ISLAMIC CAPITAL MARKETS

advertisement

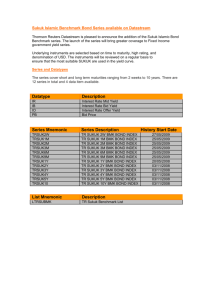

ISLAMIC CAPITAL MARKETS • Main function is to facilitate transfer of investable funds from those having surplus to those requiring funds. Achieved by selling of securities (Bonds/Sukuk and Shares) • Primary and Secondary Markets • Islamic Financial Instruments must comply with the following: Prohibition of Riba (Interest) Avoidance of Gharar (Ambiguity) in agreements Prohibition of Maisir (Gambling) No involvement in production , distribution in prohibited commodities. • Financing products of an Islamic Bank (Not capital market products) are General Investment Special Investment Leasing Partnership Deferred payment sale Deferred delivery sale Cost plus Trade Finance Islamic Capital Market products and services versus conventional market Conventional Money Market Instruments Fixed income bonds Equities Unit Trust/Mutual Funds Real Estate through Investment Funds (unrestricted leverage ) Stock broking Islamic Commodity Murabaha Sukuk Shariah compatible equities Same as conventional Real Estate with Shariah acceptable leverage Islamically acceptable broking Sukuk/ Islamic Investment Certificate • Market in the current form opened in 2002, current size well over US$ 100 billion. • Securities backed by tangible assets and streams of income. • Sukuk issues are certificate of ownership on a pro-rata basis, negotiable in the secondary market. • Issuers need not be Islamic Institutions. Sukuk/ Islamic Investment Certificate Sukuk Structure • Legal structure derived from securitization structure with special purpose vehicle (SPV) to acquire suitable asset. • Suitable assets: leasing, equities, real estate and other sukuk with a minimum of 15% in the portfolio, rest can be debt securities. • Pool of assets sold to SPV (a Charitable Trust) which issues certificates to investors for a specific maturity. • Funds collected paid to original owner of assets. • Net income generated from the assets is used to pay periodic coupons to the buyers of certificate • On maturity assets are generally sold back to the original owner, using an irrevocable undertaking. Proceeds received are distributed to Sukuk holders at the time of maturity. Sukuk/ Islamic Investment Certificate Attractiveness and concerns • Priced competitively • Shariah compliant • Mostly rated instruments, can be listed on recognized Exchanges. • Wide range of maturities, coupon fixed/floating • Liquidity is generally limited • Global investors are yet to be aware of the instrument • Institutions have limitations on assets in their balance sheets. • A large number of legal agreements need to be reviewed. Structure for IDB’s Sukuk Issuance Liquidity facility to cover periodic distribution payments Purchase Undertaking Deed to purchase all outstanding Sukuk Assets at the maturity date IDB acts as Wakeel to SPV Sukuk Assets Consideration Trust in favour of Trustee acting on behalf of investors SPV Sukuk Assets » Ijara » Sukuk (>51%) Certificates Proceeds » Equity » Installment Sale » Istisna’a Investors Equities • Sharia eligibility criteria is the most important feature. • In Dow Jones Islamic Indices were introduced in 1990’s. • FTSE indices are also available. Funds • • • • A large number of Funds are in existence Current overall size is USD 50 billion Most funds are relatively small in size Business opportunities for Brazilian institutions to launch Shariah compatible funds for equities. • Larger fund management group will have the advantage.