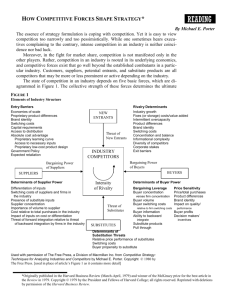

Porter*s Five Forces Analysis

advertisement

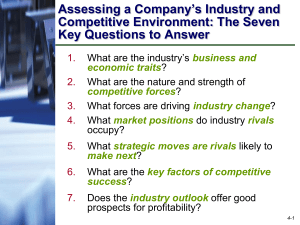

Porter’s Five Forces Analysis Finance- Asset Management Threat of Entry by New Competitors Barriers to Entry Capital Requirements Legal barriers. Prestige barriers. Hard to attract enough hundreds of clients to breakeven. High. Breakeven point requires tens to hundreds of millions of dollars assuming average industry fees. Low. Customer Loyalty Healthy. Firms’ return in the range of 30%. Industry Profitability Ease of Exit Efficient. Lack of infrastructure and capital equipment suggest ease of exit. High Threat of Substitute Propensity to Substitute Low. Increasing propensity to substitute to alternative funds. Low. Cost of Switching Perceived Product Differentiation Number of Substitutes Value of Substitute Moderate Few. Investment banks or insurance companies can provide the products that the baby boomers desire: managed risk and principal protection. Varying. Low Bargain Power of Suppliers Cost of Switching of Supplier N/A Impact of Input on Revenue N/A Presence of Substitute Inputs N/A Strength of Distribution System N/A. Ability to Forward Integrate N/A Supplier Concentration to Firm Concentration N/A N/A Bargain of Buyers Buyer Concentration to Firm Concentration Moderate. Buyers are becoming increasingly institutionalized. Information Available High. Internet, especially firms like Morningstar, has made information widely available. Buyer Price Sensitivity Moderate. Most asset management firms charge around the same. Differential Advantage of Products Moderate. Many fund proliferations however, broad generic products outperform these specialized products. Availability of Substitutes Low. Traditional banks, insurance companies, and investment banks are amongst the few substitutes. Buyer Volume Varying. Institutions can invest varying sums of money. Moderate Bargain Power of Buyers Rivalry Exit Barriers Low. Industry Concentration High. Big names still dominate a lot of the assets in industry. Product Differentiability High. Unfortunately, specialized products offer significantly less return than broad based products. Competitive Advantage Difficult to maintain. In the long run it is difficult to out perform market, especially taking into account of fees. Excellent managers are poached by competition. High Threat of Rivalry Conclusion • Despite the fairly competitive nature of the asset management industry, it remains fairly robust due to the high barriers to entry and relative lack of substitutes. The growing demand for asset management by changing demographics will suggest opportunities to profit. Entry into the fairly profitable industry will be the hardest challenge.