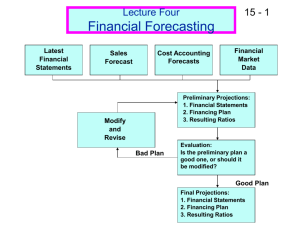

Chapter 15

McGraw-Hill/Irwin

Financial Planning and

Forecasting

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

1

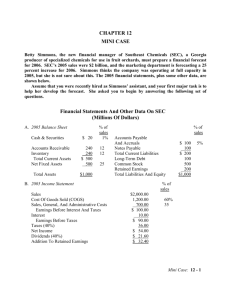

Financial Planning

• Strategic planning for a firm

– Formulating, implementing, and evaluating crossfunctional decisions to achieve long-term

objectives

15-2

Financial Planning

• Firm’s financial plan

– Base case is underlying set of assumptions

– Base case projections

• Set internal goals

• Provide information to shareholders and external

stakeholders

15-3

Forecasting Sales

• Naïve approach

– Assume future period’s sales will be equal to last

observed period

15-4

Target Historic Sales vs. Average Annual

Sales 2006 and 2007 – Conclusion?

15-5

Forecasting Sales

• Need to examine how much error exists in

using the naïve approach

• Measure forecast error with Mean Absolute

Percentage Error (MAPE)

15-6

MAPE Approach

• Measures efficiency of forecasting technique

– Uses one set of historic data to forecast a later set

of “testing data”

15-7

MAPE Approach

Calculated across n forecasts of a testing period

15-8

Average Approach

• Better than naïve approach

• Uses larger sample

• Takes mean of multiple historic observations

15-9

Average Approach

• Average approach reduces MAPE compared to

naïve forecasts

15-10

Estimating Sales with

Systematic Variations

• Accurate future sales predictions must make

adjustments for strong patterns

• De-seasonalize

– divide each month’s actual sales by the seasonal

index

15-11

External Financing

• Simple approach: Additional Funds Needed

(AFN)

15-12

Additional Funds Needed (AFN)

Capital intensity ratio

– Divide amount of assets tied to sales by amount of

current sales

– Multiply capital intensity ratio by projected sales

delta

15-13

Necessary Increase in Assets

Calculation

15-14

Additional Funds Needed

• Spontaneous liabilities ratio

– Divide the amount of liabilities tied directly to

sales by amount of current sales

– Multiply by the Retention Ratio (RR) to get

projected increase in retained earnings

15-15

Spontaneous Increase in

Liabilities Calculation

15-16

AFN with Unused Capacity Assets

• Firms often do not fully use fixed assets

• Unused capacity can support increases in sales

15-17

AFN with “Lumpy” Assets

• Fixed assets are not infinitely divisible

• Fixed assets are bought in discrete, nondivisible, integer-based quantities

15-18

AFN Using Pro Forma Statements

• Identify and compute balance sheet and

income statements items that change

• Adjust amounts for change in sales impact

15-19

AFN Using Pro Forma Statements

• Strategize changing items that do not vary

proportionally with sales

• Solve for variable that allows the balance

sheet to balance

15-20