Uniform Pricing Laws & Regulations (Costco v. Hoen)

advertisement

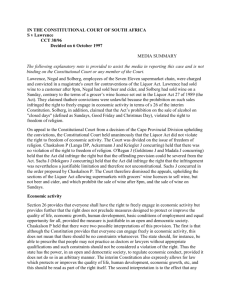

NABCA Legal Symposium on Alcohol Beverage Law and Regulation Rick Garza Deputy Director Washington State Liquor Control Board March 09, 2011 Privatization Efforts in Washington State Timeline: 2004 -2008 - Costco vs. Hoen Lawsuit 2009 - Joint Select Committee Beer/Wine Regulations • SHB 2040 Modifications to 3-Tier and Tied House Laws 2010 – • State Auditors Report • Legislative Bills to Privatize • Public Perception of State System • Initiatives 1100-1105 2011 - Liquor Control Board Response • Public Safety • Revenue • Convenience 2 Uniform Pricing Laws & Regulations (Costco v. Hoen) Costco's Challenge Costco filed a federal court challenge to several key requirements of the state’s three-tier system of beer and wine distribution, arguing they violate federal anti-trust laws. Nine specific restraints were challenged: 1. 2. 3. 4. 5. 6. 7. 8. 9. Uniform Pricing (manufacturers must offer uniform prices to distributors, distributors must offer uniform prices to retailers). Price Posting (prices posted electronically with state and may be viewed when final). Price Holding (electronically posted prices adhered to for 30 days). Minimum Mark Up (selling price at least 10% over posted price). Ban on Quantity Discounts (no price break for volume purchase). Ban on Credit (no distributor sales on credit to retailers). Delivered Pricing (price to retailer includes cost of delivery, even if delivery declined). Ban on Central Warehousing (delivery is to licensed retail location only). Ban on Retail to Retail sales (retailers cannot sell to other retailers). 3 Privatization Efforts in Washington State Timeline: 2004 -2008 - Costco vs. Hoen Lawsuit 2009 - Joint Select Committee Beer/Wine Regulations • SHB 2040 Modifications to 3-Tier and Tied House Laws 2010 – • State Auditors Report • Legislative Bills to Privatize • Public Perception of State System • Initiatives 1100-1105 2011 - Liquor Control Board Response • Public Safety • Revenue • Convenience 4 Joint Select Committee Beer/Wine Regulation • 3- Tier and Tied House Laws – Supports separation of the three tiers – Prevent domination of one tier over another or exclusion of competitors’ products – Two aspects: • Ownership – prohibit M and D from owning or having a financial interest in a R. – EHB 2040 removes prohibition in financial interest and ownership between the tiers • Money’s worth – prohibit M and D from providing things of value to R. – EHB 2040 allows manufacturers and distributors to provide branded promotional items of nominal value to retailer with conditions • All other Costco related issues rejected by Legislation 5 Privatization Efforts in Washington State Timeline: 2004 -2008 - Costco vs. Hoen Lawsuit 2009 - Joint Select Committee Beer/Wine Regulations • SHB 2040 Modifications to 3-Tier and Tied House Laws 2010 – • State Auditors Report • Legislative Bills to Privatize • Public Perception of State System • Initiatives 1100-1105 2011 - Liquor Control Board Response • Public Safety • Revenue • Convenience 6 2010 Opinion Page Editorials It’s time for the state liquor monopoly to go. This fall, Washington voters should support Initiative 1100, which keeps the state as the regulator of alcohol but not the retailer. The two tasks conflict. The state is set up to police the market, not to make money from it. Retail trade is not what government does best. While the board is divided on whether continued state control is preferable to privatization, it is persuaded that liquor sales are not essential services of state government. If Washington is to preserve its ability to provide essential educational and social services, it will need to pare state programs – even worthwhile ones. It’s time to shed this antique system, turn liquor distribution and marketing over to the free market, and enforce liquor laws without a conflict of interest or well-disguised and ignored irony. 7 Impact 1100: Deregulation of Alcohol 1. Repeals Pricing Restrictions on Alcohol Beverage Industry Initiative 1100 deregulates alcohol and treats it like any other product. It repeals traditional three-tier system, tied-house restrictions and price controls on spirits, beer and wine. Initiative 1100 allows pricing practices that are currently prohibited such as: Uniform pricing Retail-to-retail sales Quantity discounts No restrictions on financial Purchases on credit ownership or interest Central warehousing by retailers No restrictions on distribution 2. Terminates State Distribution and Retail of Spirits by December 2011 8 Impact 1105: – Terminates State Distribution and Retail of Spirits by April 01, 2012. Initiative 1105 directs the Liquor Control Board (LCB) to implement a plan to terminate the system of state liquor stores and liquor distribution and dispose of assets. • LCB policy, enforcement and licensing functions remain (unfunded) • Creates general licenses for retail and distribution • Over 930 state employee jobs eliminated • Over 155 small businesses impacted 9 Background Impacts of Initiative I-1100 I-1105 Spirits, Beer, Wine Spirits Yes Yes Date of Mandatory Closure December 31, 2011 April 1, 2012 Date Private Stores May Sell June 1, 2011 November 1, 2011 Allows Private Parties to Sell & Distribute Yes Yes Eliminates Board Mark-up Yes Yes Repeals Existing Liquor Taxes No Yes Distributors & Stores Subject to B&O taxes Yes Yes Distributor License Fee $2,000 $4,000 Retailer License Fee $1,000 $2,000 Large Retailers Large Distributors Scope of Initiative Closes State/Contract Liquor Stores Major Proponents Major Opposition In State Distributors, Unions, Law Enforcement, and Prevention Community 10 11 12 13 Privatization Efforts in Washington State Timeline: 2004 -2008 - Costco vs. Hoen Lawsuit 2009 - Joint Select Committee Beer/Wine Regulations • SHB 2040 Modifications to 3-Tier and Tied House Laws 2010 – • State Auditors Report • Legislative Bills to Privatize • Public Perception of State System • Initiatives 1100-1105 2011 - Liquor Control Board Response • Public Safety • Revenue • Convenience 14 Washington State Liquor Control Board Survey of Customers & Non-customers: Satisfaction & Potential Changes DECEMBER 2010 KEY FINDINGS 46% of all respondents shopped at a state liquor store in the last year •Frequency of shopping went down as age went up Stores got high marks from customers •Highest grades were for staff, cleanliness, safety, and supply •Lowest marks were for prices, and wine selection •7 in 10 were satisfied with selection High ratings for convenience •A’s and B’s for location, checkout speed, store layout and operating hours 2/3 said there were the “right number” of liquor stores •2/3 Customers said “right number” •4/10 Non-customers said “right number” Majority of customers supported suggested changes •On-line order •Expand items to include non-alcohol items •Open liquor stores inside other stores •Sell gift cards •Extend hours of operation Most Non-customers opposed every change Courtesy, Cleanliness Got Highest Grades; Wine Selection, Value, Prices Scored Lowest A B C D F DK Courtesy of staff 60% 29% Cleanliness of the store’s interior 60% 32% Safety in the store’s parking lot 56% 29% Adequate supply of product 54% 31% Professionalism of staff 53% 32% 45% Selection of liquor offered Number of staff members to help customers Outside attractiveness of the store 20% Selection of wines offered 20% Value for the money 18% Store’s prices 32% 28% Helpfulness in getting special order items 16% 11% 14% 16% 31% 35% Level of staff knowledge 11% 39% 38% Visibility of outside signs 20% 12% 39% 19% 21% 7% 26% 7% 18% 6% 53% 17% 31% 31% 6% 8% 36% 41% 8% 7% 4% 24% 21% 12% 27% 11% 6% 15% 6% Q8: Now, I’d like to ask about your impression of the liquor store you shop most frequently. As I read a list of things about the store, I would like you to rate each one. We will use a letter grade system, like they use in school, where “A” is Excellent, “B” is Good, “C” is Satisfactory, “D” is Unsatisfactory and “F” is Failing. 17 Convenience Factors Mostly Graded A or B A Convenience of the store’s location Speed of checkout Convenience of the interior layout Convenience of the store’s operating hours B C D F DK 56% 31% 10% 53% 36% 9% 49% 38% 42% 35% 10% 14% 5% Q10: Next, I’d like to ask you a few questions about customer convenience. Using the same grading scale as before, how would you rate… . 18 Most Customers Support Most Suggested Changes; Most Non-customers Oppose Good Idea 69% Allow order on-line, then pick up at store 37% NON-CUST 41% 23% 26% Allow sample tastings NON-CUST 69% 38% 8% 73% 10% 30% 12% 3% 38% 41% 3% 5% 54% 17% 3% 72% 55% Extend the hours of operation NON-CUST 52% 7% 5% Sell gift cards for redemption at stores 36% 3% 59% Open liquor stores inside other stores NON-CUST 55% 61% NON-CUST 26% 5% 8% Expand items available to include non-alcoholic NON-CUST Bad Idea 67% 2% 85% Q13: The state is considering some changes in the operation of its liquor stores. As I read a few of these, tell me whether you think that is a good idea or a bad idea. 19 Modernization Initiatives 2011-13 • 15 Stores and New Models – 8 new stores – Pilot up to 5 co-located within grocery stores – Open 2 new specialty “super stores” in dense, urban markets • Standardize store hours • Gift cards • Online ordering for pickup at store – Customer – Restaurant 20 Modernization Initiatives 2011-13 • Delivery to licensees – Contracted out to private sector • Liquor-related merchandise such as ice, corkscrews, and barware – Stocking contracted out to private sector • Sampling in liquor stores 21 22 Washington Pricing Revised Current $15.95 State Tax $5.06 State Profit $1.63 LCB Operational Cost $2.76 Standard Bottle Cost $6.50 $10.78 • Applying the California pricing model in Washington would reduce the average retail bottle price by 32% or $5.17 per bottle. • Annual revenue distribution would be reduced by 76% or $224 million 23 New Sales Tax $0.87 New Gallon Tax $0.65 LCB Operational Cost $2.76 Standard Bottle Cost $6.50 Washington California Comparison $15.95 State Tax $5.06 State Profit $1.63 LCB Operational Cost $2.76 Standard Bottle Cost $6.50 California $11.66 • LCB business operational expense is 32% less than average private sector. • Washington State distributes more than 4 times the money per bottle than California. 24 CA Sales Tax $0.93 CA Gallon Tax $0.65 Distributor & Retailer Mark-Up $3.58 Standard Bottle Cost $6.50 25 Questions 27