Martin Crouch – OFGEM - Future Energy Strategies

advertisement

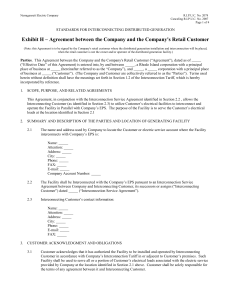

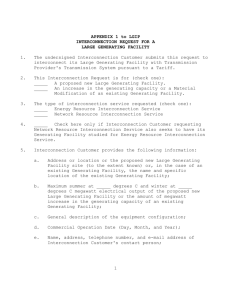

Electricity interconnectors – next generation Martin Crouch Future Energy Strategies seminar 3 July 2012 Agenda • Ofgem’s role • How much interconnection? • Regulatory framework • Is interconnection a good thing? 2 Interconnection from Great Britain: the context 2012 figure: 4.8% Average total import capacity relative to installed generation capacity by percentage, 2004 (Source, DG Competition Report on Energy Sector Inquiry, 2007) 3 Policy context – an electrical island But less so in future Existing Construction Planned/ possible 4 Energy Infrastructure Package: Interconnection capacity to support 2020 RES targets 2020 (Source: Imperial College & KEMA, study for EIP communication, 2010) 5 ECF 2050 Pathways: Interconnection capacity to support 80% RES by 2050 2050 Source: ECF – Roadmap to 2050 (www.roadmap2050.eu) 6 Agenda • Ofgem’s role • How much interconnection? • Regulatory framework • Is interconnection a good thing? 7 Drivers for change • Potential for commercially viable interconnection – But pure merchant financing of projects less viable … – We want to see timely development of new infrastructure to contribute to the delivery of internal energy market • Financing gap- greater need for 3rd party investors? • Need for a common / coordinated approach to regulation of shared assets • Challenges with merchant-exempt regime: – Regulated “risk” of exemptions, which are seen as the exception not the rule – European model, national TSOs deliver interconnector investment Need to develop a regulatory regime to remove regulatory barriers and facilitate investment 8 Regime principles • The regulatory framework will take into account the commercial viability of a project as well as considering the wider benefits efficient levels of interconnection can offer to consumers for example: security of supply, integration of renewable energy sources, competition and market integration across Europe, • Consumers should be protected from the cost implications of excessive returns or market power that might accrue to interconnector owners, • Developers should be able to earn returns that are commensurate with the levels of risk they are exposed to under the regulatory framework, • Regulatory treatment of developers should be coordinated between NRAs at either end of the shared asset and • (For GB and new interconnector developments) Regulatory treatment should allow third party developers and should be impartial and unbiased between TSOs and non-TSO developers, existing and future developers 9 The Cap and Floor approach • • • • • • • Inetrconnectors derive their revenues (congestion rents) from auctioning capacity at different time horizons Recoup returns within bounds of preset cap and floor Returns over cap – paid back to consumers Returns fall below floor – triggers payment from consumers Allows revenue regulation, protects consumers from market power Maintains element of market valuation of interconnection Within the regulated regime favoured by Third Package 10 Agenda • Ofgem’s role • How much interconnection? • Regulatory framework • Is interconnection a good thing? 11 Two real examples that demonstrate the benefits of interconnection Example 1: Interconnectors can reduce the cost for National Grid to manage the system The Moyle Interconnector was offline between June 2011 and Feb 2012 This resulted in an additional £20 million constraint costs for National Grid in Scotland (excess wind power in Scotland could not be exported to N Ireland) X Example 2: National Grid can call on interconnectors to assist in emergency situations The IFA Interconnector provided 30% of the emergency assistance used by National Grid to meet a 3.5 GW shortfall in Feb 2012 – this helped avoiding problems in GB 12 Hypothetical concerns... 40 48 50 13 Hypothetical concerns... 40 38 52 50 14 Benefits of interconnectors are likely to be higher if... 1. Interconnected countries have different generation and demand patterns – asymmetric shocks + access to diversity of generation sources and reserve 2. The GB price respects and reflects the physical constraints of the GB transmission system as well as scarcity – our price needs to signal when we need more energy and where we need it 3. Good cooperation between neighbouring TSOs and full implementation of internal market rules 15 16