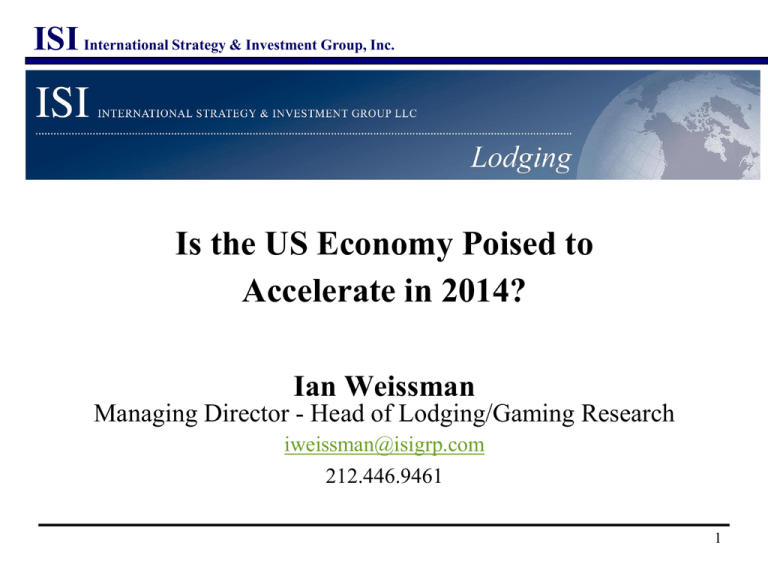

fa13-Weissman

advertisement

ISI International Strategy & Investment Group, Inc. Is the US Economy Poised to Accelerate in 2014? Ian Weissman Managing Director - Head of Lodging/Gaming Research iweissman@isigrp.com 212.446.9461 1 ISI International Strategy & Investment Group, Inc. Agenda: 1) Looking Back Over the Last 18 Months 2) A Closer Look at Important Macro Drivers for Lodging 3) 2014 Macro Forecasts 4) Can We Still Make Money in the Lodging Sector? 2 ISI International Strategy & Investment Group, Inc. First Piece of Advice: Pay Attention!!!! Stock Returns (Since April 2012) 35% 32.4% 32.0% 30% 23.4% 25% 23.3% 20% 15% 10% 7.1% 5% • Since we presented at the last HAMA conference 18 months ago, lodging stocks have materially outperformed…up 32% 0% Lodging CCorps Lodging REITs NASDAQ S&P REITs 3 ISI International Strategy & Investment Group, Inc. Rewind…Our Thoughts 18 Months Ago Positive: Bullish on lodging fundamentals – forecasting 7% RevPAR growth in Gateway cities for ‘12/’13 (market exceeded that) Bullish on lodging stocks – forecasting 15%+ returns (market exceeded that) 8% unemployment (finished ‘12 at 7.8%) Capital markets would remain open, and deal pipelines would be active Potential Roadblocks: Talk of Double Dip Recession Oil prices were spiking Investors were focused on the Deficit and fiscal drag – Fiscal Cliff Eurozone financial crisis/recession China slowdown US elections had the 1%-errs thinking about defecting 4 ISI International Strategy & Investment Group, Inc. What’s Happened with the Economy the Last 18 Months? Macro Backdrop – Global Recovery Underway Job Growth has averaged 170k/month US unemployment rate has dropped 80bp to 7.4% US averted a double dip recession Oil prices are down $10/barrel to $110 Housing prices up 15%-20% US jumped off the ‘Fiscal Cliff’ with a parachute Eurozone financial crisis behind us China slowdown averted …and Tiger Woods is Still without a Major win under his belt 5 ISI International Strategy & Investment Group, Inc. What’s Happened with Lodging the Last 18 Months? Lodging Has Been a Clear Winner… RevPAR growth +6.5% (100bp higher in gateway cities) ADR growth +4.2% Supply remains in check Company balances sheets continue to improve, as debt and equity markets remain wide open Plenty of capital on the sidelines looking to invest into lodging (Blackstone, Thayer, sovereign wealth $$$, and REITs) Hilton has finally filed plans to go public – good for the industry 6 ISI International Strategy & Investment Group, Inc. What Can We Expect Over the Next 18 Months? • Lodging in mid-cycle - 4th inning • Limited new supply growth – good through 2016 • Stronger group – largely dependent upon business sentiment and jobs • Broader US lodging recovery – secondary and tertiary markets • Forecasting 6% to 7% RevPAR growth • Rate recovery to continue – 4%+ • Incentive management fee growth will accelerate • Consolidation – its coming 7 ISI International Strategy & Investment Group, Inc. Econ 101 – US Macro Drivers 8 ISI International Strategy & Investment Group, Inc. GDP: Important for Cyclical Sectors—Just NOT This Time Around US GDP growth has averaged a disappointing 2.2% per quarter since the ‘Great Recession’ 8% 6% 4% 2% 0% -2% -4% -6% -8% -10% Q18 Q17 Q16 Q15 Q14 Q13 Q12 Q11 Q10 Q9 Q8 Q7 Q6 Q5 Q4 Q3 Q2 Q1 '90/'01 Recessions GDP is tracking nearly 200bp lower than where the US was following the ‘01 and ‘90 recessions '09 Recession 9 ISI International Strategy & Investment Group, Inc. US RevPAR Recovery: Solid, Especially in Gateways 14% 12% 12% 11% 10% 10% 10% 10% 10% 10% 10% 9% 9% 7% 8% 6% 6% 6% 4% 4% 2% 0% 0% -2% -4% 3Q13 2Q13 1Q13 Gateway RevPAR 4Q12 3Q12 2Q12 1Q12 4Q11 US RevPAR 3Q11 2Q11 1Q11 4Q10 3Q10 2Q10 1Q10 -6% Despite tepid macro backdrop, its been a particularly strong recovery with RevPAR up +7.3% over the prior 14 quarters. Gateway cities continue to outperform, beating the broader US by 150bp 10 ISI International Strategy & Investment Group, Inc. Consumer: Key to Lodging Recovery 11 ISI International Strategy & Investment Group, Inc. Consumer: Stock Market is Back in a Big Way • S&P 500 is up 19% in ’13, surpassing the ‘07 peak in March ‘13 1,900 1,700 • Consumer net worth (i.e., stock market) is a key variable of our RevPAR forecasting models 1,300 1,100 900 Jul-13 Mar-13 Nov-12 Jul-12 Mar-12 Nov-11 Jul-11 Mar-11 Nov-10 Jul-10 Mar-10 Nov-09 Jul-09 Mar-09 Nov-08 Jul-08 Mar-08 Nov-07 Jul-07 700 Mar-07 S&P 500 1,500 • Unlike prior cycles, however, QE has helped to drive equity values -- Bernanke wrote in 2010, “Higher stock prices boost consumer wealth and help increase consumer confidence which can spur spending” 12 ISI International Strategy & Investment Group, Inc. Consumer: Household Debt Continues to Fall U.S. CONSUMER DEBT % NOMINAL DISPOSABLE PERSONAL INCOME 2013:1Q 104% 130 120 110 100 90 80 70 60 50 1960 1970 1980 1990 2000 2010 As a result of the surge in equity prices, and ultimately, historically low mortgage rates with tougher underwriting standards, Consumer’s have been able to repair their balance sheets as personal leverage ratios are down nearly 30percentage points since peaking in 2010 13 ISI International Strategy & Investment Group, Inc. Consumer Sentiment is on the Rise 95 Consumer Sentiment (Index) 90 85 80 With stocks on the rise, consumer sentiment continues to move higher. 75 70 65 60 55 50 The US consumer has been a key driver in the latest lodging recovery 14 ISI International Strategy & Investment Group, Inc. While Consumer Spending Remains Robust Good news for the recovery has been that consumers are back on their feet with spending well past the prior peak 15 ISI International Strategy & Investment Group, Inc. Housing Has Been an Important Driver of Recovery Case Shilller Home Price Index 110 100 90 80 70 60 50 40 As we head into year four of the US economic recovery, Case-Shiller Home Index continues to move higher. Index is up 28% since bottoming in ’12, however, remains 36% ‘06 peak That said, recent spike in mortgage rates has ISI’s Housing Survey under pressure 16 ISI International Strategy & Investment Group, Inc. With Housing Starts Nearly Doubling Housing starts have nearly doubled since bottoming in ‘08, but remain well off the ‘06 peak That said, keeping a watchful eye on recent softness amid rising interest rates. If the US economy is going to reaccelerate, Housing needs to be strong 17 ISI International Strategy & Investment Group, Inc. Corporate America: Cautiously Optimistic 18 ISI International Strategy & Investment Group, Inc. Corporate Profits: Up 17% Per Annum 2300 2100 1900 1700 1500 1300 1100 900 700 Since bottoming in late 2008, corporate profits are up 17% per annum, well past the ‘07 peak Cost cutting/savings remains the primary driver …yet Lodging companies have yet to witness the benefits of corporate America’s rebound (Group Business remains a disappointment) 19 ISI International Strategy & Investment Group, Inc. Biggest difference has been Sentiment levels 90 Part of the explanation relates to “Confidence”. 85 75 70 65 60 55 Business Sentiment Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 50 Apr-08 Sentiment Index 80 Consumer confidence continues to surge, while Business sentiment has been flat throughout the recovery Consumer Sentiment 20 ISI International Strategy & Investment Group, Inc. As a Result: Rate Growth Has Been Disappointing 60 6% 0% -2% 30 -4% 20 -6% -8% 10 -10% ISI Trucking Survey ADR Grth Sep-13 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 -12% May-09 0 Jan-09 ISI Trucking Survey 2% 40 ADR Growth (Hotels) 4% 50 Historically, there is a very strong correlation between Business Confidence (Measured by ISI’s Trucking Survey) and ADR Growth Both have flat-lined the last several years Without jobs, business sentiment will remain flat, and hotel operators will have a hard time pushing rates higher 21 ISI International Strategy & Investment Group, Inc. Currently, Rate Accounting for 80-90% of RevPAR 12% 100% 90% 70% 8% 60% 6% 50% 40% 4% 30% 20% 2% 10% Occup. ADR Aug-13 Jun-13 Apr-13 Feb-13 Oct-12 Dec-12 Aug-12 Jun-12 Apr-12 Feb-12 Dec-11 Oct-11 Jun-11 Aug-11 Apr-11 Feb-11 Dec-10 0% Oct-10 0% ADR as % of RevPAR 80% Aug-10 RevPAR Growth 10% Rate growth accounting for 85%+ of RevPAR gains… Sector could be doing better. Operators remain hesitant to push rates on Group ADR as % of RevPAR - T3M 22 ISI International Strategy & Investment Group, Inc. Monthly Job Growth and ADR Growth Are Flat 2.0% 6.0% 1.0% 4.0% 2.0% 0.0% -1.0% -2.0% -2.0% -4.0% ADR Growth Monthly Job Growth 0.0% Near perfect correlation between monthly job growth and ADR growth -3.0% -6.0% -4.0% -8.0% -5.0% -10.0% -6.0% Both have flat-lined over the last two years -12.0% Jan-09 Jun-09 Nov-09 Apr-10 Sep-10 Feb-11 Monthly Job Growth Jul-11 Dec-11 May-12 Oct-12 Mar-13 Y/Y ADR Growth 23 -800 6/1/1988 4/1/1989 2/1/1990 12/1/1990 10/1/1991 8/1/1992 6/1/1993 4/1/1994 2/1/1995 12/1/1995 10/1/1996 8/1/1997 6/1/1998 4/1/1999 2/1/2000 12/1/2000 10/1/2001 8/1/2002 6/1/2003 4/1/2004 2/1/2005 12/1/2005 10/1/2006 8/1/2007 6/1/2008 4/1/2009 2/1/2010 12/1/2010 10/1/2011 8/1/2012 6/1/2013 T3M Employ. Chg. 200 6% 4% 0 2% -200 0% -2% -400 80% Correlation Chg. In Employment -4% -600 -6% -8% T3M RevPAR Growth (lagged 3 months) ISI International Strategy & Investment Group, Inc. Key is Employment: That Relations Goes back 25 Yrs 400 8% -10% ADR Growth 24 ISI International Strategy & Investment Group, Inc. Unemployment Needs to Be Below 5% 10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% -1.0% -2.0% -3.0% -4.0% -5.0% -6.0% -7.0% -8.0% -9.0% -10.0% 1Q88 4Q88 3Q89 2Q90 1Q91 4Q91 3Q92 2Q93 1Q94 4Q94 3Q95 2Q96 1Q97 4Q97 3Q98 2Q99 1Q00 4Q00 3Q01 2Q02 1Q03 4Q03 3Q04 2Q05 1Q06 4Q06 3Q07 2Q08 1Q09 4Q09 3Q10 2Q11 1Q12 4Q12 3Q13 10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% -1.0% -2.0% -3.0% -4.0% -5.0% -6.0% -7.0% -8.0% -9.0% -10.0% Unemployment Rate ADR Growth • Rate (ADR) growth rarely exceeds 5% (on a consistent basis), unless the US unemployment rate runs at 5% or lower. • ISI economists estimate that the US would need to add 225k jobs per month to get to under 5% unemployment • 2+ more years 25 ISI International Strategy & Investment Group, Inc. Macro Economic Forecasts 26 ISI International Strategy & Investment Group, Inc. What the “Experts” are Saying: Only Getting Better • While ‘12 was about “Growth Problems”, the current view by ISI economists is considerably more bullish – “ The US economy is poised for a reacceleration” How do we know that? • Unemployment claims and PMI data have both dramatically improved • Diffusion index of ISI’s company surveys has recently ‘hooked up’ • Global expansion underway – Eurozone, UK, Japan and China • Gasoline prices continue to fall • Taper-delay, the new QE? • Housing is key to U.S. growth accelerating: while the Homebuilding Survey has recently dropped, recent back up in mortgage rates could help reaccelerate growth 27 ISI International Strategy & Investment Group, Inc. 8.5% 60.0 7.5% 59.0 6.5% 58.0 5.5% 57.0 4.5% 56.0 3.5% 55.0 2.5% • Airline survey ticking higher – should lead to accelerating RevPAR growth… 16-Sep-13 1-Sep-13 2-Aug-13 17-Aug-13 18-Jul-13 18-Jun-13 Airline Survey 3-Jul-13 3-Jun-13 19-May-13 4-May-13 19-Apr-13 20-Mar-13 5-Mar-13 4-Apr-13 61.0 ADR Growth (T4W) RevPAR Grth 53.0 52.5 52.0 51.5 • while leading macro indicator, ISI’s Company Survey Index, continues to push higher ISI Company Surveys ISI Airline Survey (T4W) More Bullish Signals for Lodging Fundamentals 51.0 50.5 50.0 49.5 49.0 48.5 48.0 4-Jan-13 4-Feb-13 4-Mar-13 4-Apr-13 4-May-13 4-Jun-13 4-Jul-13 4-Aug-13 4-Sep-13 28 ISI International Strategy & Investment Group, Inc. ISI Economists Remain Bullish on US Economy ‘14 GDP: 3% ‘14 Job Growth: ~2.4mn jobs (200k/mos) ‘14 Unemployment Rate: 6.8% ’14 10-Year Bond: 3.5% 29 ISI International Strategy & Investment Group, Inc. ISI Forecast: Expecting RevPAR of 6%+ in ‘14 • We are forecasting +6%+ RevPAR growth in ‘14 10 5 • REIT executives putting out ranges of +5% to +7% 0 -5 -10 -15 • Everything dependent upon job growth Correlation: 86% -20 1Q88 1Q89 1Q90 1Q91 1Q92 1Q93 1Q94 1Q95 1Q96 1Q97 1Q98 1Q99 1Q00 1Q01 1Q02 1Q03 1Q04 1Q05 1Q06 1Q07 1Q08 1Q09 1Q10 1Q11 1Q12 1Q13 1Q14 US RevPAR Growth - Y/Y Change (%) 15 Series1 Series2 •West Coast likely to continue to outperform 30 ISI International Strategy & Investment Group, Inc. Lodging Stock Valuations – Can We Still Make Money???? 31 ISI International Strategy & Investment Group, Inc. Lodging Stocks Have Had a Very Solid Run the Last 5 Yrs… 100% 89% 80% 63% 60% 57% 51% 40% 31% 21% 20% 13% 17% 0% -20% 2009 2010 Lodging REITs -13%-12% 2011 2012 13YTD Lodging C-Corps 32 ISI International Strategy & Investment Group, Inc. Still Forecasting 10% Returns – Valuations Reasonable Forecasted Returns: Upside Left in Lodging While Group ‘Fairly’ Valued EV/EBITDA Forecasting 12-Month Returns 15% 10% 10% 5% 0% -5% -10% NAV Ratios Company Name '13E '14E Curr Host Hotels & Resorts Inc. 14.1x 13.9x 95% LaSalle Hotel Properties 14.2x 12.4x 98% DiamondRock Hospitality 15.1x 12.8x 94% Sunstone Hotel Inv estors 13.7x 12.0x 90% Strategic Hotels & Resorts 16.9x 16.3x 86% Pebblebrook Hotel Trust 14.1x 12.6x 96% Lodging REIT Avg 14.4x 13.5x 94% EV/EBITDA Company Name '13E '14E Starw ood Hotels & Resorts 11.8x 11.7x Marriott International 14.1x 12.4x Hy att Hotels & Resorts Lodging C-Corp Avg 11.9x 10.5x 12.7x 11.7x 33 ISI International Strategy & Investment Group, Inc. Investment Thesis on Lodging… 1) In a rising interest rate environment, the story this year has been own lodging (shorter lease duration play) 2) Investor sentiment has shifted – less concerned about Macro blow-ups 3) Among the best internal growth stories relative to other asset classes 4) Deals, deals and more deals. Consolidation talk continues. Anticipate the private market bid for lodging will remain robust. 5) Even talk of cap rate compression --- unique only to lodging 6) Management teams have been very disciplined this cycle 1) Balance sheets are in great shape 2) Accretive acquisitions 3) Capital recycling improves the overall quality of the portfolio 7) We expect lodging stocks to continue to outperform in ‘14….however, questions still remain on employment trends and supply 34 ISI International Strategy & Investment Group, Inc. C-Corps the Better Play in ‘14? In ‘14, within the lodging sector, we prefer Lodging CCorps vs. Lodging REITs in 2014 18.0x 16.0x Fwd EV/EBITDA 14.0x 12.0x 10.0x 8.0x 6.0x Lodging REITS Lodging REITS LT Avg. C Corps C Corps LT Avg. 1) Valuations more compelling 2) ADR will dominate 3) Incentive management fee growth will accelerate, which should lead to multiple expansion Risks to C-Corp Call: China RevPAR Stalling – HOT and H Weaker Group – MAR 35 ISI International Strategy & Investment Group, Inc. Questions??? 36 ISI International Strategy & Investment Group, Inc. Analyst Certification and Disclosures • • • • • • • • • • • • • • • • • • • • ANALYST CERTIFICATION: The views expressed in this Report accurately reflect the personal views of those preparing the Report about any and all of the subjects or issuers referenced in this Report. No part of the compensation of any person involved in the preparation of this Report was, is, or will be directly or indirectly related to the specific recommendations or views expressed by research analysts in this Report. DISCLOSURE: Neither ISI nor its affiliates beneficially own 1% or more of any class of common equity securities of the subject companies referenced in the Report. No person(s) responsible for preparing this Report or a member of his/her household serve as an officer, director or advisory board member of any of the subject companies. No person(s) preparing this report or a member of his/her household have a financial interest in the subject companies of this Report. At various times, the employees and owners of ISI, other than those preparing this Report, may transact in the securities discussed in this Report. Neither ISI nor its affiliates have any investment banking or market making operations. No person(s) preparing this research Report has received non-investment banking compensation form the subject company in the past 12 months. ISI does and seeks to do business with companies covered in this research Report and has received non-investment banking compensation in the past 12 months. DISCLAIMER: This material is based upon information that we consider to be reliable, but neither ISI nor its affiliates guarantee its completeness or accuracy. Assumptions, opinions and recommendations contained herein are subject to change without notice, and ISI is not obligated to update the information contained herein. Past performance is not necessarily indicative of future performance. This material is not intended as an offer or solicitation for the purchase or sale of any security. ISI RATING SYSTEM: Based on stock’s 12-month risk adjusted total return. STRONG BUY Return > 20% BUY Return 10% to 20% NEUTRAL Return 0% to 10% CAUTIOUS Return -10% to 0% SELL Return < -10% ISI has assigned a rating of STRONG BUY to 19% of the securities rated as of 6/30/13. ISI has assigned a rating of BUY to 29% of the securities rated as of 6/3013. ISI has assigned a rating of NEUTRAL to 44% of the securities rated as of 6/30/13. ISI has assigned a rating of CAUTIOUS to 3% of the securities rated as of 6/30/13. ISI has assigned a rating of SELL to 1% of the securities rated as of 6/30/13. (Due to rounding, the above number may add up to more/less than 100%). 37