Howard Energy Partners Overview

advertisement

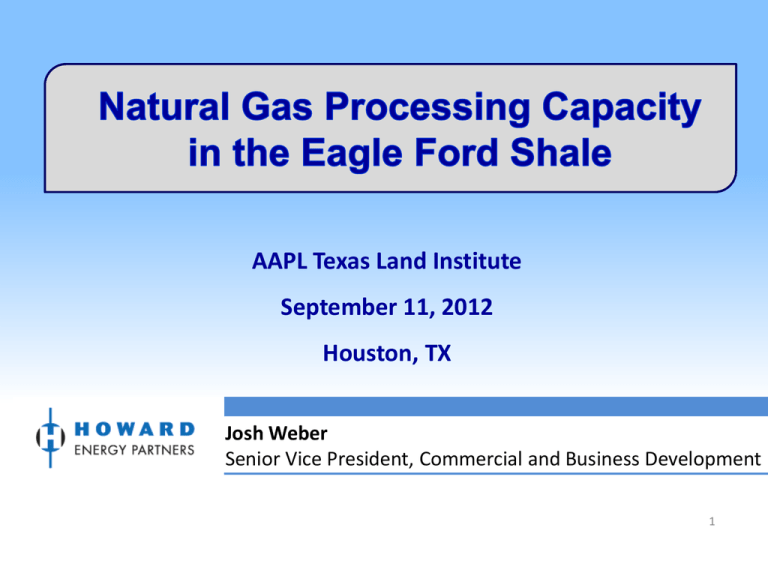

AAPL Texas Land Institute September 11, 2012 Houston, TX Josh Weber Senior Vice President, Commercial and Business Development 1 Forward-Looking Statement Statements contained in this presentation that include company expectations or predictions should be considered forward-looking statements. It is important to note that the actual results of company earnings could differ materially from those projected in such forward-looking statements. 2 Agenda • • • • • • Howard Energy Partners overview Location and timing of capacity additions Selecting optimal plant locations Efficiencies and economics of gas processing Reducing lead time to plant in-service Potential royalty considerations 3 Howard Energy Partners Overview Howard Midstream Energy Partners, LLC (“HEP”) is a private midstream company with operations primarily focused in the Eagle Ford Shale Founders Mike Howard (Former President of Midstream for Energy Transfer Partners) Brad Bynum (Former CFO of Hall-Houston Exploration Partners) Company Strategy Customer driven, asset oriented solutions to gathering and processing needs (engineering, construction, ownership and operations) Organic growth projects supplemented with strategic acquisitions Top-tier management and technical capabilities Long-term focus Assets Started operations June 2011 concurrent with the acquisition of two private companies - Texas Pipeline (250 miles of rich gathering pipeline) - Bottom Line Services (midstream energy services) Constructed 30 mile rich header in Dimmit County and put into service October 2011 Completed acquisition of Meritage Midstream’s Eagle Ford and Cuervo Creek gathering systems in April 2012 (170 miles of rich and lean gathering pipeline) 4 Howard Energy Partners Asset Map 5 Existing Natural Gas Processing Capacity 6 Where Will New Infrastructure Be Available? (New and Planned Processing Plants in Bold) 7 How have plants developed relative to production? Eagle Ford benefits by having existing infrastructure 2008 2009 2010 2011 2012 8 How have plants developed relative to production? Activity ramps up during 2010 and capacity additions planned 2008 2009 2010 2011 2012 9 How have plants developed relative to production? Significant expansion occurs in 2012 and beyond 2008 2009 2010 2011 2012 10 Selecting optimal plant locations Proximity to: - Producing Area or P/L Infrastructure - Liquids takeaway (P/L, Trucking, Injection Stations) - Gas Residue P/L Infrastructure Expansion of existing plants should be explored 11 How much total capacity is being added? New and Planned Processing Plants Plant Name Announced Capacity (MMcf/d) 300 Estimated Startup Owner/Operator Yoakum Plant Phase 2 2012 Enterprise Chisholm Plant 2012 ETC 120 Woodsboro Plant 2012 Southcross Energy 200 Silver Oak Plant 2012 Teak Midstream 200 Reveille Plant 2013 HEP 200 Houston Central Phase 2 2013 Copano Field Services LLC 400 Karnes County Plant 2013 ETC 200 Eagle Plant 2013 DCP Midstream 200 Flag City Plant 2013 Boardwalk Field Services 150 Jackson County Phase 1 2013 ETC 600 Yoakum Plant Phase 3 2013 Enterprise 300 Brasada Plant 2013 Western Gas Partners 200 Houston Central Phase 3 2014 Copano Field Services LLC 400 Jackson County Phase 2 2014 ETC 200 Jackson County Phase 3 2014 ETC 200 TOTAL 3,870 12 Historical Conventional South Texas Gas Analysis Lower GPM Prior to the Eagle Ford, most conventional S. Texas gas had fewer NGLs per cubic foot Plants already in place were designed to handle gas in the 2-4 GPM range Richer gas was small volumes associated with oil wells 0.18 5% 0.28 7% 0.34 9% Ethane (C2) 1.75 48% Propane (C3) n-Butane (nC4) IsoButane (iC4) 1.14 31% Natural Gasoline (C5+) Total GPM – 3.68 1173 Btu/CF 13 Older plant technologies still add value Although not as much attributed to ethane Assumed component recoveries 50% C2 95% C3 95% C4+ $6.00 $4.00 $0.31 $1.75/Mcf* $3.17/Mcf Estimated fuel usage of 3.25% $3.00 Nymex price of $2.75/MMBtu with a ($0.05) basis differential $2.00 Current OPIS NGL pricing for August $4.91/Mcf $5.00 Ethane (C2) $0.90 Propane (C3) $0.26 $0.45 $0.53 IsoButane (iC4) n-Butane (nC4) Natural Gasoline (C5+) $2.46 $1.00 Natural Gas $0.00 Unprocessed Value Processed Value * Margin does not include processing, transportation, or fractionation fees 14 Shift in NGL Barrel Composition “Typical” Barrel has become lighter over the past decade Enhanced ethane recoveries most significant contributor to lighter barrel Shale gas tends to contain higher ethane percentages Lighter products (ethane and propane) are not as linked to crude prices and exhibit greater volatility Ethane dependent on petrochemical demand and rejection capabilities can be limited Source: Tudor Pickering Holt , EIA 16% 11% 7% 29% 13% 9% 7% 28% Natural Gasoline IsoButane n-Butane Propane 37% 43% 2002 2012 Ethane 15 Typical Eagle Ford Gas Analysis Higher GPM, Increased Ethane Contribution Eagle Ford wet gas is richer than historical S. Texas gas However, an increased portion of the gas stream is derived from ethane 0.39 7% 0.20 4% 0.53 9% Ethane (C2) Propane (C3) 1.28 23% 3.14 57% n-Butane (nC4) IsoButane (iC4) Natural Gasoline (C5+) GPM for Eagle Ford gas ranges from 5.0 to 7.0 Total GPM – 5.54 1251 Btu/CF 16 Processing creates significant value Especially when utilizing efficient cryogenic processing Assumed component recoveries $7.00 $6.30/Mcf $6.00 $1.01 90% C2 98% C3 100% C4+ Estimated fuel usage of 1.75% Nymex price of $2.75/MMBtu with a ($0.05) basis differential Current OPIS NGL pricing for August $5.00 Ethane (C2) $2.92/Mcf* $4.00 $3.38/Mcf $3.00 $1.13 $0.32 $0.55 $1.08 Propane (C3) IsoButane (iC4) n-Butane (nC4) Natural Gasoline (C5+) $2.00 Natural Gas $2.20 $1.00 $0.00 Unprocessed Value Processed Value * Margin does not include processing, transportation, or fractionation fees 17 How can I develop capacity faster? • Streamline the in-house process • Pay vendors for expedited equipment deliveries – Can be costly • Consider using rental compression vs. purchased • Find ways to develop project in phases • Limit equipment specifications – Stay as close as possible to base packages • Offer performance bonuses for early delivery • Fabricate in the shop as opposed to the field • Take some risk and obtain a plant and compression early! 18 Or, look for existing capacity on the market And we happen to know where to find some of it… • • • • • 200 MMcfd cryogenic processing plant Expected operational date of Sept. 2013 High ethane recoveries (~90%) Anchored by producers with lower GPM conventional gas Ability to accept some quantities of richer Eagle Ford gas 19 What are the royalty considerations? • Point of sale can greatly affect value of royalty payments – Sale at wellhead, plant tailgate, or further downstream • Percent of Proceeds (POP) deals vs. fixed fee processing • How are fees associated with processing categorized? – Which components are potentially deductible? • Be aware of lease clauses with minimum commodity price floors – Both on natural gas and NGLs – Might be triggered when processing commences • Statements can be more complicated and greater potential for confusion may exist • Value of NGLs should raise overall well economics and allow more wells to be drilled – Creates additional value for both producer and mineral owners 20 Q&A 21