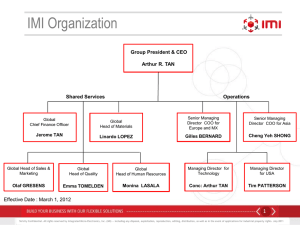

the presentations - Global Equity Organization

advertisement

GEO UK Chapter Meeting Tuesday 1 July 2014 Simmons & Simmons Agenda Introduction – Nicholas Greenacre Forfeiture and clawback – Ian Fraser and Andrea Finn Pensions Deregulation – Nick McMenemy GEO Global Equity Insights – Jay Foley and Ralph Beidelman Drinks and canapés (7pm) Dates for your Diary etc 14 November 2014 – Pan European Regional Event, Paris Presenters Notified late July 15-17 April 2015 – Annual Conference, London RFP – 8 September – 17 October GEO connect Online member only community GEO – UK/CI Chapter meeting Forfeiture and clawback clauses are becoming more common (and not just in the financial services sector) – how enforceable are they? Ian Fraser and Andrea Finn 1 July 2014 Overview Why do organisations introduce deferral (and clawback and forfeiture)? What are the benefits? Are provisions enforceable in the UK? What are the avenues for challenge? Some practical issues © Simmons & Simmons LLP 2014. Simmons & Simmons is an international legal practice carried on by Simmons & Simmons LLP and its affiliated partnerships and other entities. 4 / L_LIVE_EMEA1:21986553v1 Why defer remuneration? Why introduce power of clawback and forfeiture? Regulatory requirements Alignment of interests and control Retention tool Share costs of misconduct and fines © Simmons & Simmons LLP 2014. Simmons & Simmons is an international legal practice carried on by Simmons & Simmons LLP and its affiliated partnerships and other entities. 5 / L_LIVE_EMEA1:21986553v1 Avenues for legal challenge Penalty clause – Breach of contract – Condition to entitlement Restraint of trade – Good leaver clauses and/or specific non-compete provisions Uncertainty and discretion UCTA © Simmons & Simmons LLP 2014. Simmons & Simmons is an international legal practice carried on by Simmons & Simmons LLP and its affiliated partnerships and other entities. 6 / L_LIVE_EMEA1:21986553v1 Avenues for legal challenge Discrimination – relevant as cause of action and value of claims following departure Constructive unfair and wrongful dismissal Challenge to choice of law and jurisdiction clauses given connection to employment (For UK banks, PCBS recommendations) © Simmons & Simmons LLP 2014. Simmons & Simmons is an international legal practice carried on by Simmons & Simmons LLP and its affiliated partnerships and other entities. 7 / L_LIVE_EMEA1:21986553v1 Practical issues Enforcement Tax Accounting Competitive Disadvantage Pressure to increase salary / fixed pay Flight risk? © Simmons & Simmons LLP 2014. Simmons & Simmons is an international legal practice carried on by Simmons & Simmons LLP and its affiliated partnerships and other entities. 8 / L_LIVE_EMEA1:21986553v1 Questions? © Simmons & Simmons LLP 2014. Simmons & Simmons is an international legal practice carried on by Simmons & Simmons LLP and its affiliated partnerships and other entities. 9 / L_LIVE_EMEA1:21986553v1 Pensions deregulation – can a pension work as part of a Long Term Incentive Plan? NICK MCMENEMY Director, Head of Consulting | 1st July 2014 Agenda • About Arthur J. Gallagher • Pensions & Long Term Incentive Plans • Recent Pension Legislation changes • Some examples • Questions ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 11 Arthur J. Gallagher • Award-Winning Employee Benefits and Wealth Management Consultancy, both in the UK and internationally • Global organisation with global reach - grown to become part of one of the largest insurance and risk management organisations in the world • Founded in 1927, now employs over 16,300 employees with operations in 24 countries and an extended network of partner brokers and consultants in 140 territories ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 12 Background • Political pressure for deferred remuneration • Employers seeking creative and attractive remuneration solutions for senior execs and top talent • Recent pension changes make them more relevant and worth revisiting ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 13 Pension as long term incentive Limitations: • No withdrawal until age 55 (except in serious ill-health) • 25% tax free lump sum with residual fund as ‘income’ • Tax on ‘income’ at relevant Income Tax rate • Restrictive rules on passing funds to spouse & dependants ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 14 Pension as long term incentive The Advantages: • Income Tax relief • Tax-protected growth – no CGT, Income Tax or Inheritance Tax • No ‘cliff edge’ retirement • Annuities – high price of secure income? • Immediate Vesting Personal Pensions ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 15 Share Incentive Plans The Basics: • £3,000 of free shares or £1,500 (capped at 10% of salary) partnership shares (with 2:1 employer match) or dividend shares • Tax and NI payable if withdrawing shares within 5 years • CGT-free if shares kept in plan plus annual CGT exemption • Transfer shares into Pension within 90 days of taking them out of the SIP – treated as payable net of basic rate (20%) tax so grossed up plus further Income Tax to claim • On death, shares sold back to employer or passed to personal estate and liable to IHT ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 16 LTIPs The Basics: • There are various LTIP structures • No tax liability upon granting • On vesting, Income Tax at value of shares (plus NI if ‘readily convertible assets’) • On disposal, Capital Gains Tax if over annual exemption • Entrepreneur’s relief gives a reduced 10% CGT rate (rare in large firms) • Inheritance Tax is payable by estate on death if value flows to spouse ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 17 Deferring variable remuneration One example: • 40% deferred to 3 to 5 years for a material risk taker • Recommended increase to 60% if amount £500,000 or more • 50% paid in shares and should be retained for 6 months after relevant vesting date • Deferred amounts should be subject to forfeiture • Variations on the above across sectors and individual companies ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 18 Annual Allowance • £40,000 in 2014/15 tax year • Tax relief on contributions • Tax charge applies to the excess – scheme pays? • Annual Allowance includes employer contributions • Carry forward up to 3 years ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 19 Lifetime Allowance • Limit on an individual’s fund - £1.25 million for 2014/15 tax year • Assessed when benefits drawn (or on death) • Includes Registered Group Life schemes • Includes Defined Benefit pensions: 25:1 or 20:1 • 55% tax charge on unprotected excess ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 20 Pension Protections • Various protections can be applied for by individuals: – Primary & Enhanced Protection 2006 – Fixed Protection 2012 – Fixed Protection and Individual Protection 2014 • No further “pension accrual” including new membership of Registered Group Life Assurance • Auto-enrolment – no exemption for those with protection • On-boarding of new staff ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 21 The pensions landscape has changed • March 2014 Budget Statement • Immediate interim changes: • – Increased drawdown limits – Lower secured income requirement – Relaxation of trivial commutation From April 2015: – No restriction on amount drawn from fund – 25% tax-free, remainder taxed at marginal rate of Income Tax ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 22 Possible Variable Remuneration Structure • Individual age 50 given £100,000 award • £60,000 deferred into LTIP; £40,000 as immediate employer pension contribution • Employee saves at least £16,000 Income Tax and NICs • Employer saves £5,520 NICs • Unvested pension remains free of Capital Gains, Income and Inheritance Taxes • Full access to the pension fund from age 55 • Retirement income from pension taxed at 0%, 20%, 40%, 45% compared to 47% for vesting stock options ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 23 Summary • Despite limitations, pensions remain an attractive component of reward package • As part of a long term incentive, they make more sense as a result of recent changes • Especially attractive for those at or approaching age 55 • Powerful tax advantages over other remuneration options • For very high earners, the annual allowance is limiting. ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 24 Thank you, any questions? ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 25 Important Information This presentation is based on Arthur J. Gallagher’s understanding of current tax legislation and practices. No liability can be accepted for any error or omission and we strongly suggest that you take tax planning or independent financial advice if uncertain of your own corporate position. This presentation is not designed to replace advice and does not constitute advice under the Financial Services and Markets Act 2000. Levels and bases of, as well as reliefs, from taxation are subject to change and their value depends on the individual circumstances of the investor. ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 26 Thank You Nick McMenemy | Head of Consulting Arthur J. Gallagher | Employee Benefits D. +44 (0) 20 7204 6195 T. +44 (0) 20 7204 6000 E. nick_mcmenemy@ajg.com W. www.gallaghereb.com Arthur J. Gallagher (Employee Benefits) and Arthur J. Gallagher (Wealth Management) are trading names of Gallagher Risk & Reward Limited, which is authorised and regulated by the Financial Conduct Authority. Not all business carried out by the company is regulated. Registered Office: The Walbrook Building, 25 Walbrook, London EC4N 8AW. Registered No. 3265272 England and Wales. Tel: +44 (0)20 7204 8990 Fax: +44 (0)20 7204 6001 Web: www.gallaghereb.com ARTHUR J. GALLAGHER | BUSINESS WITHOUT BARRIERS™ 28 GEO Global Equity Insights Discussion of the 2014’s survey results Jay Foley, Computershare Ralph Beidelman, Discovery Communications Survey Framework • • • • • 169 companies including the largest global corporations: 89% of the companies surveyed have a market capitalization above USD 1 billion, with the top 10% exceeding USD 100 billion at year-end 2013. Two-thirds of the companies generated revenues above USD 5 billion. National leading companies from 20 countries around the world, with special focus on North America and Europe. Representative sample across 10 industries. Data collected within a period of six weeks starting mid-January 2014. Survey sponsors and support partners Sponsors: Support partners: Three main equity-based pay drivers of value creation 1. Companies should increase both the percentage of LTIP in the pay mix and the integration of LTIP across all staff levels and countries. 2. Companies should actively promote their equity culture by introducing ESPP on a broad scale. Both LTIP and ESPP are a key factor to compete successfully in a globalized economy. 3. Companies should allocate more time and budget to create a more diversified communication platform. Diversified communication methods are a main lever for employee satisfaction and carry the potential to invigorate LTIP and ESPP. Link between ESPP participation and performance • • High performing companies have higher participation rates in ESPP. ESPP are not only a crucial factor of success in a competitive labor market, but are also a more general value lever when it comes to participation. ESPP participation (in % of eligible employees) Link between LTIP penetration and performance • • Broad-based equity culture across staff levels and countries fosters company performance. High performing companies offer LTIP much more frequently also to other employees than executives. LTIP eligibility for non-executives (in % of companies) LTIP plan types in place • • The trend of 2013’s survey is further affirmed, as stock options are on a sharp and steady decline. Apart from this trend, European companies prefer performance shares, North American companies prefer restricted stock as long-term incentive. LTIP types (in % of companies) Restricted Stock 35 Performance Shares 26 Stock Options/SAR 20 Performance Cash 4 Equity/Cash Deferral 3 Share Matching 2 Other 12 Link between pay mix and performance • • Successful companies give more weight to long-term incentives across all levels. What is true for the top management is also valid for further levels down the hierarchy ladder. LTIP proportion (in % of TDC for executive committee) Link between communication and satisfaction • • Communication is a main lever to achieve higher employee satisfaction. Companies with a broad set of communication tools are better connected with their employees, and those are much more satisfied with their equity plans. Companies with satisfied employees (in % of companies) Allocation of actual and desired and actual budget • • Technology ranks first in both the actual budget allocation and the additional budget desired. Despite companies are aware of the need to improve communication, however, importance of communication is currently not reflected in budget allocation. Allocation of additional budget (in % of additional budget) Technology 29 Communication 24 Rollout 14 Staff 11 Outsourcing 10 Legal Other 7 5