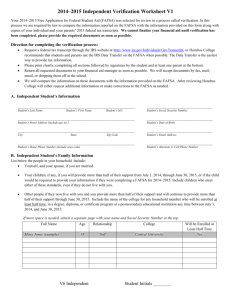

FAFSA Updates 2015

advertisement

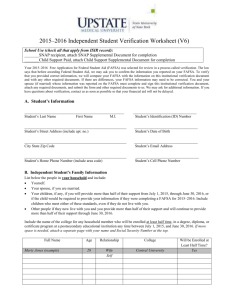

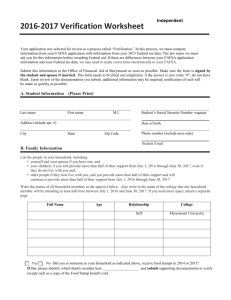

® 2015-2016 FAFSA Updates Applicant Products Team Agenda • • • • 2 Introduction Enhancements for January 1, 2015 IRS Website Updates Q&A Session Scheduled enhancements for January 1, 2015 3 Foster Care Youth Issue: Legislation now requires the FAFSA to ask applicants if they’ve ever been in foster care. Solution: A new question will display in FAFSA on the Web, and students who answer “Yes” will receive messaging about potential resources available to them. 4 Foster Care Youth (Cont’d) 5 Foster Care Youth (Cont’d) 6 Foster Care Youth (Cont’d) 7 Freely Associated States Issue: Students from the Freely Associated States often use a new pseudo-SSN each year. This became problematic with the implementation of Pell LEU. Solution: FSA will provide guidance to returning students who are from the Freely Associated States to use the pseudo-SSN already assigned to them when they complete the FAFSA in subsequent years. 8 Freely Associated States (Cont’d) 9 Freely Associated States (Cont’d) 10 Freely Associated States (Cont’d) 11 Text Updates Issue: Members of the financial aid community have identified specific FAFSA questions that are particularly troublesome for applicants. Solution: Question labels and help text will be modified to provide clearer guidance. 12 Date of Legal Residence 13 Select Foreign Country from the “In what state is your high school located?” dropdown box if you received a foreign school diploma that is equivalent to a U.S.n international high school diploma. Neither Citizen Nor Eligible Noncitizen 14 High School Diploma 15 Parents’ Number in College Question 74: How many people in your parents’ household (from question 73) will be college students between July 1, 2015 and June 30, 2016? 16 Legal Parent 17 Legal Parent (Cont’d) 18 Legal Parent (Cont’d) 19 Separated 20 Gender 21 School Selection 22 School Selection (Cont’d) 23 School Selection (Cont’d) 24 Amended Return 25 Availability of IRS DRT 26 IRS DRT Clarification Issue: There is a desire in the community to improve the clarity and completeness of the help and authentication pages related to the IRS DRT. Solution: FSA enhanced the Help topics, switched the position of action buttons to improve customer experience and modified the authentication text to clarify the correct format for data entry such as address. IRS DRT Clarification (Cont’d) Get My Federal Income Tax Information See our Privacy Notice regarding our request for your personal information. Enter the following information from your <YYYY> Federal Income Tax Return. First Name* Joe Last Name * Smith Social Security Number * *** - **- 6789 Date of Birth Required fields* * Filing Status * 01 / 04 / 1990 Select One Address - Must match your <YYYY> Federal Income Tax Return. Street Address * P.O. Box (Required if entered on your tax return) Apt. Number (Required if entered on your tax return) 28 IRS DRT Clarification (Cont’d) Technical Difficulties A technical problem has occurred. Return to the FAFSA and enter your responses to the financial questions using the information provided on your Federal tax return. 29 IRS DRT Clarification (Cont’d) The information you entered does not match the IRS records. What went wrong? • Your name may have changed. Use the name that matches your <YYYY> Federal Income Tax Return. • Check your filing status. Use the filing status that matches your <YYYY> Federal Income Tax Return. IRS DRT Clarification (Cont’d) The address you entered does not match the IRS records. What went wrong? • Your address may have changed. Enter the address that matches your <YYYY> Federal Income Tax Return. Don’t forget to include your apartment number if applicable. The number symbol (#) is not valid for identifying an apartment number. Entering abbreviations (St, Ln, Ave, Crt, Ct, Rd) in the ‘street address’ field will not impact the retrieval of your Federal Income Tax Information. 31 IRS DRT Clarification (Cont’d) Help – Microsoft Internet Explorer Address ? Enter the address that matches your Federal Income Tax Return. Entering abbreviations (St, Ln, Ave, Crt, Ct, Rd) in the ‘street address’ field will not impact the retrieval of your Federal Income Tax Information. • Your current address may not be the same as the address we have on record for you. • Your school address may not be the address you entered on your tax return. • Don’t forget to include your apartment number if youInternet entered Explorer it on your tax return. The number Help Help – – Microsoft Microsoft Internet Explorer symbol (#) is not valid for identifying an apartment number. Use the following examples as a guide: 32 Q&A 33