bay al salam and bay al istina are

advertisement

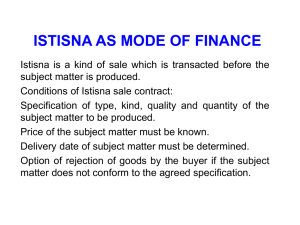

BAY AL SALAM AND BAY AL ISTINA ARE TWO CONTRACTS WHERE THE SUBJECT MATTER IS ABSENT DURING AQAD. HOWEVER THE MUSLIM JURIST TREAT THEM AS VALID AND EFFECTIVE. DISCUSS NUR AZIMUL AZAMI KHAIRUL ANUAR BIN ABDUL HADI AHAMAD FAKHRI ABU SAMAH MOHD HAZIQ DHIZAUYUDIN GENERAL RULE • Aqad WHAT DOES IT MEAN? • Literally : “al-’Aqd” means to tie (between two ends), to fasten, to link together. • In legal view, it has two interpretation either general interpretation or specific interpretation. In general : anything that is intended by a person to do/perform; either based on his own will, eg, endowment (waqaf), divorce (talaq); or depended on wills of at least two parties, eg, sale (al-bay’), marriage (nikah) In specific: ‘aqd means a connection of the words of one party (ijab) to the words of the other party (qabul) which constitutes legal implication on the subject matter. (Hurryah el Islamy, Business on the internet: Islamic Persepective and its Comparison with Common Law and the Law as Applicable in Malaysia) Cont; • Among the legal authority that show the recognition of ’aqd in Islamic Law as follow: • Surah al-Maidah 5:1: “O ye who believe! Fulfill all obligations • Similarly in surah al-Taubah 9:4, : “… So fulfil your engagements with them to the end of their term, for Allah loves the righteous.” • From the hadith, the Prophet (PBUH) expressly stated: that “Muslims are bound by their conditions (Narrated by AlBukhari), … except condition to make lawful what is unlawful and to make unlawful what is lawful (narrated as the continuance to the first hadith by al-Asqalani) Elements of aqad Hanafi Majority • Ijab • Qabul • Sighah ( consists of Ijab & Qabul • Contracting Parties • Subject Matter Subject matter • Muslim jurists had laid down four conditions for the subject matter: 1. The subject matter must exist 2. It can be delivered 3. It can be ascertained 4. It must be legal The subject matter must exist • Islamic law requires that subject matter must be in existence at the time when an ‘aqd is concluded. Otherwise an ‘aqd is void, even if the subject matter would exist in the future. • Exception is given to bay al-salam (sale by advance payment for the future delivery), bay al-istisna (contract of manufacture) BAY AL SALAM • WHAT DOES IT MEAN? • Is also known as ‘deferred sale’ • Bay’ al-salam is a sale of an object, which is not available at the time of the conclusion of the sale, but will be delivered in the future on a fixed future date. • The price is, however,to be paid immediately during the session of the contract • In other words, the transaction is called bay’ al-salam, when it is a sale for an agreed price with immediate payment for a determinate thing, to be delivered in the future on a fixed date. ( Mohd Zulkifli Mohammed and Rosita Chong as quoted from Nawawi, 1999, Islamic law on commercial transactions) Cont; • A bay’ al-salam contract is a sale with deferred delivery. It is similar to a conventional forward contract, but key differences exist. • Sale in its general sense also comprises forward sales (salam) in which one of the counter value namely, the price is paid at the time of contract but delivery of the object of salam is postponed to a later date. • The payment on a forward contract is not due until the buyer officially gains control of the asset. • In a bay’ al-salam contract, two parties agree to buy or sell an asset in the future, but the payment is due at the time of the contract, not at the time of the exchange of control. • In a conventional forward contract, two parties agree to buy or sell an asset at a specified time in the future. (Mavrakis Nadia, Islamic Finance, A Vehicle for Economic Developmet, 2009) Authority • Quran: • O you who believe! When you deal with each other in transaction involving future obligation for a fixed period (idha tadayantum bi-daynin ila ajalin musanman), reduce them into writing. Let a scribe write down faithfully as between the parties. (2:282) Cont; • Hadith: Ibn Abbas narrated that when the Prophet arrived in Medina found that the people had been practicing forward sales (i.e. salam) in fruits for one or two years. The Prophet said: anyone who pays money in advance for dates (to be delivered later) should pay it for s specified measure and specified weight and specified period. (Bukhari, sahih,III,234-44, hadith nos. 441 and 443) Examples • A contract with B to buy dates for the price of X • The dates are not yet grown but the price has been fixed upon them and A pays B at that moment X amount. • A and B agree that after 3 months that B shall deliver the dates to A. Bay al-Istina • WHAT DOES ITS MEAN ? • Literally the word istisna’ is a derivative from the root word sana’ or to manufacture or to construct something. • Istisna’ is an order or request to manufacture something,whereby the requestor invited, induced or caused another to make or manufacture some goods for him. • Technically, it is a contract to purchase for a definite price something that may be manufactured later on, according to agreed specifications between the parties. • In other words, it is a contract of sale of specified items to be manufactured or constructed with an obligation on the part of the manufacturer or contractor to deliver them to the customer upon completion (Akhtarzaite, 2006). • An istisna contract is a sale in which the customer asks the seller to manufacture aspecific product for purchase. • Both parties agree on a price and specifications for the productto be manufactured • istisna’, like the bay’ al-salam contract, is a contract whereby the sale of future goods is allowed on a certain condition or conditions. • The istisna’ contract allow an order to be placed with a manufacturer to make a certain product, answering a definite description at an agreed price to be paid either in advance or on completion. • In istisna’, the subject matter is non-existent goods at the time of the conclusion of the contract but it is treated as valid the principle of equity (istihsan) and on the basis of customary practice (‘uruf) (Nawawi, 1999). • The contract of Istisna’ creates a moral obligation on the manufacturer to manufacture the goods. • But before he starts the work, any one of the parties may cancel the contract.after giving a notice to the other. • However, after the manufacturer has started the work,the contract cannot be cancelled unilaterally Bay Al salam & Bay Al Istina • Istisna and bay’ al-salam are both exceptions to the general rule for sale contracts that the subject of the sale must exist at the time of the sale • However there exit differences between them. There are four main differences • Bay al-istina consist of an agreement made in advance to pay a deffinate price for something that is to be made delivered at future date unlike the contract of Bay Salam which has been validated on the explicit authority of hadith, bay al istina has been validated by general consensus (ijma), custom (uruf) and the necessity of business) (Abdul Rahim, Jurisprudence) • First, the purchased good in an bay ‘ al-istisna contract must be manufactured, while it does not have to be in a bay’ al-salam contract. • Buyers in istisna contracts are not required to pay the full price immediately upon signing the contract, as they are in bay’ al-salam contracts. • Bay’ al-istisna contract can be canceled by either side before the seller begins manufacturing, while a bay’ al salam contract can only be canceled with the consent of both parties. • Finally, the seller is given flexibility regarding time of delivery in an istisna contract, while time of delivery must be specified exactly in a bay’ al-salam contract Validity of Bay al Salam & Bay al Istina • Deferred sales is permitted if the the deferment is for a specified period in such a way as to eliminate the possible ground of conflicts. (Ibn Abidin as quoted from Dr. S. E Rayner in the Theory of Contract in Islamic Law) • Salam is normally valid for fungible items, although some has extended the validity of salam to all comidities except gold and silver in which case deferment is unacceptable for fear of riba (as the value of the gold and silver is uncertain, depending on the market value). (Abur Rahim, Jurisprudence quoted Dr. S. E Rayner in the Theory of Contract in Islamic Law) Conditions of bay’ al-salam i. Bay’ al-salam cannot be affected on a particular commodity or on a product of a particular field or farm. For instance, if the seller undertakes to supply the barley of a particular field, or the fruit of a particular tree, the bay’ alsalam will not be valid. This is because there is a possibility that the crop of that particular field or the fruit of that tree is destroyed before delivery, and given such possibility, the delivery remains uncertain. The same rule is applicable to every commodity the supply of which is not certain (Usmani,n.d.); ii. It is necessary that the quality of the object of sale is fully specified leaving no ambiguity which may lead to a dispute. All the possible details in this respect must be expressly mentioned. Also, the exact date and place of delivery must be specified in the contract (Nawawi, 1999); iii. Bay’ al-salam can be affected in those commodities only the quality and quantity of which can be specified exactly. The things whose quality or quantity is not determined by specification cannot be sold through the contract of bay’ al-salam. For example, precious stones cannot be sold on the basis of bay’ al-salam. This is because every piece of precious stones isnormally different from the other either in its quality or in its size or weight and their exact specifications is not generally possible; iv. It is necessary for the validity of bay’ al-salam that the buyer pays the price in full to the seller at the time of affecting the sale. It is necessary because in the absence of full payment by the buyer, it will be tantamount to sale of a debt against a debt, which is expressly prohibited by the Holy Prophet s.a.w; v. Bay’ al-salam cannot be affected in respect of things, which must bedelivered at spot. For instance, if wheat is purchased in exchange of barley, it is necessary that the delivery of both be simultaneous (according to Shari’ah) (Usmani, n.d.); vi. It is necessary that the quantity of the object of sale is agreed upon in unequivocal terms. If the object of sale is quantified in weights according to the usage of its traders, its weight must be determined and if it is quantified through measures, its exact measure should be known. What is normally weighted cannot be quantified in measures and vice versa. Conditions of istisna’ i. The subject matter should be well defined without ambiguity with respect to quality, quantity and other relevant characteristics. This follows since the object to be manufactured is an object of sale, which must be known by specifying those aspects. Therefore, if any of those aspects of the object of the contract is not specified, the contract would be rendered defective due to ignorance that may lead to legal dispute (Sudin & Shanmugam, 2001); ii. The subject matter should normally be used by the people (e.g. jewelry, shoes, pots, means of transportation, etc.). The istisna’ is not proper if the subject matter is rarely used by the people; iii. There is no specific term of deferment is specified. Hanafi school ruled that if the parties to the contract specify a term of deferment, the istisna’ becomes defective and the contract is converted to a bay’ al-salam that must satisfy all the other conditions of the latter contract; Labuan e-Journal of Muamalat and Society, Vol. 1, 2007, pp. 21-28 iv. The price of the subject matter of istisna’ is known at the time of the conclusion of the contract. The price could not be increased or decreased on account of the normal increase or decrease in commodity prices or the cost of labor. This is to avoid gharar (uncertainty) in the price of the subject matter. The price or consideration for the manufactured good to be determined could be in cash or tangible goods or the usufruct of an asset for a particular duration. As a matter of fact, the utilization of the usufruct of the manufactured item itself (the subject matter of istisna’ upon completion) could also be the price of the contract; v. The manufacturer must undertake to construct the goods with his own material. If the buyer supplies the raw material to be manufactured it is considered then as Ijarah, instead of istisna’. It is not permitted for the manufacturer to stipulate in the contract of istisna’ that he will not be liable for defects in the subject matter. The reason for this prohibition is that istisna’ is a sale of specified goods to be delivered in future, while the exclusion of liability as to defects is valid only in the sale of particular identified goods (Muhammad Al-Amine, 2001). School of thought • Syafie • The most liberal in validating deferred sale provided that the deferment period is clearly defined so as to preclude gharar. • The date of delivery bay al salam need not be fixed. • In validating deferred sale Shafie relied on Quranic text on the permissibility of deffered liability contract (2:282) Cont; • Hanbali • Validate deferred sale provided that it is devoid of usury and gharar. • Considers deferred sale to be valid but they have done so with reservations • View was criticized by Ibn Qayum on grounds that the transaction should be accepted as a matter of principle • Maliki • Validate deferred sale provided that it is devoid of gharar. • Restrictive in their stance on deferred sales and have prescribed many varieties of them on precautionary grounds for fear of indulgence in riba • Hanafi • The goods stipulated in salam must exist continuously from the time of the contract until delivery and the date of delivery must be specified at the time of contract. • Istisna is not a binding contract but an exchange of promises. Consensus vs Non Consensus • All the four Islamic schools are agreeable that Bay Al Salam and Bay Al Istisna are valid provided that there is no element of gharar and usury. • Such agreement on the validity of Salam and Istisna may be due to custom practice in the business sector and to respond to the need of the public. (Zulkifly Mohamad and Rosita Chong : The contract of Bay al Salam and Istisna in Islamic Commercial Law) • Freedom of Contract: the relevance of this theory with Istisna' lies in the fact that first of all there is no explicit text from the Qur'an and Sunnah to establish the legality of this contract and the main basis for its legality as advanced by the classical jurist is Istihsan which is based upon need and necessity Cont; • On the other hand, the advocates of freedom of contract in Islamic law held that the non-restriction of nominated contracts represents the general rule, while any restriction is considered to be exceptional. They based their argument on the Qur'anic verses: "Oh you who believe fulfil all obligations" (Al-Ma'idah 5:1). This stand is supported by the verse: "He hath explained unto you that which is forbidden unto you except under compulsion or necessity" (al-An'am 6:119), which means that, in the natural state of things, there is a presumption of legality. All acts and dispositions (including the making of contracts and conditions) are valid (mubah) unless they have been expressly prohibited.Besides, they cited the saying of the prophet: "Every stipulation is lawful among the Muslims, except one, which declares forbidden what is allowed or allows what is forbidden".17 • Hanafi states that date of delivery must be specified at the time of the contract but Shafie states that the date of delivery is need not be specified. Cont; • As a mode of investment, Istisna' can play an important role in economic development. It encourages the demand for manufacturing goods; financing economic activities, contributing to the stabilisation of prices of manufactured goods, promoting industrial and technological advancement and making use of the available possibilities of the economy. Conclusion • This may be based on difference of juristic Ijtihad and such contract (salam and istisna) has not expressly prohibited in Quran and the main concern is whether this contract is free from element of usury and gharar which is expressly prohibited by Islam.