Cargo Qualifications

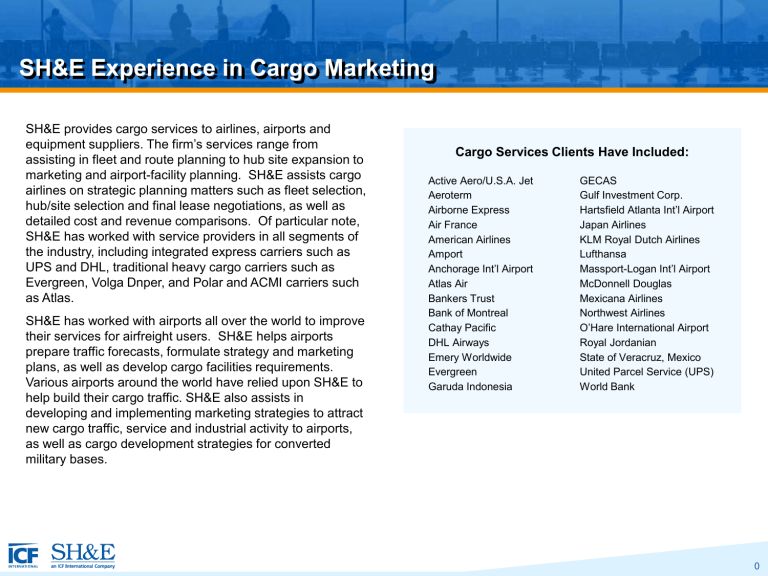

SH&E Experience in Cargo Marketing

SH&E provides cargo services to airlines, airports and equipment suppliers. The firm’s services range from assisting in fleet and route planning to hub site expansion to marketing and airport-facility planning. SH&E assists cargo airlines on strategic planning matters such as fleet selection, hub/site selection and final lease negotiations, as well as detailed cost and revenue comparisons. Of particular note,

SH&E has worked with service providers in all segments of the industry, including integrated express carriers such as

UPS and DHL, traditional heavy cargo carriers such as

Evergreen, Volga Dnper, and Polar and ACMI carriers such as Atlas.

SH&E has worked with airports all over the world to improve their services for airfreight users. SH&E helps airports prepare traffic forecasts, formulate strategy and marketing plans, as well as develop cargo facilities requirements.

Various airports around the world have relied upon SH&E to help build their cargo traffic. SH&E also assists in developing and implementing marketing strategies to attract new cargo traffic, service and industrial activity to airports, as well as cargo development strategies for converted military bases.

Cargo Services Clients Have Included:

Active Aero/U.S.A. Jet

Aeroterm

Airborne Express

Air France

American Airlines

Amport

Anchorage Int’l Airport

Atlas Air

Bankers Trust

Bank of Montreal

Cathay Pacific

DHL Airways

Emery Worldwide

Evergreen

Garuda Indonesia

GECAS

Gulf Investment Corp.

Hartsfield Atlanta Int’l Airport

Japan Airlines

KLM Royal Dutch Airlines

Lufthansa

MassportLogan Int’l Airport

McDonnell Douglas

Mexicana Airlines

Northwest Airlines

O’Hare International Airport

Royal Jordanian

State of Veracruz, Mexico

United Parcel Service (UPS)

World Bank

0

Cargo Qualifications

Ontario Int’l Airport

Pacific Gateway

Cargo Center

SH&E advised a private company bidding for a third party cargo development concession at Ontario International Airport. The assignment involved conducting a cargo market study of the greater Los Angeles basin and forecasting potential cargo growth at ONT. We interviewed cargo carriers at LAX and evaluated their issues related to moving all of their operations to ONT and/or splitting operations between the two airports. SH&E analyzed long-term cargo trends in LA, studied cargo capacity constraints at LAX and the potential and timing of cargo “spill” to ONT. We evaluated on and off airport rents for cargo warehouse space in both the LAX and ONT markets, projected absorption rates for warehouse space, modeled the financials of the operation, projected lease revenues and forecast the revenue potential available to share with the airport. Our analysis was used as part of the successful winning bid package for the concession.

JFK International Airport

Feasibility Assessment of

Cargo and Maintenance

Facilities

On behalf of a client seeking a 15-year lease agreement with the Port Authority of New

York and New Jersey for cargo and maintenance facilities, SH&E evaluated the cargo market at the airport and requirements for cargo and maintenance space. The facilities in question included a 268,000 s.f. main hangar, a warehouse with 500 thousand s.f. of leaseable space, and an adjacent airside ramp with parking space for 5 widebody cargo aircraft. SH&E examined the dynamics of cargo demand at JFK and the probable requirements for cargo warehouse space at the airport. In order to identify parties that might be interested in using these facilities, SH&E analyzed the demand for both on-airport and offairport facilities, “market” rents, and estimated the “all-in” level of rent which might reasonably attract companies to consider using these properties.

Finally, SH&E identified critical issues and risk factors related to the proposed client investment.

1

Cargo Qualifications

Dallas-Ft. Worth

International Airport

Air Cargo Development

As part of a major air service development engagement, SH&E put together an air cargo development strategy for DFW. SH&E profiled DFW’s cargo operations and throughput relative to other major cargo facilities in the United States, and prepared comprehensive evaluations of DFW’s domestic and international cargo markets. In each case, SH&E evaluated strategic developments at the major integrated air cargo carriers, as well as at major airport-to-airport freighter operators, and examined the implications of these developments for DFW. The study included an estimate of origin-destination international cargo volumes – both imports as well as exports – for DFW’s primary catchment area, by international partner region.

The evaluation concluded with an identification of priority growth opportunities for DFW within Asia, Europe and Latin America, based on projected trade developments and growth initiatives by specific carriers serving these markets.

Airport Authority of

Hong Kong

Strategic Land Use Plan

As part of a consortium of planning and engineering consultancies, we undertook the analysis and development of a new strategic land use plan for the airport. Among the tasks undertaken were a market analysis of the Hong Kong air cargo network, future demand for the regional manufacturing industry, assessment of the competitive situation versus other Asian airports, evaluation of the likely long-term aircraft fleet plans of cargo carriers and the development of a long-term traffic forecast. We also undertook the feasibility of implementing a Free Trade Zone and establishment of a new cargo facilities land use plan along with its integration into the overall strategic master plan which will form the basis of the airport’s long-term development strategy.

2

Cargo Qualifications

Louisiana

Cargo Airport

Feasibility Study

SH&E served as an advisor to the state of Louisiana, studying the feasibility of a major new airport/multimodal transportation center project proposed to be located between

New Orleans and Baton Rouge. SH&E developed long range forecasts for air, surface, port and rail cargo, analyzed project development costs, existing and forecasted operating costs and revenues, prepared a capital improvement plan, developed a financing plan which structured GARB's and LOI bond financing, and developed long term cash flow projections for the project

Huntsville Intermodal

Tradeport

Market Study

On behalf of Huntsville International Airport and Huntsville Intermodal Tradeport, SH&E developed a market study and marketing documents for the airport to use in attempting to attract all cargo airlines to serve Huntsville. The market assessment study reviewed recent trends in the air cargo industry, evaluated cargo market characteristics primary and secondary catchment areas in the southern United States, and examined HSV’s position versus competing airports. SH&E developed targeted marketing presentations for specific Asian and European carriers presenting the carrier benefits of operating at

HSV.

3

Cargo Qualifications

Belgrade Cargo and

Logistics Center

Feasibility Study

SH&E, jointly with a consortium of lawyers , bankers and engineers, advised the Serbian government on the concessioning of the several projects at Belgrade International

Airport to the private sector. The first project is the development of an 86,000 square meter cargo/logistics/industrial project at a minimum cost of US$ 55 million. SH&E developed a detailed market study of Serbia and Southeastern Europe identifying possible cargo flows and forecasting growth in the region. We then developed a financial feasibility study that was used to framed the investment and the parameters of the concession. SH&E assisted in the development of the tender documents, structuring the technical terms of the TOR and identified potential international bidders for the project.

Chicago O’Hare

International Airport

Demand Forecasting and Noise Analysis

SH&E has worked on various cargo assignments at O’Hare International Airport for the

City of Chicago Aviation Department. These have included long-term cargo traffic and facility demand forecasts and analysis of the noise impacts of all-cargo operations.

SH&E also prepared an analysis of air cargo facility demand at O’Hare for the private developer of the O’Hare Express Center cargo project.

4

Cargo Qualifications

Boston Logan

International Airport

Business Plan

SH&E prepared a cargo business development plan for Massport, operator of Boston

Logan International Airport. This included a detailed analysis of domestic and international cargo traffic trends and the outlook for all-cargo and passenger belly freight at Logan. The report also focused on cargo facility demand including aircraft parking requirements for all-cargo operators.

San Jose Int’l Airport

Demand Forecasting and Financial Analysis

SH&E prepared a demand and financial analysis for an air cargo facilities study at San

Jose International Airport which included an analysis of available development options, and the preparation of specifications and evaluation criteria for a cargo facility RFP.

Development of a Bay Area air cargo database included traffic at the three major airports and economic data for the Bay Area. The accompanying financial analysis addressed the feasibility of developing a cargo facility; and comparison of costs/benefits associated with a municipally developed facility to one developed by an air cargo carrier or third party developer under a B.O.T. (build, operate, transfer) concept.

5

Cargo Qualifications

Anchorage

International Airport

Business Plan

With SH&E’s assistance, the State of Alaska and Anchorage International Airport successfully applied to USDOT for expanded cargo transfer authorities. This expanded authority allows foreign air carriers to expand their cargo operations at ANC to include online freight transfer between aircraft, inter-line transfer between foreign and US carriers and change-of-gage service.

Additionally, SH&E developed an ongoing international air cargo marketing program for

Anchorage. The program included the use of a detailed analysis of the Northern Pacific air cargo market in order to develop strategies for promoting cargo activity at the airport, and participation in presentations to prospective clients.

6

Cargo Qualifications

Baltimore/Washington

Int’l Airport

Air Cargo Development

For Baltimore-Washington International Airport, SH&E performed a market assessment of cargo opportunities for the airport as well as a number of follow-on initiatives aimed at attracting direct international air freighter service.

The market assessment study reviewed recent trends in the air cargo industry and their implications for BWI, evaluated cargo market characteristics in BWI’s primary and secondary catchment areas in the eastern United States, and examined BWI’s position vis-

à-vis competing airports. The study also identified service gaps and important regional partner market opportunities. Based on the foregoing analysis, the study concluded with an action plan for attracting direct international air freighter services.

As a follow-on to its initial study, SH&E was again retained by BWI to evaluate freighter operators in the United States, Europe and Asia and identify key target cargo carrier prospects to pursue. In this study, SH&E screened the top 20 freighter operators in the

U.S.-Europe and U.S.-Asia markets and selected a subset of 9 carriers for further evaluation. Each of the 9 carriers was profiled in detail, with a comprehensive assessment of strengths, weaknesses, opportunities and threats and evaluated against a number of important selection criteria including financial condition, potential gaps in their U.S. networks, demonstrated rapid growth and evidence of willingness to serve

“non-traditional” U.S. destinations. The study concluded with a prioritized list of target carriers to pursue, and an action plan for attracting scheduled freighter service from these operators. Since this study was completed, SH&E has continued to work with

BWI on its cargo air service marketing initiatives, including putting together tailored information and presentation materials aimed at specific target carriers.

7

Cargo Qualifications

Volga/Dnepr

Technical Business

Strategy Reviews

Working for the International Finance Corporation, SH&E conducted due diligence in respect of a potential IFC financing for two AN-124 aircraft to be acquired and operated by VolgaDnepr. SH&E’s assignment included a comprehensive evaluation of the operational and marketing capabilities of Volga-Dnepr, the technical capability of the AN-124 aircraft and the future market prospects for heavy and outsize airfreight. Based on SH&E’s favourable recommendations, Volga-Dnepr became the first Russian airline to obtain aircraft financing from the IFC. In a subsequent assignment SH&E developed a comprehensive business strategy review of launching of new cargo division called Air Bridge, cargo market review, marketing plan review, revenue plan review, fleet review, operating cost review.

AirUnion/Krasnoyarsk

Hub Study

SHE worked for AirUnion as part of a multi-firm project on a feasibility of developing

Krasnoyarsk (KJA) Airport as a major passenger and cargo hub. Our study analyzed the potential of KJA as a domestic and international transit hub for AirUnion using our proprietary “Networks®” airline route modeling tool. We used this analysis to develop the required route network for AirUnion and forecasted the level of passengers that could be accommodated through the KJA hub. We also analyzed the performance of Air

Bridge Cargo (“ABC”) and the potential of other cargo airlines to use KJA, in order to project the level cargo volumes at the airport. SH&E’s analysis was the basis for application to the Russian Investment Fund (“RIF”) as well as a business plan to present to private investors.

8

Cargo Qualifications

Air Malta

Cargo Development

Air Malta has been an SH&E client for many years. Most recently, SH&E assisted in creating a cargo development strategy, conducting a pre-feasibility study for Air Malta and Lufthansa Cargo on the possibility of developing an air-sea cargo hub in Malta.

DHL

Hub Selection Study

The integrated freight carrier DHL chose SH&E to conduct a hub site selection study, in order to identify potential alternatives to its existing US domestic hub, measure the operating cost and service characteristics of alternative sites -- including factors such as weather and taxi-time – and manage the process of obtaining competitive bids for economic assistance in developing new hub facilities.

9

Cargo Qualifications

TAM

Due Diligence

SH&E conducted a due diligence evaluation of TAM S.A. in 2005. The project included an overview of the airline industry in Brazil and South America; assessment of TAM’s existing route network; review of its existing and proposed passenger and cargo businesses; benchmarking of TAM against other, similar size carriers; commentary on TAM’s fleet and fleet plans; review of TAM’s existing and forecast cost structure; review of TAM’s business plan; evaluation of TAM’s financial projections and underlying assumptions; commentary on TAM’s organizational structure, management practices and operations; commentary on its security and safety record, as well as aircraft condition and maintenance practices; and evaluation of the effectiveness of TAM’s sales, distribution, reservation, yield management and other IT practices.

VARIG LOG

Due Diligence

A New York private equity firm hired SH&E to advise on potential investments in bankrupt VARIG assets, including cargo carrier VARIG LOG and maintenance and engineering organization VEM. SH&E provided expertise on turn-around and risk considerations, as well as management suitability. SH&E’s analyses directly contributed to MatlinPatterson’s acquisition of VARIG LOG in 2006.

10

Cargo Qualifications

Atlas Air

Demand Forecasting and

Financial Analysis

SH&E advised investors who own equipment trust certificates for 12 747-400 freighters operated by Atlas Air and Polar Air Cargo as part of a Chapter 11 restructuring. A large part of the analysis for this assignment focused on the future demand for Trans-Pacific all-cargo services.

SH&E has also assisted Atlas in bidding for scheduled route authority between the U.S. and Mexico. Our support included detailed traffic forecasts, based on an assessment of overall market growth, as well as estimates of market share in each major origin-destination freight market accessed by the proposed services.

Northwest Airlines

Route Valuation

SH&E was retained by Northwest to assess the asset value of Northwest’s Pacific route network. Given the importance of Northwest’s trans-Pacific 747 freighter operations, much of this assignment involved an understanding and valuation of the contribution provided by air cargo service.

11

Cargo Qualifications

Polar Air

Slot Valuation

SH&E was retained by Polar to provide a value opinion on its slot holdings at Narita Airport.

This assignment required a full understanding of how slot value differs by type of use

(passenger vs. freighter) and time of day – and in particular the drivers of heavy slot demand by all cargo operators during certain peak

Royal Jordanian

Fleet Analysis

SH&E was retained by Royal Jordanian in to advise it on options for replacing its aging fleet of Boeing 707 freighters. We explored 11 aircraft options in total, ranging from status quo

– continuing to maintain the 707’s in service - to acquiring 757’s,

767’s, A310’s, A300’s, DC-10’s, Tu-204’s and other types or variants. SH&E found that the most costeffective solution was to convert several of the carrier’s otherwise under-utilized passenger Airbus A-310300’s into freighter configuration. Royal

Jordanian has implemented this solution, and returned two such modified aircraft to service in 2003.

12