HERE - Macon County, NC

advertisement

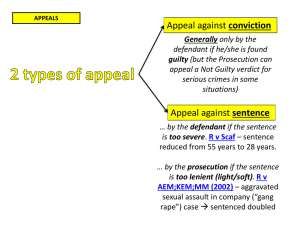

NCGS 105-286 & 105-283 Requires Counties to Establish market values ● ●Value must be at or near 100% of current market value ● Utility companies requires values to be between 90-100% of market values ● To reflect changes in the market conditions Appraisal Process • Collect & Review Sales • Route all 369 County Maps • Map Sales From 2013 & 2014 • Analyze Construction Cost • Develop Land Pricing Model • Develop Schedule of Values • Apply Schedule of Values to Properties Appraisal Process Continued • • • • • • • • • • • Visit Properties Review Sales to Comparable Properties Identify Any Areas of Concern Correct any Concern Areas Send Notice of Value to Property Owner Receive Any Informal Appeals and Review Send Notice of Change Begin Taking Formal Appeals to Board of Equalization Set Hearing Dates and Times After all Hearings send Notice of Change from Board of E&R Property Owners then have 30 Days to Appeal to Property Tax Commission in Raleigh, NC THREE APPROACHES TO VALUE Comparable Sales Approach: Subject property is compared with similar properties that have recently sold. Income Approach: This approach uses income derived from similar properties in the same area. Income is not the value that individual business generate but what similar income producing properties will produce. An Example would be that all Two Bedroom apartments rent for $500 monthly in a given location thus the value of a 20 unit apartment can be determined. Cost Approach: Construction cost less depreciation MARKET VALUE Market value is the most probable selling price that a property will bring in a competitive and open market with both the buyer and seller being motivated and well informed. MARKET VALUE IS NOT Transactions resulting from auctions Short sales Some Estate sales Bank liquidation sales Foreclosures Family or associates sales The most obvious is an addition or remodeling of a structure. Supply and Demand in a particular type of property. The local economy and the factors that determine its stability. Cost of replacing or building similar structures. County’s Growth Rate Has Led WNC For Past Twenty Years County Leads WNC In Sales Growth Population Is Expected To Continue To Rise Population Growth 40,000 35,000 30,000 25,000 1980 20,000 1990 15,000 2000 10,000 2020 5,000 2000 0 1980 1990 2000 2020 1980 45000 40000 35000 30000 25000 20000 15000 10000 5000 0 1991 1999 2001 2014 1991 1999 2001 2014 REAL ESTATE MARKET INDICATORS REAL ESTATE SALES 2010-2014 EXCLUSIVE HOME SALES REAL ESTATE MARKET ACTIVITY Code A - TWO OR MORE PARCELS B - OTHER IMPROVMENTS INCLUDED C - REVENUE STAMPS < $6.00 ($3,000) D - DATE OUT OF RANGE E - RELATIVE OR BUSINESS F - CONVEYING INTEREST ONLY G - LIFE ESTATE OR OTHER INTEREST H - GRANTOR POSSESSION I - GOVT, LENDING, UTILITY IC - IMP COMM IR - IMP RESIDENTAIL J - TAX EXEMPT K - CHURCH OR SCHOOL M - IN MORE THAN ONE COUNTY MR - MANF HOME O - INCLUDES PERSONAL PROPERTY P - FORCED SALE OR AUCTION R - TRADE OR EXCHANGE TC - TOWNHOUSE/CONDO VC - VACANT COMMERCIAL VR - VACANT RESIDENTIAL X - OTHER TOTAL 2014 190 5 1,023 74 7 18 94 16 411 6 2 64 2 45 24 1 163 25 2,170 2013 215 2 1,196 42 7 3 126 9 461 12 2 3 53 2 57 23 8 190 57 2,468 2012 175 1,143 40 3 1 158 11 325 2 7 48 52 18 2 92 112 2,189 2011 155 942 218 4 1 317 6 257 9 4 34 2 15 1 7 2 120 91 2,185 2010 192 9 1,014 57 5 5 107 9 236 3 2 41 5 2 10 2 148 72 1,919 VALID INVALID 679 1,491 744 1,724 496 1,693 426 1,759 446 1,473 VALID SALES SALES > $500,000 SALES > $1,000,000 2014 63 25 2013 52 11 2012 49 15 2011 34 6 2010 29 14 REVENUE NEUTRAL TAX RATE 2014 TAX VALUE OF ALL PROPERTY $ 9,348,950,012 2014 TAX VALUE TOTAL TAXES x .00279 $26,083,570 2015 TOTAL REAL ESTATE VALUE $ 7,733,733,213 2015 ESTIMATE PUBLIC SERVICE $ 130,000,000 2015 ESTIMATE MOTOR VEHICLES $ 271,595,000 2015 SUB TOTAL $ 8,135,328,213 LESS APPEALS’ VALUE $ (100,000,000) LESS HOMESTEAD EXCLUSSION $ ( 70,000,000) NET TOTAL NEW TAX VALUE $ 7,965,328,213 ROUND TO $ 7,965,000,000 $ 7,965,000,000 OVERALL DECREASE OF VALUE: 14.80% $7,965,000,000 / 9,348,950,012 REAL ESTATE ONLY DECREASED 14.52 % $ 7,563,733,213 / 8,848,875,468 TAX REVENUE NEEDED/TOTAL VALUE $26,083,570 / $7,965,000,000 = .003274 ROUNDED TO $ .0033 2007 VALUES & TAXES COMPARED TO 2015 VALUES & TAXES PIN # 7448-58-3589 HOUSE & 87 ACRES 2007 Value $1,248,310 2014 Tax Rate .00279 Base Tax $ 3,482 2015 Value $935,160 Est. Tax Rate .0033 Base Tax $3,086 Savings $ 396 Decrease of 11.4% PIN # 7438986076 2007 Value $ 316,270 2014 Tax Rate .00279 Base Tax $ 882 2015 Value $ 260,500 Est. Tax Rate .0033 Base Tax $ 859 Savings $ 23 Decrease of 2.6% PIN # 7438-97-6569 2007 Value $ 148,040 2014 Tax Rate .00279 Base Tax $ 413 2015 Value $ 100,880 Est. Tax Rate .0033 Base Tax $333 Savings $ 80 Decrease of 20% PIN # 7530-93-7003 2007 Value $1,166,770 2014 Tax Rate .00279 Base Tax $3,255 2015 Value $ 907,620 Est. Tax Rate .0033 Base Tax $2,995 Savings $ 260 Decrease of 8% PIN # 6580-49-7864 HOUSE & 17.43 ACRES 2007 Value $522,040 2014 Tax Rate .00279 Base Tax $1,456 2015 Value $396,170 Est. Tax Rate .0033 Base Tax $1,307 Savings $149 Decrease of 10.4% PIN # 7540-41-2457 2007 Value $ 182,780 2014 Tax Rate .00279 Base Tax $ 510 2015 Value $ 220,000 Est. Tax Rate .0033 Base Tax $ 726 Increase of $ 216 Increase of 42.35% PIN # 7540-52-3321 2007 Value $1,002,780 2014 Tax Rate .00279 Base Tax $2,798 2015 Value $1,846,810 Est Tax Rate .0033 Base Tax $ 6095 Increase of $ 3,297 Increase of 118% PIN # 6581-70-0263 2007 Value $ 115,510 2014 Tax Rate .00279 Base Tax $322 2015 Value $111,450 Est. Tax Rate .0033 Base Tax $368 Increase $46 Increase of 14.3% PIN #6581-41-8759 2007 Value $127,990 2014 Tax Rate .00279 Base Tax $357 2015 Value $127,730 Est. Tax Rate .0033 Base Tax $421 Increase $64 Increase of 18% PIN # 7550-23-4331 2007 Value $ 14,155,100 2014 Tax Rate .00279 2014 Base Tax $ 39,493 2015 Value $ 10,190,130 Est. Tax Rate $ .0033 Base Tax $ 33,628 Decrease $ 5,865 Decrease of 14.85% FINALLY Reassessments are volatile and established procedures must be followed. The established appeal process outlined by the Machinery Act must be adhered to. Equality between similar properties must be one of the top priorities. Properties will not increase at the same percentage countywide. Location is still very much a factor. Things to Remember Values must be set at 100% of Market Value. Percentage of increase is not a reason for an appeal. Value may or may not be what the owner has invested in the property. Burden of proof is on taxpayer to show that property is excessively overvalued. Different classes of properties change at different rates. NC courts have ruled that tax assessments are assumed to be correct and are accepted until proof is provided to the contrary. Location or demand on certain types of properties will affect values differently depending on the market. Summary of Important Information Values will be finalized by December 2014 Notices will be mailed in January 2015 Appeal information will accompany the notice of value Informal appeals must be a written appeal supported with documentation of value Board of Equalizations starts April 2015 2015 VALUATION BY TOWNSHIPS G R O S S V A L U E S TWP TOTAL PCLS FRANKLIN 8,282 MILLSHOAL 3,704 ELLIJAY 3,203 SUGARFORK 1,518 HIGHLANDS 3,999 FLATS 1,185 SMITHBRIDGE 4,480 CARTOOGECHAYE 3,146 NANTAHALA 2,476 BURNINGTOWN 1,279 COWEE 3,722 FRANKLIN CITY 2,527 HIGHLANDS CITY 2,927 42,448 2007 Taxable $ 1,103,872,780 $ 389,495,910 $ 370,791,250 $ 221,051,440 $ 2,051,601,730 $ 321,882,710 $ 578,994,680 $ 442,611,210 $ 433,406,203 $ 161,007,280 $ 439,669,325 $ 628,336,480 $ 1,800,491,780 $ 8,943,212,778 2015 Taxable $ 924,939,240 $ 317,270,230 $ 300,883,180 $ 174,230,050 $ 1,787,614,120 $ 237,907,640 $ 459,072,710 $ 370,669,510 $ 342,897,923 $ 122,791,970 $ 328,730,700 $ 618,201,480 $ 1,746,013,960 $ 7,731,222,713 PROJECTED TAX BASE TAX RATE TAX $ Trend FRANKLIN MILLSHOAL ELLIJAY SUGARFORK HIGHLANDS FLATS SMITHBRIDGE CARTOOGECHAYE NANTAHALA BURNINGTOWN COWEE FRANKLIN CITY HIGHLANDS CITY 1,103,481,410 390,149,280 370,413,680 220,966,150 2,054,187,930 321,887,220 578,940,960 442,539,120 432,822,513 161,871,270 439,877,355 628,291,760 1,800,688,190 -16.21% -18.54% -18.85% -21.18% -12.87% -26.09% -20.71% -16.25% -20.88% -23.74% -25.23% -1.61% -3.03% (178,870,100.43) (72,346,836.84) (69,836,883.88) (46,803,324.54) (264,320,386.46) (83,976,246.60) (119,910,843.46) (71,929,982.54) (90,386,387.93) (38,420,379.27) (110,991,115.73) (10,134,278.67) (54,483,762.81) 8,946,116,838 -13.55% (1,212,383,625.12) $ DIFF $ (178,933,540) $ (72,225,680) $ (69,908,070) $ (46,821,390) $ (263,987,610) $ (83,975,070) $ (119,921,970) $ (71,941,700) $ (90,508,280) $ (38,215,310) $ (110,938,625) $ (10,135,000) $ (54,477,820) $ (1,211,990,065) $ $ % CHG -16.21% -18.54% -18.85% -21.18% -12.87% -26.09% -20.71% -16.25% -20.88% -23.74% -25.23% -1.61% -3.03% -13.55% 2007 2015 LOSS 8,946,116,838 $ 7,733,733,213 -13.55% 0.00279 0.00323 $ 1,212,383,625 24,959,666 B E F O R E A P P E A L S MACON COUNTY, NORTH CAROLINA NOTICE OF PROPERTY REVALUATION THIS IS NOT A BILL MACON COUNTY TAX ADMINISTATOR 5 W MAIN STREET FRANKLIN, NC 28734 RETURN SERVICE REQUESTED PIN #: Acreage/Lot: Date of Notice Market Value: Deferred Value: Net Total Value: YOU ARE HEREBY NOTIFED THAT AS OF 01/01/2015 YOUR ASSESSED VALUE HAS BEEN CHANGED DUE TO THE 2015 COUNTY WIDE REVALUATION OF ALL REAL PROPERTY IN MACON COUNTY. DETACH ONLY IF YOU WISH TO APPEAL THE VALUE OF THIS NOTICE. PLEASE RETAIN TOP OF FORM FOR YOUR RECORDS MACON COUNTY INFORMAL REVIEW FORM If you wish to appeal the value of this notice. You must complete this form in its entirety and return by mail within 30 days of the date of this notice. Macon County Revaluation personnel will review your assessed value based on the information provided on this form. A change in value will be considered if the owner can demonstrate that the assessed value is more than market value as of 01/01 /2015, or is inconsistent with the value of similar property. APPEALS WILL NOT BE TAKEN BY TELEPHONE PIN # DATE OF NOTICE PROPERTY DESC MARKET VALUE DEFERRED VALUE NET VALUE A review of assessed values may result in assessments being: (1) left unchanged, (2) reduced, or (3) increased in value. PLEASE INDICATE WHICH OF THE FOLLOWING APPLIES TO YOUR PROPERTY (CHECK ONE OR BOTH) _____ _____ The subject property is appraised at more than it’s fair market value. The subject property is not equally appraised as compared with similar properties. Please list comparable properties on back. What in your opinion is the FAIR MARKET VALUE as of 01/01/2015? $ Is your opinion of market value (1)____ Personal Judgment, (2) ____ Recent Appraisal, (3) ____ Comparable Sales, (4) ____ Income/Expense Data, (5) Other What was the purchase date and price (If purchased since 1/1/2013)? ____/____/______ Describe any major building or remodeling and the cost involved (since 1/1/2013) $ $ If listed for sale in the past two years, please complete the following: List Price $ Name of Broker/Agent Dates of Listing Period (From & To) PLEASE ATTACH COPIES OF INFORMATION OR EVIDENCE SUPPORTING YOUR OPINION OF VALUE. Under penalties prescribed by law, I hereby affirm that to the best of my knowledge and belief that the information submitted on this appeal form, including accompanying statements and other information is true and correct. SIGNATURE OF OWNER DATE DAYTIME TELEPHONE (If agent or representative of owner, please attach notarized Power of Attorney) All requests must be made within 30 days of the date of this notice. RETURN THIS FORM ONLY IF YOU WISH TO APPEAL THE ASSESSED VALUE. STANDARDS FOR APPRAISAL AND ASSESSMENT: North Carolina General Statute 105-283 Uniform Appraisal Standards. All property, real and personal, shall as far as practicable be appraised or valued at it’s true value in money… the words “true value” shall be interpreted as meaning market value, that is, the price estimated in terms of money at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of all the uses to which the property is adapted and for which it is capable of being used. INFORMAL REVIEW PROCESS: If you wish to appeal the value of this notice. You must complete, in entirety, the Macon County Informal Review Form and return it to the Macon County Revaluation office by mail or drop off (within 30 days of the date of this notice). Macon County Revaluation personnel will review your assessed value based on the information provided on this form. A change in value will be considered if the owner can demonstrate that the assessed value is more than ma rket value as of 01/01/2015, or is inconsistent with the value of similar property. You will receive written notice of the results of the informal review. BOARD OF EQUALIZATION AND REVIEW: If you disagree with the results of your Informal Review, you have a right to file a formal appeal to the Board of Equalization and Review. You may request and appeal any time prior to the adjournment of the Board of Equalization and Review or within 15 days of your last notice of Assessed Value. All requests for app eal must be made in writing and on the proper form. Appeal forms are available at the Macon County Administrator’s Office. Actual time and dates will be advertised in the local newspaper. The first meeting of the Board of Equalization and Review must be held no earlier than the first Monday in April and no later than the first Monday in May. Market Value is not: Actual or Historic Cost Condemnation Value Forced Sale/Foreclosure Liquidation Value or Salvage Value Aesthetic Value Construction Cost Inheritance Value Present-Use Value Bank Sale Depreciated Asset or Book Value Insured Value Short Sale GROUNDS FOR REVIEW OR APPEAL CANNOT INCLUDE THE FOLLOWING: The percentage of increase over the previous reappraisal Your financial ability to pay the anticipated tax COMPARABLE PROPERTIES: COMP #1 COMP #2 COMP #3 Owner Name Owner Name Owner Name PIN # PIN # PIN # Sale Date Sale Date Sale Date Sale Price Sale Price Sale Price Sq. Ft. Sq. Ft. Sq. Ft. Acreage Acreage Acreage Remarks: Remarks: Remarks: *IF YOU HAD NEW CONSTRUCTION ON YOUR PROPERTY IN 2014 YOU MAY RECEIVE ANOTHER NOTICE. *** MACON COUNTY IS NOW ONLINE *** LOG ON TO: www.maconnctax.com CLICK ON Land Records Search to search properties IN-HOUSE REAPPRAISAL COST • $355,000 over 8 years • Less Discoveries $133,000 • 43,500 Real Estate Parcels • $ 222,000/43500= $ 5.10 per parcel • County savings of $21.84 parcel • Total Savings for 2015 $ 1,083,150 • Total savings to Macon County since 1999 QUESTIONS