Cash vs Synthetic Structures

advertisement

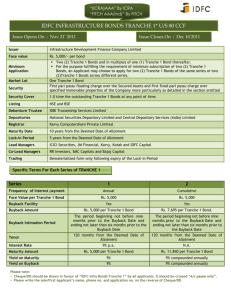

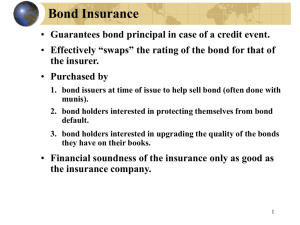

Cash vs Synthetic Structures • Synthetic CDO structures involve the use of credit derivatives. Arbitrage Transactions Create an arbitrage CDO is whether a structure can offer a competitive return for the subordinate/equity tranche as below: Tranche Par Value Coupon Value Coupon Rate Senior $80,000,000 Floating LIBOR+70 basis points Mezzanine $10,000,000 Fixed Treasury rate + 200 basis point Subordinate/Equity $10,000,000 Assumptions • The collateral of the CDO: • bonds that all mature in 10 years • The coupon rate for every bond is a fixed rate • The fixed rate at the time of purchase of cash bond is the 10 year treasury plus 400 basis points • To finance the senior tranche, • collateral manager enters into an interest-rate swap with another party with a notional principal of $80 million in which it agrees to do the following: • Pay a fixed rate each year equal to the 10-year Treasury rate plus 100 basis points • Receive LIBOR Cash flows • Assuming the 10-year rate at the time the CDO is issued is 7%. • Interest received from collatoral: • Interest to senior tranche: • Interest to mezzanine tranche: • Interest to swap counterpart: • Interest received from swap counter part • As a result, • Total interest received: • Total interest paid: • Net interest Synthetic CDOs • In a synthetic CDO, the collateral absorbs the economic risk associated with specified assets but does not have legal ownership of those assets • Requires the use of CDS