Monetary System: Economics Textbook Chapter

advertisement

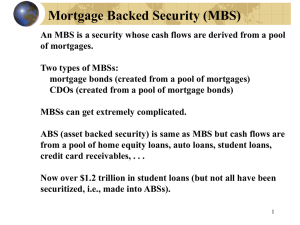

Click on the button to go to the problem © 2013 Pearson The Monetary System 27 CHECKPOINTS © 2013 Pearson Click on the button to go to the problem Checkpoint 27.1 Problem 1 Clicker version Checkpoint 27.2 Problem 1 Clicker version Clicker version Checkpoint 27.3 Problem 1 Clicker version Problem 2 Clicker version Clicker version Problem 2 Problem 2 Problem 3 Problem 3 Problem 3 In the news Problem 4 Problem 4 In the news In the news © 2013 Pearson Click on the button to go to the problem Checkpoint 27.4 Problem 1 Problem 2 Clicker version Problem 3 Clicker version In the news © 2013 Pearson CHECKPOINT 27.1 Practice Problem 1 In the United States today, money includes which of the following items? Your Visa card The quarters inside vending machines U.S. dollar bills in your wallet The check that you have just written to pay for your rent The loan you took out last August to pay for your school fees © 2013 Pearson CHECKPOINT 27.1 Solution Money is defined as means of payment. Only the quarters inside vending machines and U.S. dollar bills in your wallet are money. © 2013 Pearson CHECKPOINT 27.1 Study Plan Problem In the United States today, money includes ___________. A. Your Visa card, the quarters inside vending machines, and the U.S. dollar bills in your wallet. B. The U.S. dollar bills in your wallet and your Visa card, but not quarters inside vending machines. C. The quarters inside public phones, the U.S. dollar bills in your wallet, the check you wrote to pay the rent, and the loan you took out to cover the school fees. D. The U.S. dollar bills in your wallet and the quarters inside vending machines, but not your Visa card. © 2013 Pearson CHECKPOINT 27.1 Practice Problem 2 In January 2011, • Currency held by individuals and businesses was $920 billion • Traveler’s checks were $5 billion • Checkable deposits owned by individuals and businesses were $926 billion • Savings deposits were $5,378 billion • Small time deposits were $905 billion • Money market funds and other deposits were $705 billion. Calculate M1 and M2 in January 2011. © 2013 Pearson CHECKPOINT 27.1 Solution M1 is the sum of Currency held by individuals and businesses, $920 billion, Traveler’s checks, $5 billion, and Checkable deposits owned by individuals and businesses, $926 billion. M1 = ($920 + $5 + $926 ) billion = $1,851 billion. © 2013 Pearson CHECKPOINT 27.1 M2 is the sum of • M1, $1,851 • Savings deposits, $5,378 billion • Small time deposits, $905 billion • Money market funds and other deposits, $705 billion M2 = ($1,851 + $5,378 + $905 + $705) billion M2 = $8,839 billion. © 2013 Pearson CHECKPOINT 27.1 Practice Problem 3 In August 2011, • M1 was $2,108 billion • M2 was $9,545 billion • Checkable deposits owned by individuals and businesses were $1,127 billion • Time deposits were $810 billion • Money market funds and other deposits were $716 billion. Calculate currency and traveler’s checks held by individuals and businesses and calculate savings deposits. © 2013 Pearson CHECKPOINT 27.1 Solution Currency and traveler’s checks equals M1 ($2,108 billion) minus checkable deposits owned by individuals and businesses ($1,127 billion). Currency and traveler’s checks held by individuals and businesses is $981 billion. Saving deposits equals M2 ($9,545 billion) minus M1 ($12,108 billion) minus time deposits ($810 billion) minus money market funds and other deposits ($716 billion). Saving deposits are $5,911 billion. © 2013 Pearson CHECKPOINT 27.1 In the news The cell phone as wallet: Will the trend catch on? In the next few years, you'll be able to pull out your cell phone and wave it over a scanner to make a payment. The convenience of whipping out your phone as a payment mechanism is driving the transition. Source: CTVNews.ca, September 24, 2011 As people use their cell phones to make payments, will currency disappear? How will the components of M1 change? Will debit cards disappear? © 2013 Pearson CHECKPOINT 27.1 Solution Most people will probably carry less currency, but it won’t disappear because currency is used in the underground economy. Most of M1 will be checkable deposits. Cell phones and debit cards will be perfect substitutes, so debit cards will probably disappear. © 2013 Pearson CHECKPOINT 27.2 Practice Problem 1 What are the institutions that make up the U.S. banking system? © 2013 Pearson CHECKPOINT 27.2 Solution The institutions that make up the U.S. banking system are • The Fed • Commercial banks • Thrift institutions • Money market funds © 2013 Pearson CHECKPOINT 27.2 Study Plan Problem The institutions that make up the U.S. banking system are ______. A. the Fed and money market funds B. thrift institutions, the Fed, money market funds, and commercial banks C. New York Stock Exchange, the Fed, and banks D. the New York Stock Exchange and the U.S. Treasury E. the Fed and commercial banks © 2013 Pearson CHECKPOINT 27.2 Practice Problem 2 What is a bank’s balancing act? © 2013 Pearson CHECKPOINT 27.2 Solution A bank makes a profit by borrowing from depositors at a low interest rate and lending at a higher interest rate. The bank must hold enough reserves to meet depositors’ withdrawals. The bank’s balancing act is to balance the risk of loans (profits for stockholders) against the security for depositors. © 2013 Pearson CHECKPOINT 27.2 Study Plan Problem What is a bank’s balancing act? A bank must balance _______ against _____. A. security for depositors; profit for stockholders B. high-risk loans; lending to business and home buyers C. lending to business and home buyers; profit for stockholders D. cash assets; securities E. long-term loans; long-term deposits © 2013 Pearson CHECKPOINT 27.2 Practice Problem 3 A bank has the deposits and assets set out in the table. Calculate the bank’s • Total deposits • Deposits that are part of M1 • Deposits that are part of M2 The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 Solution The bank’s deposits and assets $320 in checkable deposits Total deposits are $320 + $896 + $840 = $2,056. $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 Deposits that are part of M1 are checkable deposits, $320. The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 Deposits that are part of M2 are checkable deposits, savings deposits, and small time deposits. Deposits that are part of M2 total $2,056. The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 Practice Problem 4 A bank has the deposits and assets set out in the table. Calculate the bank’s • Loans • Securities • Reserves The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 Solution Loans are loans to businesses and outstanding credit card balances. Loans equal $990 + $400 = $1,390. The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 Securities are $634. The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 The bank’s reserves are its reserve account at the Fed and the bank’s currency in its vaults and ATMS. Reserves are $30 + $2 = $32. The bank’s deposits and assets $320 in checkable deposits $896 in savings deposits $840 in small time deposits $990 in loans to businesses $400 in outstanding credit card balances $634 in government securities $2 in currency $30 in its reserve account at the Fed. © 2013 Pearson CHECKPOINT 27.2 In the news Regulators close Georgia bank in 95th failure for the year Regulators shut down Atlanta-based Georgian Bank. On July 24, 2009, Georgian Bank has $2 billion in assets and $2 billion in deposits. By 29 September, 2009, Georgian Bank had lost about $2 billion in home loans and other assets. Source: USA Today, September 30, 2009 Explain how Georgian Bank’s balancing act failed. © 2013 Pearson CHECKPOINT 27.2 Solution In July, Georgian Bank’s $2 billion of assets (home loans and securities) balanced its deposits of $2 billion. The bank expected to make a profit on its assets that exceeded the interest it paid to depositors. The financial crisis increased the risk on all financial assets. The bank was now holding assets that were more risky than it had planned to hold. © 2013 Pearson CHECKPOINT 27.2 As people defaulted on their home loans and the value of securities fell, the value of Georgian Bank’s assets crashed to about minus $2 billion. With fewer assets than deposits, regulators had no choice other than close the bank and sell its assets and deposits. The bank failed to balance risk against profit. © 2013 Pearson CHECKPOINT 27.3 Practice Problem 1 What is the Fed and what is the FOMC? © 2013 Pearson CHECKPOINT 27.3 Solution The Federal Reserve (Fed) is the central bank in the United States. The central bank in the United States is a public authority that provides banking services to banks and the U.S. government and that regulates the quantity of money and the banking system. The FOMC is the Federal Open Market Committee. The FOMC is the Fed’s main policy-making committee. © 2013 Pearson CHECKPOINT 27.3 Study Plan Problem The Fed is _______and the FOMC is _______. A. the U.S. central bank; the New York Federal Reserve B. a federation of commercial banks; its management committee C. the U.S. central bank; the Fed’s main policy-making committee D. the world’s central bank; the Fed’s chairman and the U.S. president © 2013 Pearson CHECKPOINT 27.3 Practice Problem 2 Who is the Fed’s chief executive? What are the Fed’s main policy tools? © 2013 Pearson CHECKPOINT 27.3 Solution The Fed’s chief executive is the Chairman of the Board of Governors, currently Ben Bernanke. The Fed’s main policy tools are required reserve ratios, the discount rate, and open market operations. © 2013 Pearson CHECKPOINT 27.3 Study Plan Problem What are the Fed’s main policy tools? A. Discount rate, interest rates, and open market operations B. Open market operations and required reserve ratios C. The monetary base and the discount rate D. Required reserve ratios, discount rate, and open market operations E. The monetary base and open market operations © 2013 Pearson CHECKPOINT 27.3 Practice Problem 3 What is the monetary base? © 2013 Pearson CHECKPOINT 27.3 Solution The monetary base is the sum of • Coins • Federal Reserve notes (dollar bills) • Banks’ reserves at the Fed © 2013 Pearson CHECKPOINT 27.3 Study Plan Problem The monetary base is ______. A. the sum of U.S. government securities and loans made by the Fed to commercial banks B. excess reserves held by the commercial banks C. the sum of gold and U.S. currency held by U.S. citizens but not U.S. currency held foreigners D. money held by the regional federal reserve banks E. the sum of coins, Federal reserve notes, and banks’ reserves at the Fed © 2013 Pearson CHECKPOINT 27.3 Practice Problem 4 Suppose that at the end of December 2009, • The monetary base in the United States was $700 billion. • Federal Reserve notes were $650 billion. • Banks’ reserves at the Fed were $20 billion. Calculate the quantity of coins. © 2013 Pearson CHECKPOINT 27.3 Solution The monetary base is the sum of coins, Federal Reserve notes, banks’ reserves at the Fed. Quantity of coins = Monetary base – Federal Reserve notes – Banks’ reserves at the Fed. At the end of December 2009, the monetary base was $700 billion, Federal Reserve notes were $650 billion, and banks’ reserves at the Fed were $20 billion. Quantity of coins = $700 billion – $650 billion – $20 billion = $30 billion. © 2013 Pearson CHECKPOINT 27.3 In the news Risky assets: Counting to a trillion Prior to the September 15, 2008, … the Fed held less than $1 trillion in assets, most of which were in U.S. government securities. By mid-December, 2008, the Fed’s balance sheet had more than doubled to over $2.3 trillion. Much of the increase was in mortgage-backed securities. The massive expansion began when the Fed rolled out its lending program—sending banks cash in exchange for risky assets. Source: CNNMoney, September 29, 2009 What are the Fed’s policy tools and which policy tool did the Fed use to increase its assets to $2.3 trillion in 2008? © 2013 Pearson CHECKPOINT 27.3 Solution The Fed’s policy tools are the required reserve ratio, discount rate, open market operations, and extraordinary crisis measures. The Fed used an extraordinary crisis measure called credit easing. The Fed’s lending program took banks’ own risky assets to increase their reserve deposits at the Fed. © 2013 Pearson CHECKPOINT 27.4 Practice Problem 1 How do banks create new deposits by making loans? What factors limit the amount of deposits and loans that banks can create? © 2013 Pearson CHECKPOINT 27.4 Solution Banks can make loans when they have excess reserves—reserves in excess of those required. When a bank makes a loan, it creates a new deposit for the person who receives the loan. The bank uses its excess reserves to create new deposits. The amount of loans that the bank can make, and therefore the amount of new deposits that it can create, is limited by the monetary base, the desired reserve ratio, and the currency drain ratio. © 2013 Pearson CHECKPOINT 27.4 Practice Problem 2 If the Fed makes an open market sale of $1 million of securities, who can buy the securities to the Fed? What initial changes occur in the economy if the Fed sells to a bank? © 2013 Pearson CHECKPOINT 27.4 Solution The Fed sells securities to banks or the public, but not the government. The initial change is an decrease in the monetary base of $1 million. Ownership of the securities passes from the Fed to the bank and the Fed’s assets decrease by $1 million. The bank pays for the securities by decreasing its reserves at the Fed by $1 million. © 2013 Pearson CHECKPOINT 27.4 The Fed’s liabilities decrease by $1 million. The bank’s assets are the same, but their composition has changed. The bank has $1 million less in reserves and $1 million more in securities. © 2013 Pearson CHECKPOINT 27.4 Study Plan Problem If the Fed makes an open market purchase of $1 million of securities, who can sell the securities to the Fed? A. B. C. D. E. The government or the public Only the public The banks or the government The banks or the public The banks, the public, or the government © 2013 Pearson CHECKPOINT 27.4 Study Plan Problem When the Fed makes an open market purchase from a bank, the monetary base _____. The bank’s deposit with the Fed _____. The bank’s total assets _____, reserves ______ and securities _____. A. decreases; decreases; are the same; decrease; increase B. increases; increases; decrease; increase; decrease C. increases; increases; increase; decrease; increase D. increases; increases; are the same; increase; decrease E. decreases; decreases; decrease; decrease; increase © 2013 Pearson CHECKPOINT 27.4 Practice Problem 3 If the Fed makes an open market sale of $1 million of securities, what is the process by which the quantity of money changes? What factors determine how much the quantity of money changes? © 2013 Pearson CHECKPOINT 27.4 Solution When the Fed sells securities to a bank, the bank’s reserves decrease by $1 million, but its deposits do not change, so the bank is short of reserves. The bank calls in loans and deposits decrease by the same amount. The desired reserve ratio and the currency drain ratio determine the decrease in the quantity of money. The larger the desired reserve ratio or the currency drain ratio, the smaller is the decrease in the quantity of money. © 2013 Pearson CHECKPOINT 27.4 Study Plan Problem If the Fed makes an open market sale , the larger the ______, the smaller is the decrease in the quantity of money. A. open market sale or the currency drain ratio B. currency drain ratio or smaller the desired reserve ratio C. desired reserve ratio or the smaller the currency drain ratio D. open market sale or the smaller the desired reserve ratio and the currency drain ratio E. the desired reserve ratio or the currency drain ratio © 2013 Pearson CHECKPOINT 27.4 In the news Fed doubles monetary base During the fourth quarter of 2008, the Fed doubled the monetary base, but the quantity of money (M2) increased by only 5 percent. Source: Federal Reserve Why did the quantity of M2 not increase by much more than 5 percent? What would have happened to the quantity of M2 if the Fed had kept the monetary base constant? © 2013 Pearson CHECKPOINT 27.4 Solution The quantity of M2 equals the money multiplier, (1 + C/D) divided by (R/D + C/D), multiplied by the monetary base. (R/D is the banks’ desired reserve ratio and C/D is the currency drain ratio). The quantity of M2 didn’t increase by more because the banks increased their desired reserve ratio, R/D, which decreased the money multiplier. If the Fed had not increased the monetary base, the quantity of M2 would have decreased because the money multiplier decreased. © 2013 Pearson