2-in-one savings 4 education - Home | OMBD

advertisement

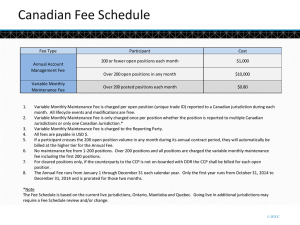

2-IN-ONE SAVINGS 4 EDUCATION Retail Mass Market Broker Distribution February 2014 KEY PRODUCT FEATURES Saving for tomorrow shouldn't stop you living today HOW THE 2-IN-ONE SAVINGS PRODUCT WORKS • It is a savings product you can use to save for your child’s education • The product is split into a Short Term Pocket and a Long Term Pocket. • The Short Term Pocket enables you to access your saved money when you need it and the Long Term Pocket enables you to achieve your savings objective. Your savings in the Long Term Pocket are invested in the Old Mutual Smoothed Bonus Fund, and your savings in the Short Term Pocket are invested in the Old Mutual Money Market Fund. LONG TERM POCKET Minimum term: 10 years Fund: Old Mutual Smoothed Bonus Fund Growth: Annual bonuses 1 2-IN-ONE SAVINGS SHORT TERM POCKET Minimum term: 12 contributions Fund: Old Mutual Money Market Fund Growth: Monthly interest HOW THE 2-IN-ONE SAVINGS PRODUCT WORKS For whom is this product suitable? • This product is designed for customers who are able to commit to savings of at least R150 per month for 10 years or longer, but also require access to some money during this time. What are the benefits of this product? LONG TERM POCKET • The main benefit is the accumulated value of your savings, which will be available in full at the end of the term of your product, on your death, or on disability. SHORT TERM POCKET • The main benefit is the accumulated value of your savings, which will be available any time you need it. However, as your savings are invested in a Money Market Unit Trust, which is not like a bank account, it may take up to 10 days to clear and show in your bank account. 2 2-IN-ONE SAVINGS HOW THE 2-IN-ONE SAVINGS PRODUCT WORKS Monthly contributions are split between the two pockets • Customers have a choice of the total monthly contribution, but how it is split into the two pockets is determined automatically. Below are examples of how Old Mutual splits each monthly contribution: 3 2-IN-ONE SAVINGS Monthly Contribution Long Term Pocket Short Term Pocket R150.00 R130.00 R20.00 R200.00 R130.00 R70.00 R250.00 R162.50 R87.50 R300.00 R195.00 R105.00 R350.00 R227.50 R122.50 HOW CHARGES ARE DEDUCTED Long Term Pocket Short Term Pocket Regular premium fee 15% of long term premium portion + R10.00* No fee Investment & administration fee 1.25% per year No fee Guarantee fee 0.25% per year No fee Fund management fee 0.25% per year 0.57% per year Termination fee R300* + Reducing fee** R155 No fee Termination fee from paid-up No fee * Fees for 2014. Fees are reviewable annually ** Reducing fee depends on how long the product has been active What are these charges for? Deducted from long term premiums • Regular premium fee: for advice, issuing the product, and ongoing servicing. This is deducted from your long term premiums paid each month. 4 2-IN-ONE SAVINGS HOW CHARGES ARE DEDUCTED Deducted from long term investment growth • Investment & administration fee: for administration and maintenance of the product. • Guarantee fee: for providing the guaranteed part of your payout in the Long Term Pocket • Fund management fees: for managing the Smoothed Bonus Fund‘s investments. Deducted from Long Term Pocket • Termination fee (Part Withdrawal, Surrender and Paid-up): Administration fee plus a reducing fee. The reducing fee is only charged if you take money out of your Long Term Pocket (under certain legislated conditions), or you completely stop paying contributions within the first half of your product's term. SHORT TERM POCKET • Fund management fees: for managing the Money Market Fund's investments. This is deducted from the monthly interest. • Withdrawal fee: The first two withdrawals from your Short Term Pocket are free of charge each calendar year. Thereafter a R50 fee is charged per withdrawal. 5 2-IN-ONE SAVINGS WHAT ARE THE TAX IMPLICATIONS? LONG TERM POCKET • Benefits paid out to you from the Long Term Pocket are not taxed. Old Mutual pays the various taxes on investment growth during the term of your product. SHORT TERM POCKET • You will owe income tax on the total interest you earn from all your investments, including the interest added into your Short Term Pocket, if it is above a certain level specified by SARS. 6 2-IN-ONE SAVINGS PRODUCT FEATURES AND BENEFITS Minimum Premium: R150.00 split to: Long Term Pocket: R130 Short Term Pocket: R20 With Premium Waiver Benefit: R175.00 split to: Long Term Pocket: R130 + 10% Savings Protection = R143 Short Term Pocket: R20 What is a Premium Waiver Option? If you die or become disabled in the first 10 years of taking out your product, Old Mutual will pay an amount into your Long Term Pocket. This amount will be equal to the current value of the remaining long term premiums (after regular premium fees) up to the first 10 years of your product. If you die or become disabled due to natural causes in the first 6 months, this amount is not payable. This option needs to be chosen at the time of application and increases your monthly contribution to the Long Term Pocket by 10%. A premium waiver charge of 10% will be added to your contribution for the Long Term Pocket if you select the Premium Waiver Option. The 10% increase will be used as a waiver charge for the first 10 years and will not be invested in the Smoothed Bonus Fund. After 10 years, the full Long Term Premium will be invested in the Smoothed Bonus Fund (10% included). 7 2-IN-ONE SAVINGS PRODUCT FEATURES AND BENEFITS Minimum Term: Long Term Pocket: 10 years Short Term Pocket: 12 contributions Investment Fund: Long Term Pocket: Smooth Bonus Fund Short Term Pocket: Money Market Fund Growth: Long Term Pocket: Bonuses declared annually Short Term Pocket: Interest added at end of each month Benefit available: Long Term Pocket: Available in full at the end of the term, on death, or on disability Short Term Pocket: Benefit is the value of your savings, which will be available any time you need it Premium Holiday Benefit: 8 2-IN-ONE SAVINGS The Premium Holiday allows for up to six premiums to be skipped, during the term of the policy. This benefit is available again to the client, on payment of the skipped premiums PRODUCT FEATURES AND BENEFITS Contribution Increases: Contributions increase in July each year, as long as it has been active for at least 6 months. The increase is determined by Old Mutual and will be related to the level of inflation. Customers can choose to decline the increase Savings Boosters: These are amounts added by Old Mutual to your Long Term Pocket to motivate you to be disciplined towards your long term savings, and to keep paying your premiums until maturity. After 24 premiums 60 premiums 110 premiums Part Withdrawals: 9 2-IN-ONE SAVINGS Savings Booster added is an amount equal to: 2 Long Term premiums 3 Long Term premiums 8 Long Term premiums Long Term Pocket: One part-withdrawal up to 100% will be available within the first 5 years of the policy term, and then at 5-yearly intervals thereafter. The period between any part-withdrawals must also be at least 5 years Short Term Pocket: Any withdrawal amount, up to the sum of all Short Term contributions received 24 HOUR FAMILY SUPPORT SERVICES Access to the following Family Support Services* from independent service providers: Health support*: Telephone access to health advisers for assistance with health queries Trauma, assault and HIV treatment*: Assistance and treatment following assault (e.g. rape, hijacking, child abuse), accidental exposure to HIV or other kinds of trauma Emergency medical response*: Advice, emergency treatment and transportation to an appropriate medical facility Legal support*: Free telephone advice and assistance on legal matters, help with legal documents Important note: *Family Support Services - Certain terms and conditions apply to the facilitation of this access. For a copy of these, call 0860 00 1919. Old Mutual facilitates access to independent Family Support Service providers. Such access is not offered as a benefit under your insurance policy and may be varied or cancelled at any time. The service providers provide services directly to you on terms agreed between you and the service providers. Old Mutual does not accept any liability arising from the services rendered by the service providers. 10 2-IN-ONE SAVINGS