What We Do - The National Chicken Council

advertisement

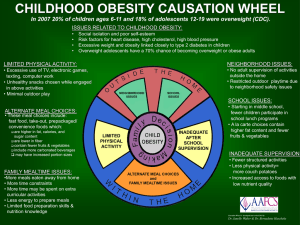

Understanding How Consumer Trends Shape Your Market Culinary Tides, Inc. Suzy Badaracco, President Toxicologist, Chef, Dietitian Who We Are…What We Do • Who we are: – Private Trends Forecasting Think Tank – Staff = 7 – 2 Satellite offices – Washington DC, Tokyo – Forecast work is created through military intelligence techniques, Chaos Theory – Background: BS Criminalistics, Assoc. Culinary Arts, MS Nutrition • Toxicologist, Chef, Registered Dietitian • What we do: – Partner long term w/ food industry clients – side along Think Tank – Look for patterns in Chaos to aid future strategy – Produce custom monthly & quarterly reports for clients • Government, Technology, Adversaries / Allies, Competitors, Research, Flavor & Cuisine - tracked and forecasted specific to client • Quarterly reports include updated 12-18 month forecast for each area Chaos, Blips, Shadows, Trends • Chaos – Birth • Blips • Shadows • Trends – Tracking Today’s Area of Focus • Consumers – Sentiment vs. Behavior, Drivers, Recovery Behavior • Health Horizons – Generational Concerns – Health Drivers • Flavor Horizons – Meal Patterns, Settings, Preparations, Flavor Landscape – Couriers, Ricochets, Rock Stars & Rising Stars, Orphan • How to Play on a New Playground – Headwinds & Tailwinds, Forecast, Suggestions Consumers The Generations: Age The Depression Era • Born: 1912-1921 • Coming of Age: 1930-1939 • Age in 2013: 92 to 101 • Current Population: 11-12 million (and declining rapidly) World War II • Born: 1922 to 1927 • Coming of Age: 1940-1945 • Age in 2013: 86-91 • Current Population: 11 million (in quickening decline) Post-War Cohort • Born: 1928-1945 • Coming of Age: 1946-1963 • Age in 2013: 68 to 85 • Current Population: 41 million (declining) The Generations: Age Boomers I or The Baby Boomers • Born: 1946-1954 • Coming of Age: 1963-1972 • Age in 2013: 59-67 • Current Population: 33 million Boomers II or Generation Jones • Born: 1955-1965 • Coming of Age: 1973-1983 • Age in 2013: 48 to 58 • Current Population: 49 million Generation X • Born: 1966-1976 • Coming of Age: 1988-1994 • Age in 2013: 37 to 47 • Current Population: 41 million Generation Y, Echo Boomers or Millennials • Born: 1977-1994 • Coming of Age: 1998-2006 • Age in 2013: 19 to 36 • Current Population: 71 million Generation Z • Born: 1995-2012 • Coming of Age: 2013-2020 • Age in 2013: 1-18 • Current Population: 23 million and growing rapidly The Generations: Personality uncertainty comfort security familiarity discomfort Cold War known activities, environments Post War focus on self-help Boomers I Boomers II narcissism largely optimistic economic struggles “I’m out for me” skepticism -media /institutions good economic opportunities The Generations: Personality lowest voting participation “what’s in it for me” pragmatism children of divorce caution “lost” generation Gen X concern over family technology wise price driven Gen Z Gen Y not brand loyal not sustainability driven involved in family purchases skepticism best educated (++) “latchkey” kids flexible very brand loyal sustainability driven style conscious more ethnically diverse eat according to social cues immune to traditional marketing eat according to hunger Influenced by peers, marketing, not parents Consumer Sentiment vs. Behavior *Shows recession vs. recovery behavior NRA- restaurant performance index h NRA- restaurant performance index h Consumer + Black Boxrestaurant $ h Commerce Dept consumer confidence h Conference Board – consumer confidence h Consumer - NRF- retail $ i NRN-Millerpulsesame store $ h Black Box –same store $ h NRN-Millerpulsesame store $ h Black Box –willingness to spend h Census Bureau- restaurant sales h Reuters – Consumer confidence i Black Box – restaurant traffic i Consumer Reports- retail $ i 3/13 4/13 Consumer Sentiment vs. Behavior *Shows recession vs. recovery behavior Conference Board – present situation index h Black Box –same store $ h Conference Board – sentiment index h Commerce Dept consumer spending h Conference Board – expectations index h Consumer - Consumer + Conference Board consumer confidence h 5/13 NRN-Millerpulsesame store $ h Saying One Thing…Doing Another Conscious Lie • Mis-represent what they paid for item • Buy something against partner’s / parents wishes • To hide embarrassment • Anticipate correct answer (surveys), leading q’s Disconnect • • • • Ignorance Fear Mis-informed Sub-consciously influenced • Denial • Cherry picked data *American Express research: Generation Y is more secretive and belligerent about money than baby boomers Consumer Influencers • • Texas A&M Edelman Berland, 8095 Live • Mintel • Analytic Partners • SocialVibe • Industry Intelligence • Cone Communications • FGI Research • Children between the ages of 3 and 8 - advertisements were more influential than parents • 80% of Millennials want brands to entertain them, with 40% wanting brands to let them influence products via co-creation • 90% of adults ages 25 to 34 prepared ethnic foods at home in the last month, 91% of adults with children under 18 made ethnic food • About half of 18 and 44 year olds base brand loyalty on brand experience - video/online gaming, social media and third-party expert information through blogs and articles • 70% of consumers actively engaged in social media have made a purchase as a result of being connected to a brand online • 86% of US shoppers consider sustainability when buying groceries • 91% of consumers say they would switch brands to one that supports a cause, and 90% say they would boycott if they learned of irresponsible behavior • 36% of consumers say Meatless Monday campaign influenced their decision to cut back on meat and 47% ate more whole grains Consumer Apathy / Disconnect • InSites Consulting • RAND Corporation • NPD • Accenture • NPD • NPD • Just 4% of all Americans aged 15 to 25 thinks that a brand page on Facebook is a credible source of information about the product • Teen snack purchases were influenced by taxes, subsidies and the presence of peers when buying snacks • Consumers are looking for products made with less fats/oils, sodium and sweeteners, however, this has little influence on a diner’s choice of restaurant and menu item • 20% of consumers switched the companies they typically buy from, an increase of 5% over 2011. However, 85% said companies could have done something to prevent them from switching • 80% of US adults describe themselves as “extremely healthy” or “very healthy”, but only 20% have what is considered to be a “most healthy" diet • 52% of Americans said figuring out their taxes is easier than knowing how to eat healthy, 23% of obese and 44% of overweight consumers say they are not trying to lose weight Health Horizons Generational Health Concerns Cognitive Function Cognitive Function (Development) Health Issue Diabetes Associated Elements Generation Vision (Focus, Mood, Stress) Cognitive Function (Focus, Memory, Mood) Digestion Obesity Immunity Digestion Obesity Digestion Obesity Vision Obesity Cancer Diabetes Digestion Immunity Heart Health Muscle / Joint Cognitive Function (Focus, Memory, Mood) Gen Z Gen X Gen Y Boomers + (Millennials, Echo Boomers, Boomerangers) Omega 3’s Sugar Fiber Pre, Probiotics Sat, Trans Fat Breakfast Caffeine Fiber Pre, Probiotics Sat, Trans Fat Breakfast Sat, Trans Fat Fiber Pre, Probiotics Caffeine Breakfast Caffeine Salt Sat, Trans Fat Fiber Pre, Probiotics Omega 3’s Vit D, Calcium, Mg Breakfast Health Trends: Drivers Digestion Vision Digestion Muscle Fiber / Grains Seniors Joint / Bone Calories Mood h Flexitarian Cholesterol Salt, Sugar, Fat Kids CVD Satiety Health Organic / Natural Trust Free From Sustainability Menu Labeling Apps Unprocessed Simplify Benefit? Health Claims Convenience Naturally Healthy Food Safety Energy Acrylamide Control Prevention Obesity Diabetes Seasonal / Local Cognitive Function Focus Relaxation Development / Decline Obesity Stress Satiety Sleep Memory Depression Snacking Kids Dining Out Portion Control Flavor Horizons Health Couriers *Couriers shuttle trends in from neighboring industries / focuses Kids Focus Gluten free backlash Pure, Simple i Salt, Fat, Sugar Health Couriers Healthy Indulgences Botanicals Flavorful Health Mindful Snacks Double sided menus Meal Patterns Kids Meal Evolution All Day Breakfast American Regionalism Daypart Disintegration Seasonal Meal Types Vibrant Perpetual Snacking Fast Casual Copycats Farm Branded Ingredients Family Friendly Fine Dining Meal Settings & Preparation Translation Inspiration Factor Settings *Approachable, Family Friendly *Vibrant, Inspired, Risk Taking *Authentic, Rustic Preparation *Scratch Prep, Wildcrafting *Adventure, Discovery *Portion Size i, Portion Options h *Seasonal, Regional, Authentic *Fast Casual, Approachable Fine Dining *Minimally Processed *Rock Star Butchers, Millers, Bar Chefs *Meatless *Communal Tables, Shared Spaces *Street Food, Underground Restaurants *Pop-ups, Speakeasies *Open Flame, Foraged *House Smoked, Herb Infused *Pickled, Fermented, Peppered Wine & Travel Trends *Couriers - shuttle trends in from neighboring industries / focuses NZ Spain Africa Italy Happy Hours h Speak-Easies Great Barrier Reef Flights Northern Lts Sports Chile Space Settings Argentina Regions Rotating/Guest Bartender France Cocktails Sparkling House blends Petit Verdot Muscato Experiential Scandinavia Philippines Sweet Red Nepal Asia Vouvray Burma Arctic Travel Pacific South America Guatemala Peru Norway Antarctica Congo Sudan Middle East Brazil Sweden Tasmania Caribbean Galapagos Cuba Ethiopia Africa Central America Panama Earthing Themed Iceland Cambodia Belize Leap/Bucket List Spa Wine Styles Multi-Destination Argentina Jordan Israel Lebanon Oman Food & Flavor Landscape 2013 Familiar / Historical Macro Seasoning *Horseradish *Zip code honey *Citrus *Smoke *Chilies *Pickling *World Salt *Chutney Experimental Personality Cage-Dancers *Huacatay *Nordic *Flowers *Ashes *Flavored Heat *Geranium leaf *Sour/Fermented *Miso *Curry *Hyssop Fruit/Veg Dairy Protein Grain Beverage *Culinary *Grapefruit *Oats *Greek Yogurt *Wild Game Cocktails *Coconut *Sardines *Popcorn *Micro-Distilleries *Farmstead *Citrus *Quinoa *Oysters *Coconut Cheese *Berries *French Pastry *Lemonade *Artisan *Offal *Pumpkin soft serve *Lentils *Ancient Tea *Beans *Roots *Moonshine *Ricotta *Almond Butter *Multi-grain *Chilies *Goat *Hand Crafted Tortillas *Kale *Eggs Cheese Soda *Waffles Sensuals *Muntries *White Strawberries *Hibiscus *Finger Limes Tree Huggers *Lebanese Yogurt Bi-Polars *Goat, Lamb Bellies *Bone Marrow *Paneer *Blood *Skin *Kimchee *Plant Based *Fin to Tail *Sunchokes Dairy *Insects *Wild Greens *Burrata *Lethal *Mizuna *Savory ice *Invasivors *Seaweed cream *Salumi Interpreters *Chia *Sprouted *Black rice *Freekah *Global Noodles *Farro *Grits *Arepas Type A *Barrel Aged Cocktail *Kombucha *Bubbles *Vietnamese Coffee *Dessert Cocktail *Sipping Vinegar *Kefir *Agua Fresca Flavor & Cuisines – Rock / Rising Stars • Rock Stars • Rising Stars • Soul Food • Asia – Korea, Vietnam • Central America –Regional Mexico • South America – Peru • Middle East • Africa – Egypt, Morocco, S. Africa, Kenya • Caribbean, Pacific- Cuba, Fiji, Tasmania • Asia – Nepal, Cambodia, Philippines • Central America –Nicaragua, Guatemala, Belize • South America- Ecuador • Arctic – Denmark, Scandinavia, Norway Pathways: USA – Regional, Regional Specialty Foreign Familiar (think Mexican) – Regional, Regional Comfort Nuevo Foreign (think Middle East) – National, National Comfort Other Flavor Factions & Their Parentage • Central America – Fusion birth, Parents = Travel & So. American flavor trends – Costa Rica, Panama, Guatemala, Nicaragua, El Salvador, Belize, Honduras • Asian Shift – Courier birth, Parent = Travel – Shift away from Thai, Japanese, Korean & towards Malaysia, Laos, Cambodia, Nepal – Shift due to rise in consumer confidence, risk taking, adventure seeking • Caribbean & Pacific – Courier birth, Parent = Economic recovery translated to travel shifts – Cuba, Bora Bora, New Zealand, Tasmania, Fiji, French Polynesia – Travel here signals luxury, time h, $$, playfulness • Arctic – Fusion birth, Parents = Travel, Economic Recovery – Cross ties Arctic & EU – Antarctica, Nepal, Lapland, Iceland, Norway, Scandinavia, Finland, Netherlands, Ukraine – Travel here signals solitude, bravery, $$, fearlessness, curiosity, exploration Nordic: 1/11-3/13 Wine Ind. Packaging Bakery Food Mnft./RCA/IFT/ASTA *Birth Family / Quick Serve Restaurants Travel Ind. Hi-End Restaurant/ Celebrity Chef Universities Diet Ind. Bars/Cocktails Governments Industry Mags Hollywood TV/News Mags Book Publishers Consumer Mags Cosmetics / Beauty Grocery Pharmaceutical Consumer AMA AACC ADA Biotech How to Play on a Changing Playground Consumer Drivers - Recovery Recession Rejection Portion Options Wellness=Quality Cost / Value Co-exist Resilience Brands=Value Deal Chic Men Evolve Kids Optimism Mobile Relationships Economy Pure Risk Taking Health Snacking Family Meals Simplicity Motivation FOP Playfulness Drivers Legacy Authenticity Value Control, Safety Escapism Reassurance Sustainability Invigorating Indigenous Accountability Never Eat Alone Brands Animal Rights Stability Seasonal GMO Re-commerce Green Verification Affordable Green Red Herrings Red Herring Re-Focus • • • • • • • • • • Diabetes (low GI) Brands make comeback, Brands = Value Whole food, Nutrient density, Pure Rock star butchers, Bar chefs, Farmers Global Comfort, Playfulness, Adventure, Risk Butcher, Baker, Agri, Renegade, YouTube Chef Convenience Trade off Recession Rejection, Resilience, Value (not $) Global, Seasonal Gluten free Private Label Functional Food Rock star chefs Comfort Food “Foodies” Budget Trade down Frugality Local Consumer Behavior: Recovery Forecast Factor Food & Flavor •Efficiency •Value •Ease •Worth •Educate •Explore Time i Income h •Return to restaurants •Coupon use i •Convenience trumps budget •Value trumps budget Inspiration Spending Translation Cause Priorities •Brands rebound •Travel abroad h •Green spending h •Organic rebounds Fear i •Desserts in spotlight •Exotic, experimental trumps comfort •Luxury, Indulgence rebound •Playfulness, risk returns •Wine varietals, •Trade off trumps trade down regions h Forecast: 12-18 months Convenience Store new competition for Grocery, QSR, Fast Casual Restaurant performance, consumer confidence continue upward swing Breakfast is mealtime to watch for signals of economic recovery – Breakfast traffic h = sign that economy h Vegetarian / Flexitarian #s will be linked directly to sustainability, obesity – Sustainability & Obesity h = expect Veg / Flex h Flavors / cuisines- more extreme, adventurous items as recovery unfolds Wines will cross borders to unfamiliar regions, varietals Beverages regionalize Vegetable/seasonings demonstrate consumer experimentation vs. caution Beverage, meat, dessert categories act as barometers for consumer mood – Cocktails, craft beer, wine $ h, desserts h, insect eating = recovery behavior – Cheap domestic beer, wine $ i, cocktails i, desserts i, meatloaf = recession behavior Suggestions Know the birth and lifecycle of a trend prior to deciding to enter so you can foretell how to navigate it Neither love nor hate a trend – emotions will fog the trend’s true pattern and you may be blindsided when it shifts Spend more time researching a trend’s personality and trajectory than worrying about what your competitors are doing – after all, they may be idiots Thank You! Culinary Tides, Inc. Suzy Badaracco President www.culinarytides.com sbadaracco@culinarytides.com https://twitter.com/sbadaracco (503) 880-4682