Title Insurance - Omaha1 Real Estate Investors Association

advertisement

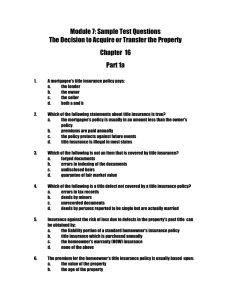

Why Title Insurance Presented by David Welte, Midwest Title Title and Title Insurance Defined • A title is the evidence, of right, that a person has to the ownership and possession of land • Title Insurance is indemnity insurance against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage liens Types of Title Insurance Policies • Owner’s Title Insurance – Basic – Expanded • Lender’s Title Insurance Owner’s Title Insurance (Basic and Expanded) • The owner's policy assures a purchaser that the title to the property is vested in that purchaser and that it is free from all defects, liens and encumbrances except those which are listed as exceptions in the policy or are excluded from the scope of the policy's coverage. It also covers losses and damages suffered if the title is unmarketable. • The policy also provides coverage for loss if there is no right of access to the land. Lender’s Title Insurance • The basic elements of insurance provided to the lender cover losses from the following matters: – The title to the property on which the mortgage is being made is either • Not in the mortgage loan borrower • Subject to defects, liens or encumbrances or • Unmarketable • There is no right of access to the land Lender’s Title Insurance • The lien created by the mortgage – is invalid or unenforceable – is not prior to any other lien existing on the property on the date the policy is written, or – is subject to mechanic's liens under certain circumstances When Does an Investor need a Title Company? • Because of the information disclosed in a title insurance commitment and a title search investors need a title company – At the time a potential investment property is discovered – At the time an investment property is under contract or placed in escrow, and – At the time of closing of an investment property The Title Search and Commitment • County Assessor’s Office – Parcel ID Number – Legal Description • County Treasurer’s Office – County Tax Amount – Special Assessments – Tax Sales • County Register of Deeds Office – – – – Chain of Title Deed of Trust/Mortgage Easements/Covenants/Restrictions State and Federal Tax Liens The Title Search and Commitment • County Court – Probate or Guardianship/Conservatorship • District Court – Judgments – Divorces/Alimony/Child Support • Federal Court – Bankruptcy – Federal Judgments Why does a real estate investor need a Title Company? • Two Reasons and Two Services – Title Insurance – Escrow Services Title Insurance To the Investor Purchasing Real Estate • Protection against serious financial loss due to a defect in the title to the property purchased. • Cover both claims arising out of title problems that could have been discovered in the public records, and those so-called "non-record" defects that could not be discovered in the record, even with the most complete search. • Not only protects the insured owner, but also their heirs for as long as they hold title to the property, and even after they sell by warranty deed. • Not only satisfy any valid claim made against the insured's title, but it will pay for the costs and legal expenses of defending against a title claim. Title Insurance to the Investor Selling Real Estate • An owner of real property whose interest is insured by an owner's title insurance policy has the assurance that the title will be marketable when selling the property • The title insurance policy protects the seller from financial damage if the seller's title is rejected by a prospective purchaser • When the seller conveys with "warranties" the seller is still protected if the buyer sues because of a breach of those warranties Escrow and Closing To the Investor • The final step in executing a real estate transaction in which a title company holds the money and the signed deed, and arranges for the transfer – seller can give up ownership of the property, and the – buyer can hand over the payment, without both parties having to be present at the same time – escrow ensures an orderly transaction, or if something goes wrong, an orderly termination of the agreement • The closing date is set during the negotiation phase, and is usually several weeks after the offer is formally accepted. On the closing date, the parties consummate the purchase contract, and ownership of the property is transferred to the buyer. Escrow and Closing To the Investor • Closing process summarized – The seller signs the deed over to the buyer and all other documents insuring clear title – The buyer or buyers lending institution delivers the funds for the balance owed on the purchase price – The seller receives a check or wire for the proceeds of the sale, less closing costs , taxes, liens and /or mortgages found and disclosed on the title commitment – A title company registers the new deed with the register of deeds office What does a Title Company do for its clients? • Provides – Protection – Security – Peace of Mind How much should a client expect to pay? • Title Insurance Rates are set by the Nebraska Department of Insurance – Generally split 50/50 • Settlement/Escrow/Closing Fee – 300.00/ escrow closing fee • Generally split 50/50 – 20.00 per express mail, courier, or wire – 175.00/ lender closing fee • Generally buyer Examples • American National Bank • Inheritance Tax • Omaha State Bank/Thunder Alley How should a client prepare for the Title Company to become part of their power team? Contact Information David Welte Midwest Title 10410 South 144th Street Omaha, NE 68138 • • • • Office Phone Number: 402-493-6200 Office Fax Number: 402-896-0466 Email Address: dwelte@midwesttitle-ne.com General email addresses: – closingdocs@midwesttitle-ne.com – title@midwesttitle-ne.com First Meeting • • • • Breakfast Lunch Dinner Coffee No preparation needed! Call me anytime.