Lisbon to the Europe 2020 agenda Is the object of a fully fledged «package» of measures proposed by the European Commission 10 The Social investment state: core traits Emphasis on social promotion (enablement logic) Ex ante (early) prevention of risks and needs (ECEC) Large role for capacitating social services during the life cycle Robust safety nets and activation (inclusion) Individuals within households (dual earner/dual carer model) Support for reconciling paid work and family life Education (schooling, training, LLL) as integral part of welfare sphere Encouragement of «social innovation» Social Investment: what rationale? More growth: human capital + labour market participation Better growth: knowledge based, quality jobs More cohesion: safety nets, inclusion policies, elderly care More equal opportunities: early child education and care, work-life balance, capacitating services More social justice: containment of inter-generational transmission of advantage/disadvantage, greater mobility chances Ratesof return toHUmn capitlInvstment: the Heckman curve Return to a dollar unit invested at different ages fromthe perspective of the beginning of life, assuming one dollar initilly invested at each age 13 Social Investment spending by function: the state of play in selected countries TOTAL PUBLIC EXPENDITURE ON EDUCATION, 1995-2010 (% gdp) 8,00 7,00 6,00 5,00 1995 4,00 2010 3,00 2,00 1,00 Source: Eurostat G re ec e ly Ita Sp ai n an y G er m EU 15 EU 27 Fr an ce Po rtu ga l Sw ed en 0,00 Social Investment spending by function: the state of play in selected countries TOTAL PUBLIC EXPENDITURE ON FAMILY/CHILDREN, 1995-2010 (% gdp) 4,0 3,5 3,0 2,5 1995 2,0 2010 1,5 1,0 0,5 Source: Eurostat ly Ita Po rtu ga l Sp ai n EU 27 G re ec e EU 15 Fr an ce Sw ed en G er m an y 0,0 Social Investment spending by function: the state of play in selected countries TOTAL PUBLIC EXPENDITURE ON FAMILY/CHILDREN, 2005-2010 (per-capita, pps) 1.000,00 900,00 800,00 700,00 600,00 500,00 400,00 300,00 200,00 100,00 0,00 2005 Source: Eurostat ly Po rtu ga l Ita Sp ai n EU 27 G re ec e Eu 15 Sw ed en Fr an ce G er m an y 2010 Social Investment spending by function: the state of play in selected countries TOTAL PUBLIC EXPENDITURE ON ALMP, 2005-2010 (% gdp) 1,2 1 0,8 2005 0,6 2010 0,4 0,2 Source: Eurostat G re ec e ly Ita Po rtu ga l EU 15 EU 27 Sp ai n Fr an ce Sw ed en G er m an y 0 Social Investment spending: the state of play in selected countries TOTAL PUBLIC EXPENDITURE ON EDUCATION, ALMP and FAMILY/CHILDREN, 2010 (% gdp) 12 10 Gdp% 8 6 4 2 Source: Eurostat Fr an ce Sw ed en an y G er m EU 27 EU 15 Po rtu ga l Sp ai n ly Ita G re ec e 0 Si possono mettere qui alcuni dati di outcome: %povertà (anche children), NEETs, female employment, unemployed in receipt of benefits, posti in asili nido ecc.? Per dire che le lacune del welfare pubblico hanno conseguenze sociali negative (anche % di figli che vivono a casa dei gen) 19 Sothern European Social models: the challenges Further recalibration of public social expenditure towards «social investment» Budgetary constraints + increasing needs Need for a SECOND WELFARE, mobilizing additional non public resources: household savings, private sector (e.g. company welfare), non profit sector 20 WHY «SECOND» WELFARE - it comes after the historical develompent of FIRST welfare, i.e. state-centred and state-funded social protection during the long XX century - it complements FIRST welfare: - integrates/supplements existing public schemes - adds new schemes/measures in uncovered areas of need Stimulates social innovation Does NOT replace FIRST welfare 21 SECOND WELFARE mix of innovative interventions mainly funded by non public resources With a view to offering benefits and services new social needs and new categories of vulnerable people Provided by a multiplicity of stakeholder Anchored to local contexts, but inserted in wider networks (no «parochialism») Carefully monitored and evaluated 22 The protagonists of SECOND WELFARE Private insurance Mutual funds Non public financers Mobilizing private savings Users Social enterprises Private companies Cooperatives Trade Unions Voluntary sector Interest associations Regions Non profit Foundations Local Charitable institutions Erogatori di prestazioni governments non pubblici Coordinamento /regolazione/ monitoraggio/v alutazione M. Ferrera – Università di Milano e Centro Einaudi 2 Before working age risks/needs Working age risks/needs Post working age risks/needs I welfare II welfare Early childhood, Education Education & Care Service mix e.g. Work-life balance services Social insurance & Health care Service mix e.g. Company based welfare Private provision of services Coordination Pension I pillar LTC Pension Service mix II pillar Pensio n III pillar State Public funds Universalism The Third Sector in Italy In 2011, the third sector in Italy: - 300.000 organizations - with a financial weight of about 67 billions euros (4,3% of gdp) - 5,7 millions people involved, of which 681.000 employees and 271.000 contract workers, 3,4% of the labour force 25 Paid employment in the «social economy» (% of total employment) country % 2002-2010 Austria 5.7 - 10.2 Belgium 10.3 +65.4 France 9.0 +16.8 Germany 6.3 +21.0 Netherlands 10.2 +10.9 UK 5.6 -4.6 Ireland 5.3 -36.4 Denmark 7.2 +21.6 Sweden 11.1 +146.6 Italy 9.7 +66.7 26 Italy: The role of foundations In 2012, the FOB system: - assets: 42 billions euros - 965,8 millions euros spent on 22.000 interventions 32 Community Foundations - of which 15 in Lombardy, with 22,5 millions spent in 2012 to support 2.300 social projects 27 Dati sulla distribuzione funzionale interventi fondazioni 28 Foundations and social innovation Not only financial support but also… Catalysts of multi-actor partnerships Innovative solutions and governance mechanisms 29 SECOND WELFARE: The challenges Inappropriate «nesting» between FIRST and SECOND welfare Insufficient coordination: no «system», only isolated experiments Territorial disparities and inequities Weak monitoring/evaluation Weak adhesion to the Social Investment approach 30 EU interest and activism on the fronts of social innovation/social economy/social businesses A Southern European Network on Second Welfare experiences? 2wel-South 31