Banking Style Powerpoint example

advertisement

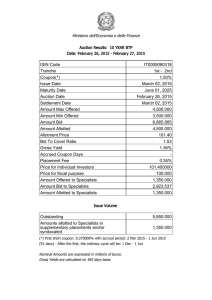

9 October 2014 Capacity Market Mark Walker © Allen & Overy 2014 1 What we will cover Rationale and aims of the Capacity Market How the Capacity Market works Recent updates and developments Principal parties involved in the Capacity Market Stages of the Capacity Market in practice Future proposals and developments © Allen & Overy 2014 2 Capacity Market – rationale and aims Introduced as a precaution against the risk of failures in the energy market Fundamental aim is to improve security of supply and prevent blackouts This will be achieved by incentivising investment in reliable capacity © Allen & Overy 2014 3 British power market in January 2030 with January 2000 weather Source: Pöyry © Allen & Overy 2014 4 How the Capacity Market works © Allen & Overy 2014 5 Capacity Market – an update – The Energy Act 2013 sets out powers for the Secretary of State to introduce the Capacity Market – The Capacity Market regime received state aid approval from the EC on 23 July 2014 – The Capacity Market Rules and the Electricity Capacity Regulations came into force on 1 August 2014. The Capacity Market (Amendment) Rules 2014 came into force on 22 August 2014. – The first T-4 auction is due to start on 9 December 2014 – The Consultation on Capacity Market supplementary design proposals and Transitional Arrangements was published in September 2014 – A new set of regulations, the Electricity Capacity (Supplier Payment) Regulations 2014 are expected to come into force in November 2014 – There has been a huge number of applications for the first Capacity Market auction. A total of 513 separate applications were received, equating to nearly 70GW of de-rated capacity. © Allen & Overy 2014 6 Parties Secretary of State Delivery Body National Grid Capacity Market Settlement Body Electricity Settlement Company Settlement Services Provider Electricity Market Reform Settlement Limited (wholly-owned subsidiary of Elexon Ltd.) Auctioneer National Grid or person appointed by National Grid (Regulation 21) Auction Monitor As per Rule 5.14, the Delivery Body must appoint a third party to monitor the conduct of each Capacity Auction Authority Ofgem © Allen & Overy 2014 7 Stages of Capacity Market Operation Amount to auction Enduring reliability standard established by Govt. System Operator develops scenarios of peak demand, and advises on the amount of capacity needed to meet the reliability standard. Eligibility and prequalification Demand side response and storage eligible as well as generation. Mandatory for all licenced generators to go through prequalification process or submit an optout notification. Auction Central auction held to set the price for capacity and determine which providers are issued with capacity agreements. Trading Capacity providers may adjust their position in private markets. Delivery Providers of capacity commit to be available when needed or face penalties in the delivery year. Payment Costs of capacity shared between suppliers in proportion to their share of peak demand. Capacity Market does not replace electricity market. Source: DECC © Allen & Overy 2014 8 Amount of capacity to be procured National Grid carries out an annual security of supply analysis of the amount of capacity required to meet the enduring reliability standard and that is scrutinised by the independent panel of technical experts. The target capacity level takes account of capacity available outside the Capacity Market. The reliability standard published in the first EMR delivery plan is a LOLE of 3 hours/year (a system security level of 99.7%) 50.8GW of capacity is targeted for the first auction, for the first delivery year 2018/19 The capacity demand curve is determined by the Government 6 months ahead of capacity auctions. The target level of capacity and an estimate of the net cost of new entry (or Net CONE) determines the slope of the demand curve. Indexation of payments © Allen & Overy 2014 9 Net cost of new entry Net CONE is the central administrative estimate of the level of capacity payment needed to incentivise new build Net CONE was estimated to be £29/kW by DECC in 2013. This was based on the level at which a new build large scale OCGT was expected to be able to bid into the first auction. However, it is unlikely that large scale OCGT will be built in time for the first delivery year (2018/19) so for the first auction Net CONE is based on the estimated level at which new build CCGT will bid into the CM and has been increased to £49/kW. Net CONE is important because it is used: • to construct the demand curve • to set the price taker threshold (i.e. half of Net CONE, £25/kW) It is no longer proposed that the auction price cap is a multiple of Net CONE. This cap has been administratively set at £75/kW year. © Allen & Overy 2014 10 Illustrative Capacity Demand Curve Source: DECC © Allen & Overy 2014 11 Eligibility The following are eligible to participate in the Capacity Market: • new and existing generation (including CHP) • demand side response (DSR), including embedded generation • electricity storage The following are not eligible to participate in the Capacity Market: • capacity receiving support through the ROO, CfD, FiT, RHI, NER 300 or UK CCS grant • long term STOR • interconnected non-GB capacity, and the interconnectors themselves (it is intended that this capacity will be eligible from 2015) • capacity below 2MW threshold (if not combined) © Allen & Overy 2014 12 Pre-qualification requirements (1) – Pre-qualification takes place 4 months before the auction – The requirements that must be met depend on the Capacity Market Unit (CMU) type In order to pre-qualify for participation in an auction: All CMUs must • Identify the applicant (for a generating CMU, this can be the legal owner or the Despatch Controller) • Provide details about the applicant (including legal status) and the CMU • Provide various declarations © Allen & Overy 2014 13 Pre-qualification requirements (2) Existing Generating CMUs must • Specify highest physically generated net outputs in previous 24 months • Declare Grid Code compliance • Confirm connection arrangements • Provide details of metering arrangements New Build CMUs must • Have a valid connection agreement (or confirm that a distribution connection agreement will be in place 18 months prior to the start of the relevant delivery year) • Have all planning consents (or for the first T-4 auction confirm that planning consents will be obtained by 17 working days before the first bidding window) • Provide a construction plan including dates for achieving construction milestones Refurbishing CMUs – similar to New Build © Allen & Overy 2014 14 Pre-qualification requirements (3) Proven DSR CMUs must • Include a DSR Test Certificate • Include details of On-Site Generating Units • Include a business model • Include details on metering arrangements Unproven DSR CMUs must • Include a business plan • Confirm that it will complete the required testing The application window for pre-qualification for first T-4 auction ran from 4 August to 29 August 2014. A total of 513 separate applications were received for the first auction, equating to nearly 70GW of de-rated capacity. Over 62GW have already been accepted by National Grid as eligible to participate. A further 5GW was initially unsuccessful but it is expected that the majority of these will be able to prequalify successfully following the dispute resolution process. © Allen & Overy 2014 15 Routes to auction for eligible providers Auction choices for CMUs Opt Out of CM Participate in CM CMU Retirement Prequalification Process Existing CMU (1yr contract) Auction Price Taker: Price Maker: Can set price up to threshold; no justification needed Sets price; provides justification to Regulator Refurbishing CMU (up to 3yr contract) New CMU (up to 15yr contract) Price Maker: Price Maker: Sets price; no justification needed Sets price; no justification needed Source: DECC © Allen & Overy 2014 16 Auction Auctions will be held four years ahead of delivery, supplemented by a further auction one year ahead of delivery. The first T-4 auction is due to start on 9 December. Capacity Market is a descending clock, ‘pay as clear’ auction meaning that all successful bidders are paid the same price (set by the most expensive successful bid) Generators will participate as “price makers” or “price takers” • Price takers can only bid up to a threshold of half Net CONE • Price makers can bid up to the auction cap © Allen & Overy 2014 17 Timetable 1st T-4 Auction Date Event 4 to 29 August Application window for prequalification 21 October Notification of updated Auction Parameters and confirmation of the conditional Prequalified Applicants which have fully Prequalified pursuant to Rule 4.6.3 18 November Notification of Prequalified CMUs pursuant to Rule 5.5.10(b) and associated update of affected Auction Parameters 25 November (T–10 Working Days) Price Maker decisions notified to Auctioneer 9 December Start of auction © Allen & Overy 2014 18 Auction Parameters 1st T-4 Auction Category Parameter Target capacity for 2014 T-4 Capacity Auction 50,800MW Demand curve coordinate – target volume at price cap 49,300MW Demand curve coordinate – target volume at £0/kW 52,300MW Price cap £75/kW/yr Price Taker Threshold £25/kW/yr 15 Year Minimum £/kW Threshold £250/kW de-rated capacity 3 Year Minimum £/kW Threshold £125/kW de-rated capacity Indexation base period 1st October 2012 to 30th April 2013 © Allen & Overy 2014 19 Illustrative supply curve Price (£/KWyear) Price Cap £75/kW/yr Threshold for Price Takers £25/kW/yr Capacity Outside CM (inc CfD, Opt Out etc) Price Takers Price Makers Capacity (MW) Source: DECC © Allen & Overy 2014 20 Auction format (1) The Auctioneer must use its reasonable efforts to conduct the Capacity Auction in an efficient manner consistent with any guidance from the Secretary of State so as to minimise the Capacity Auction duration (Rule 5.5.3) The Auctioneer must notify and seek advice from the Secretary of State if it considers that the Capacity Auction will not or is likely not to be concluded within 5 Working Days of the beginning of the first Bidding Window (Rule 5.5.4) The Capacity Auction must be run as a series of price spread bidding rounds (each a “Bidding Round”) on a descending clock basis (Rule 5.5.5) The price spread for a Bidding Round (the “Bidding Round Price Spread”) must be expressed as a range from a highest price (the “Bidding Round Price Cap”) to a lowest price (the “Bidding Round Price Floor”) (Rule 5.5.6) The Bidding Round Price Cap in the first Bidding Round must be the Price Cap. In each subsequent Bidding Round, the Bidding Round Price Cap must be equal to the Bidding Round Price Floor in the previous Bidding Round (Rule 5.5.7) The Secretary of State must issue instructions to the Auctioneer as to the process for determining the size of the decrement to be represented in each Bidding Round Price Spread (Rule 5.5.8) Bidding Rounds continue until the Capacity Auction clears (Rule 5.5.9) © Allen & Overy 2014 21 Auction format (2) No later than 15 Working Days prior to the commencement of the first Bidding Round for a Capacity Auction, the Delivery Body must publish: • the date and time on which the Capacity Auction will start; • the identity of the Prequalified CMUs for the Capacity Auction and their aggregate Derated Capacity; • in the case of a T-1 Auction, the aggregate Contracted Capacity in the relevant T-4 Auction adjusted for any cancellation or termination of Capacity Agreements and/or delays in the commissioning of Prospective Generating CMUs; and • the identity of the Auction Monitor for the relevant Capacity Auction (Rule 5.5.10). Between the dates falling 15 Working Days and 10 Working Days prior to the commencement of the first Bidding Window, the Applicant for each Prequalified Prospective Generating CMU, Refurbishing CMU and DSR CMU that wishes to participate in a Capacity Auction must submit a notice to the Delivery Body which: • confirms that it will participate as a Bidder; and • in the case of a Prospective Generating CMU or a Refurbishing CMU, specifies the duration of Capacity Agreement in whole Delivery Years (not being greater than the Maximum Obligation Period for that CMU) that it requires at the Price Cap (Rule 5.5.14). © Allen & Overy 2014 22 Auction format (3) Failure to submit a confirmation will result in: • the Applicant for that Prequalified CMU not being permitted to participate as a Bidder for that CMU in the relevant Capacity Auction; and • the release of any Applicant Credit Cover relating to that Prequalified CMU in accordance with the Regulations (Rule 5.5.16). An Applicant for a Prequalified CMU will not be permitted to participate as a Bidder for that CMU in a Capacity Auction if that CMU is: • a Defaulting CMU; • an Excluded CMU in relation to that Capacity Auction; or • an Existing Generating CMU that has Opted-out in relation to that Capacity Auction (Rule 5.5.17). Prior to the start of each Bidding Round the Auctioneer must announce: • the Bidding Round Price Spread for that Bidding Round; • the Clearing Capacity at the Bidding Round Price Floor for that Bidding Round as determined by the Demand Curve; and © Allen & Overy 2014 23 Auction format (4) • except in relation to the first Bidding Round, the spare capacity as at the start of the Bidding Round (rounded to the nearest 1GW in a T-4 Auction and the nearest 100MW in a T-1 Auction) being the Remaining Auction Capacity at the end of the previous Bidding Round minus the Clearing Capacity determined by the Demand Curve at the Bidding Round Price Floor for that previous Bidding Round (Rule 5.5.18). The Capacity Auction clears in the first Bidding Round for which the Remaining Auction Capacity at the end of that Bidding Round is less than or equal to the Clearing Capacity for the Bidding Round Floor Price in that Bidding Round (the “Clearing Round”) (Rule 5.9.2). The Auctioneer must rank the Relevant Exit Bids in a Clearing Round as follows: • according to their respective Exit Prices (lowest Exit Price given the highest ranking); • if Relevant Exit Bids have the same Exit Price, according to their size (largest first); • if Relevant Exit Bid have the same Exit Price and the same Bidding Capacity, according to the duration of Capacity Agreement (with the shortest duration of Capacity Agreement given the highest ranking) followed by random number allocation (Rule 5.9.5). © Allen & Overy 2014 24 Market manipulation Rule 3.4.9 (conduct of the applicant) requires each applicant to declare: • Compliance with laws prohibiting anti-competitive practices • No engagement in market manipulation • No breaches of Bribery Act • No inducements offered to any officer of an Administrative Party • No disclosure of confidential information © Allen & Overy 2014 25 Capacity Agreement (1) A capacity agreement notice will be issued by the Delivery Body in respect of each successful CMU. A capacity provider can request an amendment of a factual inaccuracy in the capacity market notice A Capacity Market Register, maintained by the Delivery Body, records each successful CMU. This is the definitive document. Neither the Capacity Market register entry nor the capacity agreement notice is intended to create a contractual relationship. A capacity agreement is an instrument created by statute (as opposed to CfD). The length of capacity agreements will typically be one year though plants in need of refurbishments and new plants will be able to receive longer term agreements of up to 3 and 15 years respectively © Allen & Overy 2014 26 Capacity Agreement (2) Additional rules for refurbishing plant: • Financial commitment milestone • Substantial completion milestone Additional rules for new build plant: • Financial commitment milestone • Collateral • Substantial completion milestone © Allen & Overy 2014 27 Capacity Agreement (3) Termination events include: • Insolvency of the capacity provider • Failed to achieve a financial commitment milestone (new build) Termination fee £5,000/MW • Failed to achieve minimum completion requirement (new build) Termination fee £25,000/MW • Failed to obtain a connection agreement offer Termination fee £5,000/MW • Failed to maintain TEC Termination fee £25,000/MW • Failure to achieve a satisfactory metering test (if required) © Allen & Overy 2014 28 Trading FINANCIAL TRADING VOLUME REALLOCATION OBLIGATION TRADING* Eligibility Parties can trade with whomever they choose (e.g. each other or insurers) Parties can reallocate excess output to another CMU Parties can only move obligations to pre-qualified resources to the limit of their de-rated capacity and which do not have obligations (i.e. empty vessels) Payment for holding capacity obligation Unaffected Unaffected Payment goes directly to whoever holds the obligation. Timing As privately negotiated Volume reallocation can only happen ex post in 11 to 19 working days following months in which there have been stress events Obligation trading can take place following the T-1 auction up to near real time Size of trading blocks As privately negotiated No restrictions on size Minimum trading blocks to be determined *Not yet enabled © Allen & Overy 2014 29 Delivery National Grid will issue a ‘Capacity Market warning’ in advance of any anticipated stress event In stress periods providers’ obligations come into force four hours after the triggering of a Capacity Market warning Providers that do not deliver sufficient energy at the relevant time to meet their obligations will face a financial penalty • Penalty rate is 1/24th of the relevant clearing price • Penalties are capped at 200% of monthly revenues and 100% of annual revenues National Grid will have the ability to spot test providers where they have failed to demonstrate their ability to deliver the level of capacity specified in their capacity agreement © Allen & Overy 2014 30 Payment - Overview of Capacity Market Payment Flows Capacity providers Capacity payments from capacity agreements Payments from over delivery during a stress event Penalties from under delivery during a stress event Capacity Market Settlement Body assisted by settlement agent (Elexon) Monthly funding of capacity payments Payment of residual penalty charges (if any) Funding of settlement body costs Licenced suppliers Source: DECC © Allen & Overy 2014 31 Capacity Market Settlement Timetable Source: DECC © Allen & Overy 2014 32 Supplementary design proposals DECC published the Consultation on Capacity Market supplementary design proposals and Transitional Arrangements in September 2014 The Government plans to implement the changes as a result in 2019/2020 Proposals include: • Including interconnectors in the CM • Technical changes to enable Obligation Trading • Price duration curves (to enable the evaluation of bids to be based on contract duration as well as price) © Allen & Overy 2014 33 Interconnector capacity Interconnector capacity would contribute to security of electricity supply and provide value for money for consumers Eligibility for the December 2014 auction is GB capacity only but the consultation sets out an interim proposal for interconnectors to participate from December 2015 Under the interim proposal interconnector owners would participate in a very similar way to domestic bidders The consultation also sets out a more long term plan for interconnector capacity © Allen & Overy 2014 34 Capacity obligation trading Obligation Trading is where capacity providers transfer their capacity obligations to other CMUs (Capacity Market Units) Amendments need to be made to the Electricity Capacity Market Rules 2014 to give statutory backing to Obligation Trading © Allen & Overy 2014 35 Price duration curves There are inherent risks associated with the Government offering longer term capacity agreements for new build generators The Capacity Mechanism Rules and Regulations contain provisions which allow the Secretary of State to set price duration curves Aim of setting these is to render Government indifferent between longer and shorter agreements The proposals set out a methodology for setting the price duration curves © Allen & Overy 2014 36 A&O EMR site http://www.allenovery.com/UK-Electricity-Market-Reform © Allen & Overy 2014 37 Questions? These are presentation slides only. The information within these slides does not constitute definitive advice and should not be used as the basis for giving definitive advice without checking the primary sources. Allen & Overy means Allen & Overy LLP and/or its affiliated undertakings. The term partner is used to refer to a member of Allen & Overy LLP or an employee or consultant with equivalent standing and qualifications or an individual with equivalent status in one of Allen & Overy LLP's affiliated undertakings. © Allen & Overy 2014 38