ADX ENERGY - Boerse Express

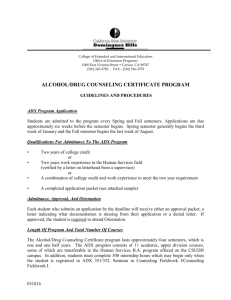

advertisement

ADX ENERGY ACIVITY SNAPSHOT APRIL 2012 Paul Fink, Technical Director DISCLAIMER This presentation contains forward looking statements that are subject to risk factors associated with the oil and gas industry. It is believed that the expectations reflected in these statements are reasonable, but they may be effected by a variety of variables which could cause actual results or trends to differ materially, including but not limited to: price fluctuations, actual demand, currency fluctuations, drilling and production results, commercialization, development progress, operating results, reserve estimates, loss of market, industry competition, environmental risks, physical risks, legislative, fiscal and regulatory developments, economic and financial markets conditions in various countries, approvals and cost estimates. ADX ENERGY: Started in late 2007 ASX ticker: ADX Shares on Issue Maket Capitalisation @ 10 cents 411 million $ 41.1 million Options * * exercise price between 25 to 40 cents Geographic focus Energy exploration focused on North Africa, Mediterranean and Central Europe Gold & Base Metals (via Riedel Resources) in Australia 31 million EUROPEAN – NORTH AFRICAN ASSETS SICILY CHANNEL – OFFSHORE: ITALY & TUNISIA (5,000 sqkm) Vienna ONSHORE TUNISIA ONSHORE ROMANIA MILESTONES SINCE START IN LATE 2007 3D Seismic, 2010 ADX operated, PGS boat ADX executed a +$60 million exploration program with only $12 million of shareholder funds. Acquire high quality assets in countries with excellent & stable fiscal regimes First Geostreamer 3D seismic acquired First ever Tunisian deepwater well drilled incident free gas discovery Onshore Romania (ADX license, Petrom facilty) Offshore 2D seismic Onshore well drilled oil discovery Offshore Sicily ADX rig Offshore Sicily ADX rig Onshore Tunisia ADX rig HOW DID WE DO - AND FUND IT? PART1/2 Directors Ian Tchacos Wolfgang Zimmer Paul Fink Andrew Childs Non executive Chairman Managing Director Executive Director Non executive Director Company Secretary Peter Ironside ………EXPERIENCED & PROVEN MANAGEMENT TEAM HOW DID WE DO - AND FUND IT? PART2/2 70 Gross JV Operated Cost 60 50 58 MM ADX Value ADX Contributed 40 32 MM 30 20 12 MM 10 0 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 ……ADX COMPETENT OPERATOR – GOOD ASSETS – GOOD JV PARTNERS (E&P companies) ADX ENERGY – NEAR TERM ACTIVITY MAP SICILY CHANNEL – OFFSHORE: DOUGGA RESOURCE UPGRADE FARM OUT EFFORTS TO START SOON TO: FUND LAMBOUKA RE-ENTRY & DEEP POTENTIAL FUND DOUGGA APPRAISAL FUND EXPLORATION ACTIVITY TUNISIA – ONSHORE CHORBANE: •TEST SIDI DHAHER OIL DISCOVERY •START APPRAISAL & DEVELOPMENT ROMANIA- ONSHORE: FARM OUT PARTA TO FUND SEISMIC & WELLS, START 3D AND 2D SEISMIC IN Q2 – Q4 2012 GROW ASSET BASE ENERGY ASSET SELECTED EXAMPLES Paul Fink, Technical Director www.adxenergy.com.au TOP EIGHT EXPLORATION & APPRAISAL PROJECTS Gas condensate Oil 3D Gas Dougga –West Medium risk 3D Lambouka Deep Kerkouane-1 Appraisal CHS 3D Lambouka Appraisal 3D ..to be acquired Sidi Dhaher Test 3D Dougga Appraisal Low risk Saint M Mean Resources Size SIDI DHAHER DRILLING SUCCESSFUL DRILLING OPERATION Tunisia “Jasmine” revolution and uprising in neighboring Libya caused several weeks of delay. Completed a safe and timely drilling operation during a time of partial power vacuum. Developed a relationship of mutual trust with the local population. ADX was the only company drilling in a populated area at the time. Other operators declared force majeure. Sidi Dhaher TD’ ed at 2,011 meters in the 3rd week of September. SIDI DHAHER DRILLING SIDI DHAHER-1 SIDI DHAHER OIL RESOURCE POTENTIAL Pressure (PSIA) 1400 1100 1500 1600 1700 Oil gradient MDT Oil sample Depth 1150 1200 Formation Water gradient 1250 Risk Category STOIIP [mmbbls] P90 13 P50 37 Mean 51 P10 111 Three Cretaceous reservoirs pre drill (Abiod, Douleb, Bireno) Oil found in Bireno reservoir, others Oil in place resource estimates, recovery factor to be determined post well test absent OFFSHORE ITALY & TUNISIA Combined most likely contingent and prospective resources: 1.15 billion barrels of oil equivalent. Kerkouane-1 Lambouka Elissa Dougga - West Total ADX permit areas approx. 5,000 sqkm (1,23 MM acres) 15 VISION : THE DOUGGA HUB A LARGE GAS CONDENSATE RESOURCE CLOSE TO MARKETS 15 km Dougga West Satellite Exploration Dougga Appraisal Lambouka Appraisal & Drill Deeper Condensate-rich resource Possibility for oil Close to shore (40kms) Close to onshore infrastructure Close to high price local and European markets Proximal tie – in opportunities covered by 3D 226 mmboe 173 mmboe 126 mmboe 525 mmboe within a radius of 15 km (mean resources) Covered with Geostreamer 3D Proven Hydrocarbons - Low to medium risk upside DOUGGA GAS CONDENSATE FIELD RESOURCES CB run Jan 2012, GRV method Total RECOVERABLE MMBOE Abiod RECOVERABLE MMBOE Total Sales Gas recoverable [bcf] Total Condensate Recoverable [mmbbls] Total LPG Recoverable [mmbbls] p90 88 71 264 35 12 p50 159 133 476 63 21 MEAN 173 142 517 68 23 p10 268 225 804 106 36 PRODUCTION FORECAST (TRACS, COOL ENERGY) Sales Gas CO2 50 MMscfpd 32 MMscfpd Fuel Gas 4 MMscfpd Raw Gas 106 MMscfpd Condensate 114 kmol/hr 50 mmscf/d sales gas (base case) 9,400 bopd condensate production 3,200 bopd LPG production project NPV (10) 1.6 Billion USD (ADX share currently 60%) Dougga total daily production: 22,000 boepd (Austria’s OMV total production in Pakistan, Yemen, Kurdistan, Kazakhstan: 27,000 boepd) (source: OMV annual report 2010) DEVELOPMENT PLAN & CASH FLOW Discounted (10%) Project Cash Flow 350.0 250.0 150.0 MM US$ 50.0 -50.0 0 5 10 15 20 25 -150.0 -250.0 -350.0 -450.0 Hannibal Gas Plant, Sfax, Tunisia Years project NPV (10): 1.6 Billion USD (ADX share currently 60%) Revenue at today’s oil & gas prices: 8.3 Billion USD Sources: Offshore, Petrofilm, BG KEY STRATEGIES Corporate Strategy Early entry to high impact exploration opportunities in proven oil and gas basins. Commercialisation of existing discoveries. Operating Strategy Maintain operatorship through the exploration - appraisal phase of the asset cycle. Use leading edge technology to reduce risk Funding Strategy Fund drilling via farmouts, retain large interests in material prospects with potential to deliver exceptional shareholder returns. NEAR – MID TERM NEWS FLOW Test Results of Sidi Dhaher oil discovery: fast track production Farm out parts of Offshore Sicily to fund appraisal of Dougga, Lambouka Farm out parts of Romania to fund seismic and first well Dougga Appraisal & Well Test