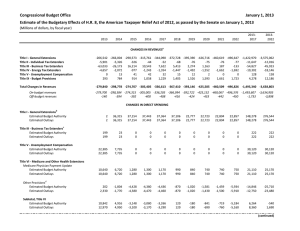

REVENUES, OUTLAYS, & DEBT OF THE FEDERAL

advertisement

SESSION 13: REVENUES, OUTLAYS, & DEBT OF THE FEDERAL GOVERNMENT AND GOVERNMENT SPENDING & TAXES Talking Points Revenue, Outlays, & Debt of the Federal Government 1. The typical sources of revenue for the federal government are personal income taxes, Social Security taxes, Medicare taxes, unemployment taxes, corporate income taxes, and other taxes (custom duties, excise taxes, tariffs, and so on), and borrowing. To see the previous year’s revenue, go to http://www.usgovernmentrevenue.com/breakdown. 2. Typically, the main spending (outlays) of the federal government are Social Security and Medicare payments, national defense and foreign aid, social programs, physical/ human/community development, net interest on debt, law enforcement, and general government. To see the previous year’s spending, go to http://www.usfederalbudget.us/federal_budget_actual. Session 13: Talking Points, Cont’d Revenue, Outlays, & Debt of the Federal Government 3. If government revenue is greater than its outlays, the government has a budget surplus. 4. If government revenue is less than its outlays, the government has a budget deficit. 5. If the government has a deficit, it must borrow funds (i.e., increase its debt). 6. The debt of the federal government (public debt) is the total amount owed by the federal government as a result of its current and past borrowing. 7. The main historical causes for accumulated public debt have been a. wars, b. unanticipated downturns in the economy (recessions), c. tax cuts with no offsetting cuts in outlays, and d. increases in outlays with no offsetting increases in revenues Session 13: Talking Points, Cont’d Revenue, Outlays, & Debt of the Federal Government 8. Foreign investors hold just less than one-third of U.S. public debt, which represents a loss of wealth as interest payments leave the country. 9. Private debt of households, corporations, and small businesses is much larger than the public debt of the federal government. 10. For every debt in an economy, someone else has a credit—an IOU—a valuable asset. 11. If a borrower defaults—that is, is unable to pay their loan—the lender loses wealth (the IOU becomes worthless). Session 13: Talking Points, Cont’d Government Spending & Taxes 1. The tax revenues received by the government from a tax are equal to the average tax rate times the tax base, which is typically income. 2. With a progressive tax, the average tax rate rises as the tax base rises—that is, those earning higher income pay a higher percentage of their income in taxes. 3. With a regressive tax, the average tax rate falls as the tax base rises—that is, those earning higher incomes pay a lower percentage of their income in taxes. 4. With a proportional (flat) tax, the average tax rate is the same for all levels of the tax base—that is, everyone pays the same percentage of their income in taxes. 5. Federal personal income taxes are progressive, rising to a top rate of 35%. Session 13: Talking Points, Cont’d Government Spending & Taxes 6. Federal corporate income taxes are proportional (a flat rate of 35% on net income), as is the Medicare tax (a flat rate of 1.45% on earned income, paid by both the employee and employer). 7. The Social Security tax is proportional (a flat rate of 6.2%) up to a capped income level ($110,100 in 2012), but is regressive at income levels above the cap because income above the cap is not taxed. 8. When tax rates are increased, consumers have less disposable income, so consumption spending (C) tends to decrease. 9. When tax rates are decreased, consumers have more disposable income, so consumption spending (C) tends to increase. Visual 13A: Types of Taxes Visual 13B: A Brief History of U.S. Public Debt