The System of Accounting

Accounts

Receivable and

Bad Debts

Expense

© Copyright

Doug Hillman 2000

1

Receivables on Balance Sheet

Trade receivables

› Arise from sale of goods or services to customers

Nontrade receivables

› Arise from other sources

© Copyright

Doug Hillman 2000

2

Bad Debts Expense

An account receivable that proves uncollectible

Accrual accounting requires that we recognize the bad debts expense in the same period as the sales revenue

Since we may not know at end of period which accounts will be uncollectible, we must estimate the amount

Use allowance method

© Copyright

Doug Hillman 2000

3

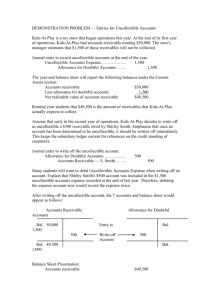

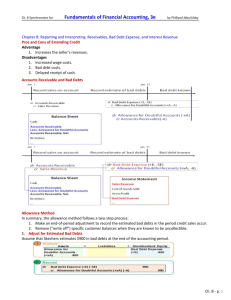

Recording Bad Debts

Adjustment

Estimate and record amount in an endof-period adjustment

Estimate uncollectible amount

Record increase in expense and decrease in accounts receivable

Since specific uncollectible account not known, use contra account Allowance for Doubtful Accounts

© Copyright

Doug Hillman 2000

4

Balance Sheet Presentation

Current assets

Cash

Accounts receivable $8,000

$1,000

Deduct: Allow for DA 500 7,500

Notes receivable 900

© Copyright

Doug Hillman 2000

5

Writing Off Uncollectible

Accounts

After determining a specific account is uncollectible

Decrease accounts receivable

Decrease allowance for doubtful accounts

© Copyright

Doug Hillman 2000

6

Balance Sheet

Before Write-off After

Accts Rec $8,000 $(200) $7,800

Allowance 500 (200) 300

Net realizable value $7,500 $7,500

© Copyright

Doug Hillman 2000

7

Recovery of Bad Debts

Reinstate the account

› Increase accounts receivable

› Increase allowance for doubtful accounts

Collect the account

› Increase cash

› Decrease accounts receivable

© Copyright

Doug Hillman 2000

8

Estimating Bad Debts:

Based on Sales

Use a historical average of annual uncollectibles to annual net sales

Calculate amount of bad debts expense

› Multiply net sales by percent

Adjust Bad Debts Expense by the amount calculated

© Copyright

Doug Hillman 2000

9

Estimating Bad Debts:

Based on Accounts Receivable

Use a historical average of annual uncollectibles to year end accounts receivable

Calculate balance of allowance for doubtful accounts

› Multiply year end accounts receivable by percent

Adjust Allowance for Doubtful Accounts to the amount calculated

© Copyright

Doug Hillman 2000

10

Aging of Accounts Receivable

Schedule that lists each invoice by days elapsed since due date

Aging categories

› Not Yet Due

› 1-30 Days Past Due

› 21-60 Days Past Due

› etc.

© Copyright

Doug Hillman 2000

11

Estimating Bad Debts with

Aging Schedule

Use different percentage to estimate uncollectible amount for each aging category

Sum of amounts calculated is desired balance in Allowance for Doubtful

Accounts

© Copyright

Doug Hillman 2000

12

Direct Write-off Method

Write off accounts receivable and record expense when account determined to be uncollectible

Causes a mismatching of revenue and expense

Simple to maintain

© Copyright

Doug Hillman 2000

13

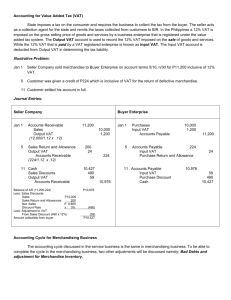

Credit Card Sales

Credit card fee reduces amount received from sales amount

Bank credit cards

› Accepted as deposit for amount of sale less fee

Nonbank credit card

› Receivable for amount of sale less fee

© Copyright

Doug Hillman 2000

14

Analyzing Information

Is percent of bad debts expense to net sales increasing or decreasing?

Is percent of allowance for doubtful accounts to gross accounts receivable increasing or decreasing?

© Copyright

Doug Hillman 2000

15