Marketing_Sem1_Group11_Kellogs

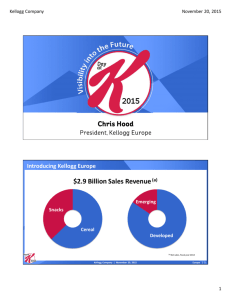

advertisement

Kellogg’s • • • • • • Founded by Will Keith Kellogg in Battle Creek, Michigan, in 1906 Has manufacturing plants in 18 countries Sells in more than 180 countries Offers more than 50 different products worldwide Total revenue $ 12.4 billion in 2010 World’s leading producer of cereal and convenience foods First coming in India • • • • • • Launched in September 1994 High profile launch Excited media activity Invested more than $30 million in India Completely untapped market potential Introduction of new trend with nutritional value in breakfast A Failed Launch • • • • • 25% decline in countrywide sales since March 1995 Consumers reportedly rejected the taste Expensive product Wrong evaluation of projection in market demand Less than 5% buyers were regular customers Reason of failure • • • • • Ignorance of cultural aspects Lack of understanding of Indian consumer behavior and habits Premium pricing policy Low/scattered availability Flawed positioning The Re-Launch • Launch two of its highly successful brands – – Chocos (September 1996) – Frosties (April 1997) • Also launched Mazaa Series in August 1998 The Second Coming • • • • Refocused on ‘Fun-&-taste’ Positioning. Reduction in Price - brought down price per kg by 20%. Different Sku’s – 500 gm family pack, Rs.10 pack of each variant. Gave away free gifts with packs of chocos. eg. Glowing stickers with Rs. 10 pack of chocos. 1996 1997 Chocos Frosties Chocolate flavoured scoops Sugar frosting on individual flakes Fun n Health, Sweet, Kids Centric Products 1998 2000 2008 MAZZA Iron Shakti K plus Mango A crunchy, Elaichi almond shaped corn breakfast Coconut cereals in three flavors namely Rose Mazza was positioned as a tasty , nutritional breakfast cereals for families. Offered a new dimension to health with iron fortified cornflakes Low-fat breakfast option, targeted especially to women Specifically targeted women, and their wish to loose weight Again focussed on the healthily eating but targeting mainly kids The Marketing Mix Product Price • Indianised Taste • Launched much sweeter ‘Chocos’ and ‘Frosties’ brands & Mazaa Series with 3 flavours; Mango, Elaichi, Coconut Kesar • Launched Special K to target Women • Price per kg by 20% • 60 gms sku, apart from 500 gms sku • Glossy cardboard packaging was replaced by pouches which helped in reducing the price The Marketing Mix Place Promotion • Unlike Metropolitan approach of 1995, used nationalized approach • Increased its stores by 33% from 30,000 in 1995 to 40,000 in 1998 • Positioned itself as ‘Fun and Taste’ Cereals • Majorly targeted kids with help of mascots • Launched Chocos Biscuit to improve brand awareness and brand recognition for Kellogg’s Current Market Scenario • Kellogg’s has more than 65% percent of market share of Rs. 600+ crore morning cereals market, where the current market will more than double in next 4 years CHI-SQUARE TEST • • • • Hypothesis: H0: Consumer wants all the benefits equally by consumption of cereal food. H1: Consumer do not want all the benefits equally by consumption of cereal food . This means all benefits are not equally asked for . In particular health and fitness is the most preferred one. SUGGESTIONS FROM NON- USERS • If portrayed as more filling breakfast and Indianised, Kellogg can substantially increase its consumer base in India. SUGGESTIONS FROM USERS Users clearly pointed out that taste is the most important driver to purchase cereals after nutritional value ADVERTS: SOLE DRIVER FOR THE AWARENESS OF A BRAND INSIGHTS FROM RETAILERS • The retailers stocked many brand. • If the retailer had no stocks of Kellogg’s & Chocos he suggested some other brand SWOT Strength Weakness • • • • Kellogg’s flexibility and adaptability towards consumer needs Customization of products History of changing food habits globally • • • Opportunity • • • • Introduction of new trend with nutritional value in breakfast Changing work-life demanding processed foods Less competition Scope for entering untapped markets If even they liked taste, the product was too expensive initially failed to make a lasting impression Product not adopted to the Indian taste or Indian traditional food habit Wrong evaluation of projection in market demand. Threats • • • • • • Cultural factors and eating habits Population not used to processed foods Easy availability of traditional breakfast Blinded by the population figures of India Low awareness about processed foods and calorie requirements Price sensitive customers Lessons and Conclusion • The Habit Barrier • The Price Barrier • Advertising plays an important role Thank You