Assets

advertisement

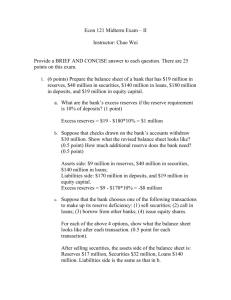

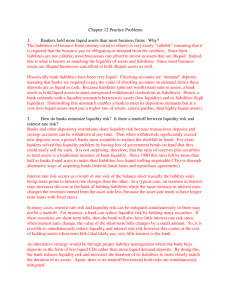

Chapter 9 Commercial Banking ©Thomson/South-Western 2006 1 Road Map CH 9 Commercial Bank Balance Sheet Commercial Bank Management Liquidity Management Assets What are they? Trade-Off Liabilities Management Technique Liabilities What are they? Capital Management Changing Trends Capital Accounts What are they? 2 The Commercial Bank Balance Sheet Banks earn a profit on the “spread” Bank fees also played an increasingly important role in bank profits. A bank balance sheet is a statement of its assets, liabilities, and net worth at a given point in time. Assets are what it owns. Liabilities are what it owes. Net worth (capital accounts, capital) is the difference between its assets and liabilities. Assets - Liabilities = Net Worth Assets = Liabilities + Net Worth 3 Figure 9-1 4 Table 9-1 5 Table 9-1 (TH) 6 Commercial Bank Assets Cash Assets: legal reserves as dictated by reserve requirements or required reserve ratios Loans Real Estate Loans: collateralized by property, securitized or packaged collections of loans Business Loans: regular installment loans, lines of credit Consumer Loans: auto loans, credit cards Other Loans: federal funds sold Securities About 25% in US but only about 16% in TH (% of total assets) Building, Land, and Equipment 7 Commercial Bank Liabilities (1) Transactions Deposits (checkable deposits) Any accounts for transaction purpose, either saving or checking Lowest-cost source of fund Non-Transactions Deposits Any accounts for saving purposes ie. Fixed saving, CDs 8 Commercial Bank Liabilities (2) Non-deposit Borrowing or Borrowing Borrowing from the Fed at the discount rate Borrowing from other banks at the federal funds rate Borrowing through repurchase agreements Other Liabilities Account payables, accrued wages, and other regular liabilities as regular businesses. 9 Figure 9-2 10 Thailand’s Figure 9-2 11 Commercial Bank Capital Accounts Bank capital derives from the issue of bank stock shares and from retained earnings. In 2004, aggregate capital accounts of all U.S. commercial banks were 8.2 % of total bank assets. Bank capital provides a cushion that protects a bank's owners from potential bank insolvency. 12 Writing Off Bad Loans 13 Commercial Bank Management Commercial banks strive to: earn solid profits; maintain extremely low exposure to the possibility of becoming insolvent, and maintain high liquidity (the ability to immediately meet currency withdrawals while abiding by existing reserve requirements) by managing liquidity and capital. Bank use liquidity management and capital management to maintain financial viability 14 T-Accounts T-accounts are statements of the change in the balance sheet resulting from a given event. ie. if a customer withdraws $200 in cash from a savings account at the Bank of Medicine Bow, Wyoming. ie. Clearing a check for $12,000 written by a bank customer 15 Reserves Withdrawal of currency and/or clearing of checks written on a bank Reduce the bank’s reserves by the amount of the transaction Deposit of currency into a bank account and/or clearing of deposited into a customer’s account Increase the bank’s reserves dollar for dollar Due to fluctuation in reserves, banks try to prevent large loss of reserves which force banks to make a choice between bank liquidity and bank risk. 16 The Importance of Liquidity Banks must have emergency plans to meet large reserve withdrawals, so banks need to hold liquid assets like Treasury bills. If a bank is exposed to large deposit outflows and can obtain reserves only at substantial cost, it could find itself in serious trouble, even if it has a relatively large capital account. Banks that exhibit higher risk need larger capital accounts. 17 The Liquidity-Risk Trade-off With a reserve requirement of 10%, the bank has no excess reserves. Its assets are 90% in high return loans and 10% in low return securities. If depositors withdraw $20 million, then the balance sheet changes and the bank must come up with $18 million, of which only $10 million is liquid. 18 The Liquidity-Profitability Trade-off The bank has $10 million excess reserves. Its assets are split between high return loans and low return securities. If depositors withdraw $20 million, then the balance sheet changes and the bank must come up with $8 million, but its assets are so liquid that this is no problem. It is less profitable because it has fewer high-risk, high-return loans on equity for bank owners. 19 Summary of LQ vs. Profit Not enough LQ (Aggressive) Pros: higher short-run profit Cons: may experience LQ problem that may lead to bank’s insolvency and eventually closed down Maximize profit by penalizing liquidity Too much LQ (Conservative) Pros: less likely to experience LQ that lead to bank’s insolvency Cons: lower short-run profit Minimize risk by penalizing profit 20 Indicators of Bank Liquidity The ratio of bank loans to total assets 35% in 1950s vs 60% in 2004 Low ratio means relatively more liquid The ratio of securities to total assets 40% in 1950s vs 15% today Low ratio means relatively less liquid The ratio of demand deposit to total bank deposits 60% in 1960 vs 10% today Lower ratio indicate lower liquidity need 21 Liability Management 1 Yesteryears Low competition on seeking deposits Banks practiced asset management – allocate funds among cash assets, loans, and securities Now High competition on seeking deposits Banks practiced liability management – look for good lending opportunities and then search for the funds to finance these loans. it can seek money by: “buy” federal funds; issue negotiable CDs at whatever interest rate is required to attract funds; issue repurchase agreements or borrow Eurodollars, obtain funds through the commercial paper market. Asset management limited banks ability to profit from good lending opportunity because bank’s fund was limited Aggressive liability management allows banks to make profitable loans that they would otherwise have to turn down. 22 Liability Management 2 The Dark side of Liability Management Aggressive liability management can be dangerous, because a bank’s assets typically have longer maturities than its liabilities. If interest rates rise sharply, banks can suffer severe losses. Weaken the central bank’s ability to control aggregate expenditure because the bank can issue more liabilities (by borrowings) to fund surging load demand in periods when the economy is growing too fast 23 Capital Management Bank capital provides a financial cushion so that transitory adverse developments will not cause insolvency. Bank capital also protects bank managers and owners from their own mistakes and from various risks: default risk interest-rate risk (bank assets have longer maturity than liabilities) liquidity risk (risk that people will withdraw funds) political or country risk management risk. Predominant cause of bank insolvency is from bad loans 24 Capital Management 2 A higher bank capital ratio (capital/assets) implies a lower risk of insolvency, but also a lower rate of return Because higher capitals means more people taking claims of the same piece of pie 25 The Capital Management Tradeoff Earnings/Capital = Earnings/Total assets x assets/Capital Total The left-hand side of the expression is the rate of return on equity, or rate of return on capital The first expression on the right-hand side is the rate of return on total assets. The final expression is the equity multiplier: the amount of leverage that is applied to the rate of return on total assets. A high capital/assets ratio represents a low equity multiplier; a low capital/assets ratio implies a high equity multiplier. 26 Increase Capital Ratio A trade-off arises between short-run profitability and the risk of insolvency Indicating there must be an optimal ratio of capital to total assets In some cases, banks may need to increase capital ratio by Increase retained earnings by reducing dividend payments Issue new stocks Shrink the bank – lower its total assets by selling securities and reducing loan, using the proceeds to reduce bank borrowings or other liabilities 27