Agrozzi

advertisement

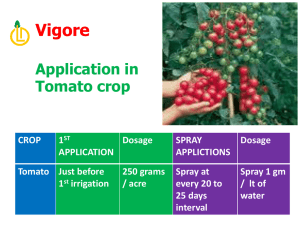

CHILEAN TOMATO INDUSTRY Mr. Cristian Alemparte AGRICULTURAL BACKGROUND Natural characteristics of Chile, it’s natural protection against plagues and its favorable Mediterranean weather. North: Atacama Desert. South: Antarctic. East : Andes Mountain West : Pacific Ocean AGRICULTURAL BACKGROUND Europe California Chile South Africa Australia Mediterranean Weather Zones Only some world areas are privileged with Mediterranean Weather This weather is present only near the 40° latitude, with western coast presence Weather characteristic: Dry & warm summers and rainy & cold winters Temperature Range: more than 15° C WORLD PRODUCTION OF TOMATOES FOR PROCESSING - YEAR 2008 36,034 THOUSAND MT USA: 31 % ITALY: 13,3% CHINA: 17,2% OTHERS: 31% NH: 92,6% BRAZIL: 3,3% SH: 7,4% CHILE: 1,4% Production Zone South America Europe USA China Others TOTAL (f) : Forecast 1993 8,7% 30,4% 39,6% N/A 21,2% 100,0% ARGENTINA: 1% 1998 8,8% 34,0% 34,7% 3,2% 19,4% 100,0% 2003 8,3% 33,2% 31,9% 10,0% 16,6% 100,0% 2008 6,0% 24,6% 31,0% 17,2% 21,2% 100,0% AUSTRALIA: 0,4% SOUTH AFRICA: 0,4% 2009 (f) 5,9% 25,7% 32,0% 17,6% 18,8% 100,0% OTHERS: 0,9% SOURCE: AMITOM FRESH TOMATO WORLD PROCESSING Main World Processing Zones (by Product) Tomato Paste Canned Tomatoes Chile Turkey China Greece Italy USA Spain Portugal Mexico Argentina Canada Germany Belgium Costa Rica Netherlands Poland Russia Sauces & Ketchup Source: Tomato News FRESH TOMATO WORLD PRODUCTION World Production Trend (Metric Tones) 40.000 30.000 20.000 10.000 1993 South America 1998 Europe 2003 2008 USA 2009 (f) China Others 1993~2008 World Fresh Tomato Production Annual average growth rate: 3,8% Equivalent to additional 1.000 thousand MT of fresh tomatoes per year 2009 production forecast Annual growth rate: 7,4% compared with 2008 Equivalent to 1,700 thousand MT of fresh tomatoes Source: Amiton FRESH TOMATO WORLD PRODUCTION Consumption v/s World Production From 2005 year to date the is an increasing gap between World Consumption and Production Year 2009, this gap might slightly decrease World Tomato consumption might reach 40 million MT in 2011 (farm weight equivalent) Source: Tomato News FRESH TOMATO WORLD PRODUCTION Regional Distribution of Tomato Consumption in 2007 (34,5 Million of MT) EU 15 (West) 23% North America 29% Africa 9% Others (Eur) 9% South America 7% Middle East 3% Others 12% EU 12 3% (East) Australasia 2% Asia 3% North America and Total Europe concentrate more than 60% Tomato World Consumption Source: Tomato News Africa in the third place with 9% FRESH TOMATO WORLD PRODUCTION Regional per capita consumption (Kg/Year) 35,0 32,5 30,1 30,0 22,8 25,0 20,8 20,0 20,0 15,8 15,0 10,0 6,3 10,6 10,8 10,1 6,1 5,6 4,8 3,1 5,0 - 5,0 2,8 0,4 0,3 North America Australasia EU 15 Others (Eur) Middle East South America (West) 1997 Africa EU 12 (East) Asia 2007 Biggest per capita consumption growth in the last 10 years Middle East Europe 2007 World average per capita consumption: 5,6 Kg per year 2010 Expected World average per capita consumption 6,1 Kg per year Source: Tomato News WORLD TOMATO PASTE EXPORTS 2007 2,359,176 MT USA: 5,6% EU: 53,5% CHINA: 36% NH: 95,5% SH: 4,5% OTHERS : 0,4% BRAZIL: 0,3 % CHILE: 3,6% OTHERS : 0,6% Source: Global Trade Information Service WORLD TOMATO PASTE EXPORTS Chilean Exports in the World context 900.000 800.000 Chile 700.000 Others 600.000 500.000 Greece 400.000 Turkey 300.000 USA 200.000 100.000 Spain Italy China Portugal Spain USA Turkey Greece Others 2007 Chile 2006 2005 2004 2003 2002 2001 2000 1999 1998 Portugal 1997 1996 Thousand of MT China Italy Source: Global Trade Information Service CHILEAN TOMATO PRODUCTS Chilean Tomato Paste Exports 1997~2008 (MT) 120.000 10,0% 100.000 8,0% 80.000 6,0% 60.000 4,0% 40.000 20.000 2,0% - 0,0% 1997 1998 1999 2000 2001 2002 2003 Chilean Exports Chile: 7th exporter in the World Decreasing participation in the World Market Chilean production decrease Other Countries production increase Internal consuption 20.000 tons 2004 2005 2006 2007 2008 % of Total Source: Global Trade Information Service CHILE: TOMATO PRODUCTS EXPORTS 2008 67.658 MT USA & CANADA 1,2 % EUROPE 1% ASIA 13.8 % LATINAMERICA 84 % SOURCE: DICOM CHILEAN TOMATO PRODUCTS Chilean Tomato Products Exports Distribution 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1998 Venezuela 1999 2000 Argentina 2001 Brasil 2002 2003 Japan 2004 2005 Mexico 2006 2007 Colombia 2008 Others Today Venezuela is the biggest market for Chilean Tomato Paste The market is more diversified than 10 years ago Source: Dicom CHILEAN TOMATO PRODUCTS Chilean Tomato Products Exports by Type (MT) Type Tomato Paste Peeled & Diced Sauce Total 1998 Peeled & Diced 6% 1998 2003 103.987 77.613 7.218 3.518 5.521 3.350 116.726 84.481 2003 Sauce 5% Tomato Paste 89% Peeled & Diced 4% Sauce 4% Tomato Paste 92% Big increase in Tomato Sauce exports for Food Service Tomato Paste and Pealed Tomato export decrease 2008 63.507 683 3.468 67.658 2008 Peeled & Diced 1% Sauce 5% Tomato Paste 94% Source: Dicom CHILEAN TOMATO INDUSTRY Chilean Tomato Exports by Company (MT) Company Aconcagua Iansafrut Nieto Agrozzi Malloa Pentzke Bozzolo Fruveg Others Total Aconcagua 1998 13.161 23.636 13.803 25.847 16.048 7.075 2.250 7.179 7.727 116.726 1999 9.889 33.445 11.515 35.125 14.695 10.038 3.353 2.466 5.018 125.546 2000 19 20.351 19.953 26.169 9.831 5.204 1.516 162 12.834 96.039 2001 2002 2003 28.425 16.193 30.317 28.506 4.053 801 703 10.091 119.088 36.575 16.099 38.990 10.916 2.042 957 90 4.677 110.348 28.986 16.417 33.280 33 1.310 1.939 72 2.444 84.481 2004 7.076 11.069 18.602 35.655 2005 41.410 6.966 2006 50.307 4.374 2007 46.860 2008 37.653 39.860 38.414 39.845 26.359 2.971 2.491 982 1.270 2.837 922 2.511 1.239 1.963 721 1.290 79.152 476 90.965 503 97.358 803 91.258 962 67.658 Agrozzi Aconcagua Foods S.A. 1999: Aconcagua bought Nieto company 2004: Aconcagua bought Iansafrut company Agrozzi 2002: Agrozzi bought Malloa plant From 8 to 4 companies in 10 Years !!! Source: Dicom CHILEAN TRADE AGREEMENTS Current FTA Negotiating Source: Direcon CHILEAN TOMATO FACTS & FEATURES Agricultural Cultivated Surface: 8.600 Has (Year 2008) Between 750 ~ 800 farmers Average yield: 78 MT/Ha Around 35 % of mechanization (Harvest) Cultivation Period • Transplant: Sep-20th ~ Nov-15th • Harvest: Jan-25th ~ Apr 4th Industrial 5 Tomato Paste Plants Installed daily processing capacity: 12.000 Metric Tons (app.) Located in the main tomato production area CHILEAN TOMATO FACTS & FEATURES Main Advantages Excellent weather Geographic isolation Low incidence of insects, pests and plant diseases Opposite Season (Southern Hemisphere) Agricultural production oriented to industry Raw material processed before 24 hours after harvest Hybrid varieties widely used High yields and reasonable cost of raw material Pending Tasks Harvest Mechanization High Investment Relatively small areas THANK YOU !