12-1

advertisement

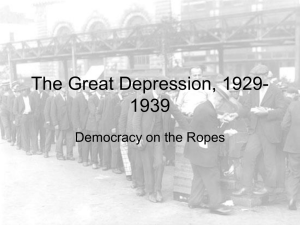

By: Laurie Linscomb Labor forces and productive capacity had been reduced sharply through was losses. This caused price levels to be higher everywhere at the war’s conclusion in 1918. Governments financed their purchases simply by printing the money they needed which caused a sharp rise in money supplies and price levels. The United States Price specie flow returned to gold in mechanism is the 1919. adjustment of prices as gold flows into or out Prices tended to adjust of a country, causing an according the amount adjustment in the flow of gold circulating in of goods. an economy, which had effects on the flows of An inflow of gold. goods and services: the An outflow of gold. current account. Realizing that gold supplies might be inadequate to meet central banks’ demands for international reserves, the Genoa Conference sanctioned a partial gold exchange standard in which smaller countries could hold as reserves the currencies of several large countries whose own international reserves would consist entirely of gold. In 1925, Britain returned to the gold standard be pegging the pound to gold at the prewar price. Britain’s price level had been falling since the war in 1925. The Bank of England was therefore forced to follow contractionary monetary policies that contributed to severe unemployment. British stagnation in the 1920’s accelerated London’s decline as the worlds leading financial center. Britain’s gold reserves were limited, however, and the country’s persistent stagnation did little to inspire confidence in its ability to meet its foreign obligations. The onset of the Great Depression in1929 was shortly followed by bank failures throughout the world. As the depression continued, many countries renounced the gold standard and allowed their currencies to float in the foreign exchange market. The United States left the gold standard in 1933. Countries that clung to the gold standard without devaluing their currencies suffered most during the Great Depression. The United States returned to the gold standard in 1934. This is because they had raised the dollar price of gold from $26.67 to $35 per ounce. Recent scholarship shows that the international gold standard played a central role in starting, deepening, and spreading the 20th century’s greatest economic downturn. The gold standard was the key culprit of the waves of bank failures around the world that accelerated the world’s downward economic spiral. Perhaps the clearest evidence of the gold standard’s role is the contrasting behavior of output and the price level in countries that left the gold standard relatively early, such as Britain, and those that stubbornly hung on. The Smoot-Hawley tariff imposed by the United States in 1930 had a damaging effect on employment abroad. A measure that raises domestic welfare is called beggar-thy-neighbor policy when it benefits the home country only because it worsens economic conditions abroad. This realization that inspired the blueprint for the postwar international monetary system, the Bretton Woods Agreement.