Module 26 - The Federal Reserve System: History and Structure

advertisement

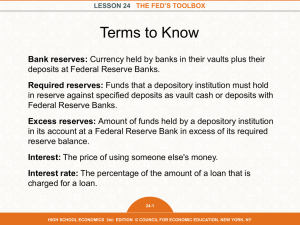

AP Economics Mr. Bernstein Module 26: The Federal Reserve System: History and Structure February 19, 2015 AP Economics Mr. Bernstein Federal Reserve System: History and Structure • Objectives - Understand each of the following: • The history of the Federal Reserve System • The structure of the Federal Reserve System • How the Federal Reserve System has responded to major crises 2 AP Economics Mr. Bernstein The Multiplier: An Informal Introduction • Central Banks oversee and regulate the banking system, control the monetary base • Our current Central Bank is the result of legislation following periods of financial crisis • Laws are designed to protect borrowers and lenders and minimize risks of panic • Federal Reserve System was Created in 1913 3 AP Economics Mr. Bernstein Crisis in American Banking at Turn of 20th Century • Lack of trust could spark “runs” on banks and deplete their reserves, becoming a self-fulfilling prophecy • The Panic of 1907 led to creation of Fed • Centralized control of reserves • Required all deposit-accepting institutions to maintain adequate reserves and open books for inspection by regulators • Monopoly on ability to print money 4 AP Economics Mr. Bernstein Structure of the Federal Reserve System • 14-person Board of Governors and 12 regional Federal Reserve Banks 5 AP Economics Mr. Bernstein Current Chairman of the Federal Reserve System Janet Yellen 6 AP Economics Mr. Bernstein Structure of the Federal Reserve System • 14-person Board of Governors are appointed by the President and approved by the Senate • Serve 14-year terms to reduce political pressure • Chairman serves 4-year terms • Federal Reserve Bank of New York conducts open market operations • FOMC (Federal Open Market Committee) makes decisions about monetary policy; includes Board of Governors plus 5 regional bank presidents 7 AP Economics Mr. Bernstein Effectiveness of the Federal Reserve System • Despite Fed, some bank runs and the Great Depression happened • Further laws were created in 1930s and 40s • Notable was the Glass-Steagall Act of 1932, separating banks from other financial activities • Beginning in the 1980s, some of these safeguards were rolled back • Use of leverage, new financial instruments often beyond Fed control and contribute to crises 8 AP Economics Mr. Bernstein Financial Crisis of 2008: Factors Beyond Fed Control • Government policies encouraging bank lending in disadvantaged neighborhoods • Mortgage bankers incentivized to close deals • ARM mortgages offering low payments for 2-5 years only • Low down payments allowing home buyers high leverage • Fraud by both mortgage bankers and home buyers • Low interest rates encouraging investors to purchase bundles of bad mortgages in complicated securities to gain yield • Bond rating agencies incentivized to allow gaming of these complicated securities to achieve deceptively high ratings • Wall Street compensation structures incentivizing executives to book short-term profits and take massive longer-term risks • Ended badly when housing price bubble began to roll over 9 AP Economics Mr. Bernstein Financial Crisis of 2008: Fed Response • Signal to markets intent to assist, reduce uncertainty • Fed Balance Sheet used to protect banks and near-money funds from runs • Bear Stearns, Lehman Brothers, and moral hazard • Still fighting hangover 10