Chapter 3: Long-term financial planning

advertisement

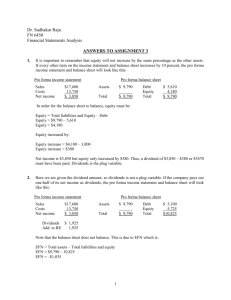

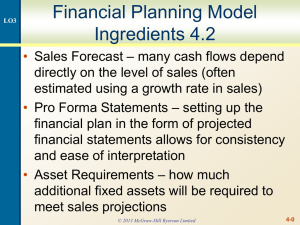

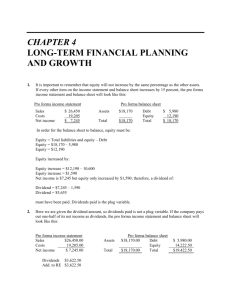

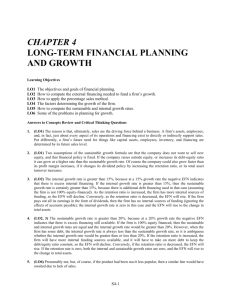

Chapter 3: Long-term financial planning Corporate Finance Ross, Westerfield, and Jaffe An overall picture Among all the financial ratios, return on equity (ROE = net income / equity) is probably the most scrutinized one among practitioners. Some practitioners view ROE as the bottom-line ratio. Thus, it is important to understand the sources (determinants) of ROE. The Du Pont Identity is popular among practitioners because it shows the determinants of ROE. The Du Pont Identity ROE = (NI / sales) × (sales / total assets) × (total assets / equity) = profit margin × total asset turnover × equity multiplier. The Du Pont Identity is the decomposition of ROE. ROE is a function of profitability, as measured by profit margin. ROE is a function of asset use efficiency, as measured by total asset turnover. ROE is a function of financial leverage. An example (Intel), I 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 ROE 30.60% 22.86% 27.72% 30.08% 32.55% 25.74% 22.39% 28.23% 3.60% 8.79% 14.91% 19.48% Profit margin 26.13% 19.86% 22.01% 24.73% 27.70% 23.10% 24.89% 31.24% 4.86% 11.65% 18.72% 21.97% Turnover 0.77 0.83 0.93 0.88 0.87 0.83 0.67 0.7 0.6 0.61 0.64 0.71 Multiplier 1.51 1.38 1.36 1.38 1.35 1.33 1.34 1.28 1.24 1.25 1.25 1.25 An example (Intel), II Intel’s ROEs seem to trend downward. Can you say something about what might have happen based on the ROE decomposition? It is also sometimes useful to compare the financial ratios (profit margin, total asset turnover, equity multiplier, etc.) of Intel with those of its peers. Pro forma analysis It is important for corporate insiders, and outside investors as well, to project future financial conditions of a firm. The process of projecting future financial conditions is call pro forma analysis. Pro forma analysis is used to generate after-tax cash flows estimates. This is the reason why we are studying Chapter 3 after we talked about those capital budgeting decision rules in Chapter 6. The default method that we use in this course is the percentage of sales approach. The percentage of sales approach The logic of the percentage of sales method is to assume that many items on the income statement and balance sheet increase (decrease) proportionally with sales. You should not be afraid to refine the estimates from this method if you have better information. Starting with sales forecasts Pro forma analysis starts with a sales forecast. For outside investors, there are at least 2 methods for obtaining sales forecasts: Use analysts’ forecasts. I/B/E/S regularly surveys analysts about their expectations on publicly held companies. See finance.yahoo.com. Use companies’ forecasts. Many companies provide sales estimates in their 10-Ks. Usually, better (worse) companies provide conservative (aggressive) estimates. These forecasts serve as starting points. Pro forma income statement, I For income statement, except for depreciation, interest expense, other income, and special items, all accounts are assumed to increase (decrease) proportionally with sales. That is, if sales will grow at 10% next year, costs (expenses) estimate except depreciation will also increase by 10% next year. This assumption is based on the observation that when a firm has sales increase, the firm needs to purchase more raw materials and needs more labor hours, etc. Pro forma income statement, II Depreciation is usually based on the asset base. It seems more reasonable to forecast depreciation as a percent of net plant and equipment. In addition, many firms provide depreciation estimates; these numbers are usually of high quality. Interest expense is a function of a firm’s financing decisions which may be independent of the firm’s operations and sales. If an item, e.g., other income and special items, is one-time in nature, its projected value is zero; unless you have more information about it. Pro forma balance sheet, I For balance sheet, cash, accounts receivable, inventories, net plant and equipment, accounts payable, and accruals are usually assumed to increase (decrease) proportionally with sales. There may be economies of scale in inventories. As a result, inventories may grow less rapidly than sales. There may be unused capacity in the exiting fixed assets. Thus, there may be no new fixed assets needed when sales increase moderately. Pro forma balance sheet, II Adding the additions to retained earnings (= NI available to common shareholders – dividends) in year T (income statement) to the retaining earnings in year T-1, you have the retained earnings in year T. Short-term investments, notes payable, longterm bonds, preferred stocks, and common stocks are “plug variables.” Pro forma balance sheet, III Plug variable(s): the source(s) of external financing (or dividends) needed to deal with any shortfall (or surplus) in financing and thereby bring the pro forma balance sheet into balance. At first we usually do not make any change to the value of a plug variable. Of course, this often will not lead to a balance for the pro forma balance sheet. EFN The difference between the right-hand-side and the left-hand-side of the statement at this stage is called “additional funds needed” (AFN) or external funds needed (EFN). If this number is positive, this means that the firm needs to raise money externally to support the firm’s growth. This amount can be financed by an increase in notes payable, long-term bonds, preferred stock, common stock, or a combination of the above. A reiterative process Preparing pro forma statements is a reiterative process. The main reason for this is that the interest expense in income statement is a function of the financing policy in balance sheet, while the retained earnings in balance sheet is a function of the addition to retained earnings in income statement. You will see this clearer when we actually work on the following mini-case. The real-life difficulties Most finance managers grouse that their companies aren't producing cash flow forecasts as quickly or as accurately as they should. In a global survey sponsored by working capital consultancy REL last summer for GTNews, a treasury news portal, only around one quarter of the 231 companies polled said the accuracy of their cash flow forecasts was "high" or "very high.“ Source: CFO.com. Mini-case – VTbeer Now, let us work on the pro forma statements for VTbeer Inc. Growth and EFN You have seen that when VTbeer experiences sales growth, it needs to expand and this requires EFN. Rule of thumb: the higher the rate of growth in sales, the greater will be the need for external financing. Growth in internal financing, via the increase in R/E, is rather slow. But, this causality is not purely one way. Financing policy also affects growth in real life. For example, VTbeer may expect higher sales, but choose not to borrow or to issue shares. If VTbeer imposes constraints on financing, it may raise the prices of its beers to increases profit and slow down sales growth. The internal growth rate If VTbeer is extremely conservative about financing, the firm may set its sales target on the internal growth rate. Internal growth rate: the maximum growth rate that can be achieved with no external financing of any kind (neither debt nor new equity). Only internally retained earnings are used to fund growth. Internal growth rate = (ROA × b) / ( 1 – ROA × b), where ROA = NI / total assets, and b is the retention ratio = addition to retained earnings / NI. The sustainable growth rate, I Sustainable growth rate (SGR): the maximum growth rate a firm can achieve with no external equity financing (no new shares) while it maintains a constant debt-equity ratio. SGR > IGR. This is a popular target for growth among many firms. This is the growth concept that most of Fortune 500 would use. Firms do not like to issue new shares because when they announce new issues, the prices of their old shares fall. Firms tend to have a comfort zone for their debt-equity ratios. The sustainable growth rate, II SGR = (ROE × b) / ( 1 – ROE × b), where b is the retention ratio. The higher the retention ratio, the higher the SGR. The higher the ROE, the higher the SGR. From the Du Pont Identity, we know that ROE is positively related to (1) profit margin, (2) total asset turnover, and (3) equity multiplier. Thus, SGR is positively related to 4 variables: (1) retention ratio, (2) profit margin, (3) total asset turnover, and (4) equity multiplier. SGR - implications If a firm wants to pursue a growth rate that is higher than its SGR, the firm must do at least one of the following: (1) retain more earnings within the firm (pay less dividends), (2) increase profit margin, (3) increase total asset turnover, (4) increase financial leverage (borrow more), or (5) sell new shares. End-of-chapter questions Concept questions: 3-5. Questions and problems: 1-13.