Understanding The Benefits of and Properly

advertisement

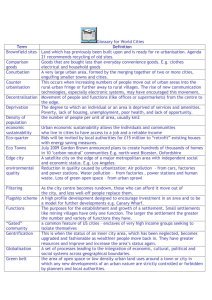

Life Settlements: Understanding The Benefits Of And Properly Utilizing The Secondary Insurance Market Presented By Doug Himmel WHAT IS A LIFE SETTLEMENT? A Life Settlement is the sale of an existing life insurance policy to a third party via the secondary institutional market in exchange for an immediate lump sum cash payment that is less than the policy’s face value, but higher than the policy’s cash surrender value. In a Life Settlement, the policy owner is relieved from making future premium payments. LIFE SETTLEMENTS HISTORICAL BACKGROUND US Supreme Court Laid The Foundation Case of Grigsby v. Russell (1911) Justice Oliver Wendell Holmes noted in his opinion that life insurance possessed all the ordinary characteristics of property, and therefore represented an asset that a policy owner could transfer without limitation. This opinion placed the ownership rights in a life insurance policy on the same legal footing as more traditional investment property such as stocks and bonds. As with these other types of property, a life insurance policy could be transferred to another person at the discretion of the policy owner. LIFE SETTLEMENTS PROGRESSION Evolved from Viatical Settlements in the 1990’s Clients Terminally Ill Private Investors Young Insureds (some as young as 25 yrs old) Policies as low as $25,000 Past 5 Years, Institutional market has developed Healthier individuals and companies who have had a change of need or a change in financial condition > 70 years old Policies > $500,000 Only Institutional Investors (Credit Suisse, Deutsche Bank, AIG, Wells Fargo, etc) Industry Statistics $18.39 Trillion inforce 2005 $19.11 Trillion inforce 2006 According to the American Council of Life Insurers: 88% of Universal Life policies are lapsed or surrendered without ever paying a death benefit. Furthermore, it is believed that 99 percent of term life insurance policies are lapsed without ever paying a death benefit. $15 - $20 Billion settled in 2007 18 – 22 % of DB average offer 74 yr old male is average insured 250 - 400% increase average over CSV or 3 to 5 times the current value Since 2001, over a billion dollars in excess of the cash surrender value has been paid to policy owners who chose to sell, rather than lapse or surrender their life insurance policy. WHAT POLICY TYPES ARE ELIGIBLE Universal Life Term Life Whole Life Variable Universal Life Group Survivorships Corporate, Individual or Trust owned PARAMETERS OF A LIFE SETTLEMENT How much will be received for a policy? There are many factors that determine the offer amounts: Age Premiums Client’s Health Type of Policy Insurance Company Rating Policy Size Competitive Bidding State of Residency General Rule: Age, health and future premiums are the primary factors that determine the amount of the Life Settlement offer. Competitive bidding assures that you have found the highest offer. WHO MAY QUALIFY? Anyone age 70 years or older with Life insurance greater than $500,000 face value whose circumstances have changed since the original policy was issued. Health Financial Personal PEOPLE OFTEN HAVE CHANGING CIRCUMSTANCES… Under-Performing Policies Sale of Business/M&A Succession planning Divorce or Bankruptcy Death of Spouse/Beneficiary Estate Size Growth or Reduction Tax Reform Family Issues / Changes Deterioration of Health Considering a 1035 Exchange Policy Donation Declining Financial Performance Loss of Key Executives/Retirement Corporate Restructuring BENEFITS TO THE CLIENT… Monetizes Often Overlooked Asset No Obligation Immediate Capital Relief of Premium Expense Maximizes Asset Recovery Alternative to Surrendering or Lapsing a Policy LIFE SETTLEMENTS An Innovative Retirement, Estate Planning, Philanthropic and Liquidity Generation Tool SETTLEMENT TIMELINE Upon Receiving the Following: 1. Completed application & signed authorizations 2. Copy of policy, if obtainable Continue… TIMELINE CONTINUED Appraisal Process Consists of: Completing the Settlement Process: 1. Collection of policy and medical information 1. Contracts are delivered to the referring professional for the policy owner 2. Obtaining multiple LE reports 2. Review, sign and return of settlement contract package 3. Complete initial underwriting of case (medical and illustrative) 3. Escrow account opened and change instructions sent to carrier 4. Send complete case to funding organizations 4. Record ownership changes by insurance carrier 5. Negotiate and obtain offers or declinations 5. Escrow company releases cash settlement to client 6. Communicate appraisal value 6. Client rescission period – State specific FINDING A BROKER Represent multiple institutionally owned funding sources (30+) Act as fiduciary to the policy owner and Financial Representative Full transparency on offers, including funding source Doesn’t work with private buyers Industry experience of at least 3 years Provide list of state licenses Doesn’t buy policies for own investment Uses 3rd party Escrow Services EXPERIENCED SETTLEMENT ADVISORY PROFESSIONALS MELVILLE CAPITAL UTILIZES ONE OF THE INDUSTRY’S LARGEST NETWORKS OF OVER 50 INSTITUTIONAL BUYERS TO COMMAND THE HIGHEST OFFERS FOR YOUR CLIENTS Licensed Insurance Professionals With Financial Services Backgrounds Innovative Take-to-Market Strategy Multiple LE’s (Life Expectancy’s) Canvassing the market Actuarial Assessment Full Disclosure Policy Auction Environment Maximizes Settlement Amounts Back Office Processing Staff Close Attention to Compliance Tools & Client Support Education CASE HISTORY ESTATE PLANNING Male age 77 and Female age 76 $5,000,000 Survivorship UL LIFE SETTLEMENT SOLUTION Policy underperforming Updated planning, only need $2MM $285,000 CSV If 1035, projected premiums = $84,000/yr Net offer = $700,000 Use as lump sum dump, new policy Projected annual premiums = $53,000 $31,000/yr savings CASE HISTORY M&A Business owner – Age 72 LIFE SETTLEMENT SOLUTION $25,000,000 UL Policy – corporate owned Selling company Has personal coverage Wanted $30MM net for company Offered $28MM plus fee’s Sale in jeopardy… Transfer policy ownership to Insured Settlement Amount of $4,750,000 Insured ends up with more than anticipated CASE HISTORY Philanthropic CRT – Alternative MALE – age 76 $2,500,000 UL Policy Cost basis = $300,000 CSV = $39,000 No longer needs policy Desires to be more supportive of charity Could donate to charity for deduction of CSV and make premiums each year as additional contribution to receive deductions Set up CRT Obtain appraisal of policy in the secondary market = $540,000 Donate policy to CRT and settle policy Get deduction based on the $540,000 Receive annual income stream from proceeds CASE HISTORY Corporate Bankruptcy and Term Conversion MALE – Age 73 $15,000,000 Term Policy LIFE SETTLEMENT SOLUTION (Policy was in 30 day Grace Period) Bankruptcy of Home Goods Merchant Policy Insuring Company Founder Failed Private Equity Acquisition Senior Creditor Trying to Recover Portion of Exposure Identified Significant Market Value Policy Immediately Brought Back In-Force * BK court permission Policy converted to UL from TERM Settlement Amount of ~$2,700,000 roughly equal to entire BK claim of Sr. Lender CASE HISTORY Personal Needs Female – Age 81 $1,400,000 UL Policy LIFE SETTLEMENT SOLUTION ( CSV = $46,000) Husband passed away Children grown and successful Feels policy is excessive Wants monthly income stream Settlement Amount of $327,000 Proceeds invested into immediate Annuity * Received $281,000 over surrender CONTACT INFORMATION Douglas Himmel Managing Director/Partner 11845 W. Olympic Blvd - Suite 510, Los Angeles, CA 90064 (866) 511-5990 (Phone) (631) 390-2422 (Fax) DHIMMEL@MELVILLECAPITAL.COM Disclaimer Life Settlement amounts are based on numerous factors. The case examples are for illustration purposes and does not represent future offers, statements, percentages or amounts. Actual results will vary. The industry average purchase price obtained by viators ranges from 12-24% of the face amount of a qualified life insurance policy. Some or all of the proceeds of a life settlement may be taxable under federal or state income tax laws from the sale of one's life insurance policy. Advice from a professional tax advisor is recommended. Melville Capital is a licensed broker or producer.